IBM’s storage hardware business fell in the first quarter, with poor DS8000 sales and weak mid-range performance to blame.

Within IBM’s overall Q1, FY2019 results, storage hardware revenues were down 11 per cent annually, which we calculate to mean $350.9m in toal. An IBM results slide mentioned “Storage declines driven by high end due to IBM Z cycle, and ongoing market and competitive dynamics.”

In the quarter’s earnings call CFO Jim Kavanaugh said: “Storage hardware was down 11 per cent with declines in both the high-end and mid-range, offset by continued growth in all flash arrays. Performance reflects declines in our high-end, which is tied to our mainframe cycle, and the ongoing competitive dynamics and pricing pressures.”

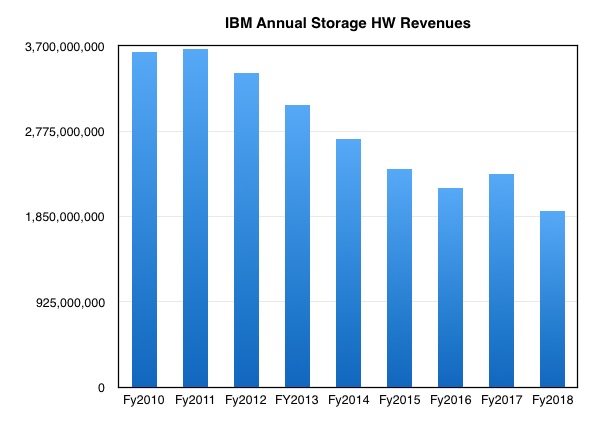

Charting IBM’s annual storage revenues shows a multi-year decline punctuated by a one-year uplift in 2017.

In early 2018 Martin Schroeter, IBM’s CFO at the time, in his discussions about the final 2017 quarter, revealed “double-digit growth in our high-end hardware products for the quarter, which reflects the demand for flash, as well as the capacity increase linked to mainframe demand. Our all-flash array offerings once again grew at a strong double-digit rate, and faster than the high-growth all-flash market.”

That was then and this is now, with mainframe demand down. There is no more mention of AFA revenues out-growing the market. The good storage times appear to be over for Big Blue.

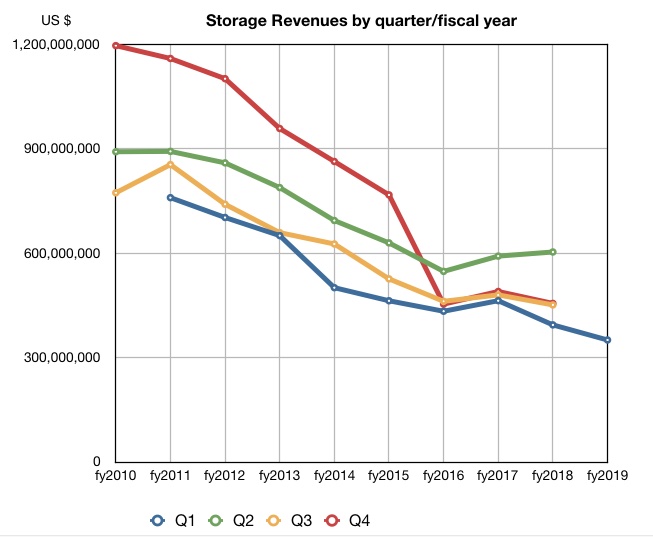

By tracking quarterly results we can see the declines and 2017 uplift more clearly:

The green line on the chart shows IBM has a seasonally strong second quarter of the year for storage hardware sales. Will that turn down in the second 2019 quarter?

It’s finely balanced, and IBM can look forward to benefits of the recent Storwize refresh. But the z14 mainframe cycle is in its trailing-off phase so that means no boost for DS8000 sales.

Note. IBM’s cloud storage-related business revenues are hidden from view. They are not mentioned in IBM’s results information and, with Cognitive Solutions, such as the Watson AI product set, now included in IBM’s Cloud segment, the cloud storage element is proportionally smaller.