Igneous Systems has seen the light and is becoming a data management supplier using commodity hardware.

In common with other data protection vendors selling proprietary hardware, Igneous faces strong competition from players who treat data protection as an entry to the wider data management market. These rivals offer data analytics and insight, and use commodity hardware.

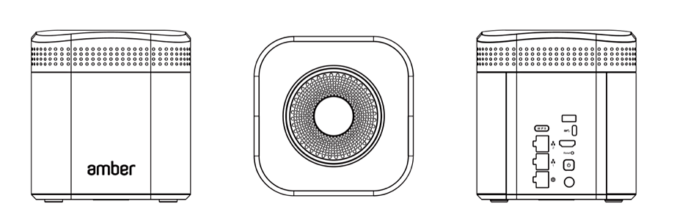

Igneous combines hybrid cloud services with a technically advanced proprietary on-premises hardware appliance. These are nanoservers – disk drives with added ARM compute. The software includes replication-based tiering off to the public cloud (AWS), and features delivered as a service.

The company protects primary data-handling filers – basically offering NAS backup. But it has always had data services ambitions and now it is making its move into this market. At the same time it is deepening integrations with three key filer players – Pure Storage, Dell EMC Isilon and Qumulo.

This is a competitive necessity. The company needs to separate itself from the pure-play pack of backup vendors and from fast-growing unstructured data management startups such as Cohesity and Rubrik.

Three new hardware integrations*, on top of the existing NAS filer integrations, help fulfil both needs:

- Pure Storage FlashBlade – NFS, SMB and S3 object integration

- Dell EMC Isilon – direct API integration with OneFS providing concurrent multi-protocol support for NFS and SMB, with switching of ACLs and permissions

- Qumulo QF2 – direct API integration via a strategic alliance

Got to pick a data set or two

Igneous classifies the market into customers with structured data sets (database and VMs) up to 100TB; unstructured data sets up to 10PB or so; and more scalable and larger needs.

For the first group, Cohesity and Rubrik provide more modern and resource-efficient data protection than legacy backup software tools such as Veritas and CommVault, according to an Igneous spokesperson.

Traditional backup engines can capture NFS and SMB file permissions like Igneous but “they’re based on the NDMP backup protocol, which may take too long to complete and may impact filer performance,” he said.

“Neither Veritas nor Commvault supports Isilon multi-protocol (NFS+SMB) permission protection, API-level integration with Qumulo, or Object support with Pure FlashBlade.”

Igneous says it can protect customers with structured data out to the 100s of TBs and unstructured data beyond 10s of PBs, and do this more affordably and with simpler management. This is a vague boast. There is no simple structured-unstructured data capacity level crossover point and Igneous is claiming tricky-to-prove advantages.

The company is to rebrand its product set from the Hybrid Storage Cloud to something that better reflects the component data services it offers in this cloud. It will extend public cloud support, possibly adding Azure alongside AWS.

Other NAS supplier integrations are coming too, such as, possibly, WekaIO.

Commodity exchange

As part of its new software focus, Igneous is developing a generic hardware strategy for its on-premises appliance. This will involve close relationships with some unnamed hardware vendors. And it is not too much of a stretch to assume that the partners will provide popular capacity-focused file storage boxes.

Igneous is also exploring a web-crawler approach to check thought NAS data sets, building up metadata such as an index and doing analytic things with that indexed data. It may also extend data provisioning capability.

Igneous is a work in progress, in product development mode as it pivots from proprietary hardware. It’ is extending data services and adding NAS array integrations to compete with strong data management services competition. Actifio, Cohesity, Druva and Rubrik are just some of the companies breathing down its neck. Object storage suppliers are also hastening into the NAS access, data management area.

Like molten lava, Igneous has to settle on and find its way across an existing landscape before it cools, solidifies, gets stuck and can flow no more. You gotta keep flowing Igneous. Standing still is not allowed. ®

* Pure Storage customers must run Purity for FlashBlade version 2.1.3 or higher with API version 1.1 or higher to protect Object shares with Igneous.

Dell EMC Isilon OneFS 7.2.0 or higher can begin importing and protecting multi-protocol shares with Igneous.

Customers using Qumulo QF2 version 2.7.6 or higher can protect their system with Igneous.