China’s entry into DRAM and NAND chipmaking will prolong the NAND downturn and will result in the acquisition or collapse of a DRAM supplier.

This is the nub of China’s Memory Ambitions, a report by semiconductor analyst Jim Handy of Objective Analysis.

China has begun a self-sufficiency project in semiconductors because the cost of importing nearly all its needs are very high.

Long-term it will save money and become a wealthier country if it uses foreign trade earnings to builds domestic semiconductor industries.

According to Nikkei Asian Review, China aims to produce “70% of its own chips by 2025. The current figure, thought to be between 10% to 30%, leaves Chinese companies reliant on foreign chipmakers”.

And vulnerable. The ongoing trade spat between the Trump administration and China has seen restrictions imposed by the US Department of Commerce on Huawei that bar US firms trading with the Chinese tech giant. The US delayed the trade ban for 90 days on August 2019.

China’s plans

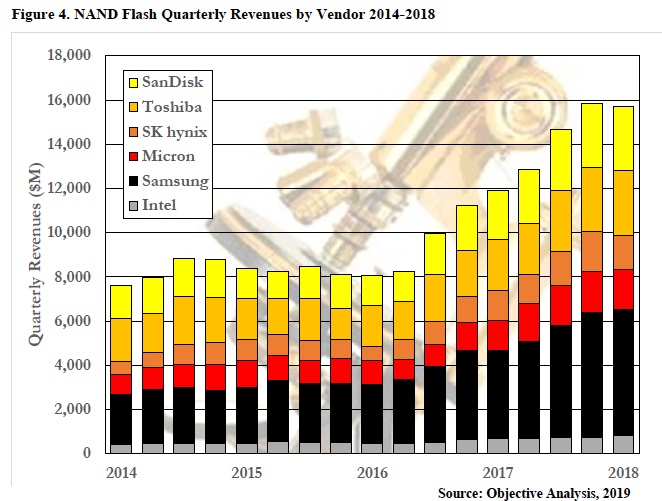

The two biggest types of semiconductors are DRAM and NAND.

The DRAM market has three suppliers: Samsung, SK Hynix and Micron. The combination of new fab cost to build the latest DRAM technology, lowish market demand growth and areal density increase, means that the industry cannot afford the entry of another supplier. If China Inc. enters the DRAM market then it will be a fourth supplier. Handy’s assessment is that the DRAM industry will contract back to three suppliers. Either Samsung, SK Hynix or Micron will exit the industry or be acquired.

Blocks & Files suggestion is that Micron will buy SK Hynix and so add DRAM and NAND capabilities in a single move.

The NAND industry has higher demand growth and its suppliers – Intel, Micron, Samsung, SK Hynix, Toshiba and Western Digital – can withstand the entry of China Inc. Handy thinks China’s YMTC will enter mass NAND wafer production in 2023. This will extend the current over-supply for a year or two and depress vendor earnings.

The report is detailed and covers the effect of China’s entry into the DRAM and NAND markets on tool suppliers and OEM customers. Handy suggests Western suppliers will need to partner with Chinese companies to progress in the Chinese market.

Contact Objective Analysis to obtain a copy.