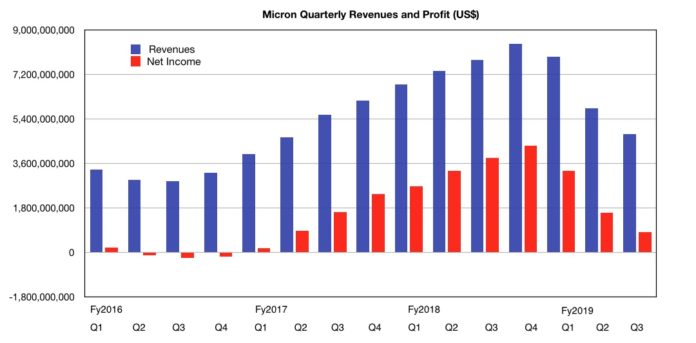

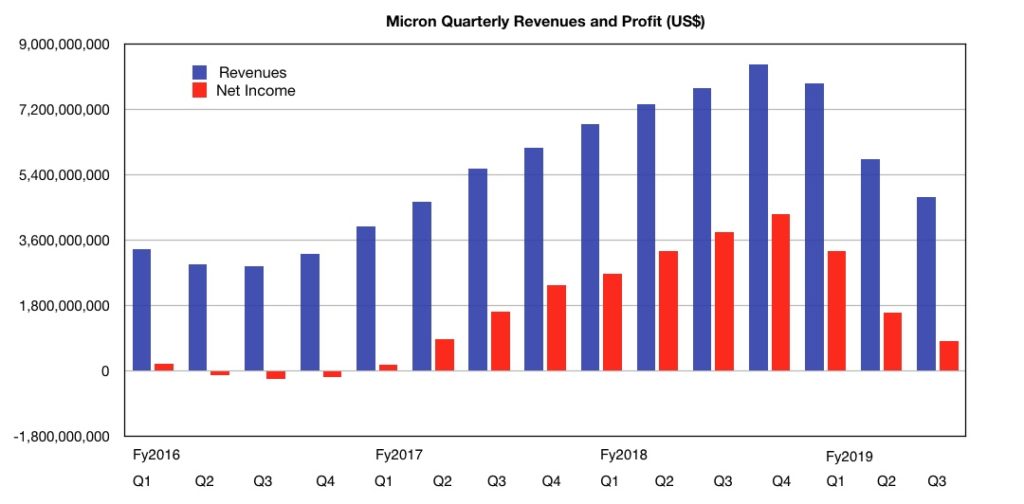

Micron’s latest quarterlies show it remains stuck in the DRAM and NAND demand doldrums. But recovery is in sight. Maybe.

Micron blamed industry over supply and steeper than expected price cutting for the sales decline. The company has also had to traverse the minefield laid by the US Department of Commerce with the trading ban imposed on Huawei, a significant Micron customer.

Some products can still lawfully be shipped to Huawei, Micron said. But it noted “considerable ongoing uncertainty surrounding the Huawei situation, and we are unable to predict the volumes or time periods over which we’ll be able to ship products to Huawei.” This makes revenue prediction difficult.

Revenues for the third fiscal 2019 quarter, ended May 30, plunged 38.6 per cent to $4.8bn and net income fell 78 per cent to $840m. Nevertheless, the company beat analyst expectations and shares rose 10 per cent yesterday in after hours trading.

In response, the company is reducing capital expenditure in fiscal 2020, “to help improve industry supply-demand balance”, CEO Sanjay Mehrotra said in a statement.

DRAM accounted for 64 per cent and NAND contributed 33 per cent to the quarter’s revenues. DRAM revenues fell 45 per cent y-o-y and NAND revenues fell 25 per cent.

Micron made $2.21bn investments in capital expenditures in the quarter and free cash flow was $504m. It ended the quarter with $7.93bn in cash, marketable investments, and restricted cash.

Supply and demand

According to Micron, there are signs of an uptick in demand. It thinks the market will return to good year-on-year DRAM and NAND bit demand growth in the second half of calendar 2019.

In the meantime it is reducing over-supply by continuing with a previously announced five per cent idling of DRAM wafer starts, and reducing NAND wafer starts by 10 per cent. Previously it had announced a five per cent reduction.

Micron expects healthy cost savings in DRAM and NAND this fiscal year due to technology improvements. DRAM processes are moving to 1y-nm and on to 1z-nm and 96-layer NAND production is ramping up. The company also reported good progress in 28-layer technology.

The fourth fy19 quarter outlook is for $4.5bn ± $200m. A year ago revenues were $8.44bn. This significant fall will possibly end at the bottom of Micron’s revenue trough.