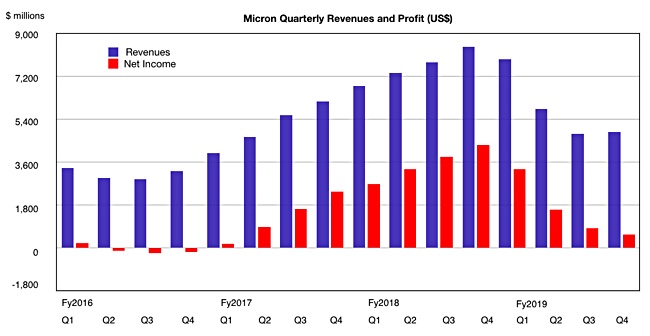

Micron’s fourth quarter revenues were affected by the US trade dispute with China – and Huawei in particular. Quarterly revenues fell 42 per cent to $4.87bn, down from $8.44bn a year ago. Net income declined from $4.33bn to $561m.

Its outlook for the next quarter is $5.1bn at the mid-point, which contrasts with $7.9bn reported a year ago.

Micron CEO Sanjay Mehrotra said: “We are encouraged by signs of improving industry demand, but are mindful of continued near-term macroeconomic and trade uncertainties.”

You can be certain of that, with President Trump’s trade dispute with China nowhere near resolution. The Trump administration has barred sales of American software and componentry to firms on the so-called Entity list without an export licence.

Micron stated fourth quarter sales to Huawei – its biggest customer – were lower than anticipated. According to IHS Markit Huawei bought $1.7bn worth of DRAM and $1.1bn worth of NAND in 2018 – not just from Micron.

Micron has applied for licenses with the U.S. Department of Commerce to sell more products to Huawei. But the company said if U.S restrictions against Huawei continue it could see a worsening decline in sales to Huawei in coming quarters.

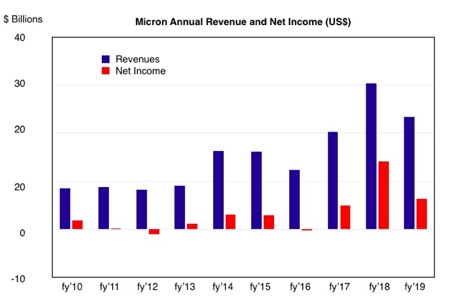

Full fiscal 2019 revenues fell 23 per cent to $23.4bn and net income fell 55 per cent to $6.31bn.

DRAM sales accounted for 63 per cent of overall revenues and were down 48 per cent on the year. NAND sales, 31 per cent of overall revenues, declined 32 per cent.

Free cashflows were $263m for the quarter and $4.08bn for the full year. Micron has $9.3bn in cash, marketable investments, and restricted cash. Making DRAM and NAND eats capital, and Micron expects capital expenditures in fiscal 2020 to be between $7bn and $8bn.

Micron Technology President and CEO Sanjay Mehrotra said: “Micron delivered fourth quarter results ahead of expectations, capping a fiscal 2019 in which we executed well in a challenging environment, significantly improved our competitive position, and returned cash to shareholders through share repurchases.”

Q4 revenues for Micron’s four business units were:

- Compute and Networking – $1.9bn revenues – down 56 per cent

- Mobile – $1.4bn – down 26 per cent

- Storage -$848m – down 32 per cent

- Embedded – $705m – down 24 per cent

The DRAM and NAND downturns are ending, according to Micron. DRAM demand has bounced back as issues affected the first half of 2019 dissipated, while NAND elasticity – i.e. lower prices – is driving robust demand. NAND bit shipments will be higher than DRAM bit ships in the next quarter.

Micron chalked up record revenue and unit shipments in consumer SSDs and said it is positioned to gain share in the NVMe SSD market in fiscal 2020. It saw quarterly rises in demand for cloud and enterprise data centre products.

The company said it was on track to ship its first 3D XPoint products by the end of calendar 2019. That will signal the end of Intel’s monopoly in selling XPoint products.