We came across Cy4Data Labs whose Cy4Secure software protects data in use, with no access performance loss and database-level encryption down to a single field or word. It offers:

- Vendor-neutral support for all commercial, open-source, cloud, SaaS & application DBs

- Individual data elements stay usable, searchable, and queryable without decryptio

- Manage millions of keys to fully protect data from the inside out

- Fully nomadic – protect data across customers, devices, enterprises, geographies

- Role-based access control and real-time threat detection

Cy4Data Labs was founded by CEO Lance Smith, ex-CEO at Primary Data and an SVP at SanDisk and COO at Fusion-io, and CMO Rick White ex-CMO at Primary Data and Fusion-io. Check out its website.

…

Vector database startup Pinecone has received acquisition interest, according to paywalled outlet The Information. It has received $138 million in 3 funding rounds, the last for $100 million in 2023 when it was valued at $750 million.

…

Quantum Corp, in the midst of exec changes, accounting problems, and renewed delisting threats, has appointed two new board directors; James Clancy and Tony Blevins, expanding its board to 7 members. Clancy has been President of Global Storage Sales at Dell and SVP of Global Sales for Dell EMC’s Data Protection Solutions. Supply chain-focussed Blevin’s CV includes being VP of Procurement at Apple and supply chain and engineering roles at IBM.

Quantum CEO Hughes Meyrath said: “Jim and Tony are both exceptional leaders, with multiple decades of experience in their respective fields. Jim is highly regarded as a proven and dynamic sales leader with deep data protection domain expertise, and Tony is a seasoned and accomplished supply chain management and operations executive. Their collective expertise and insights will be invaluable toward enhancing our go-forward strategy as we look to reinvigorate the way that we launch, sell and distribute Quantum’s products and solutions to market.” Quantum has a DXi range of deduplicating backup target appliances.

…

Sandisk has refreshed its M.2 2280 form factor WD Blue SN500 to the WD Blue SN5100, changing its 112-layer TLC NAND to 218-layer QLC flash, but the same 0.5, 1, 2 and 4TB capacity levels, DRAM-less design and PCIe Gen4 bus. Performance is up to 1 million/1.3 million random read/write IOPS and up to 7.1/6.7 GBps sequential read/write bandwidth. There is an nCache dynamic SLC cache. Endurance goes up with capacity, being 300, 600, 900, and 1,200 TBW. MSRPs go up with capacity too, being $54.99, $79.99, $149.99 and $299.99.

…

SK hynix has started supplying mobile DRAM products with highly efficient heat dissipation by adopting the High-K Epoxy Molding Compound material for the first time in the industry. The development comes as heat generated in the process of fast data transfer for on-device AI applications results in performance degradation of smartphones. Global smartphone companies welcome the launch of the product on expectations that it will help address the heat issue of high-performance flagship smartphones.

…

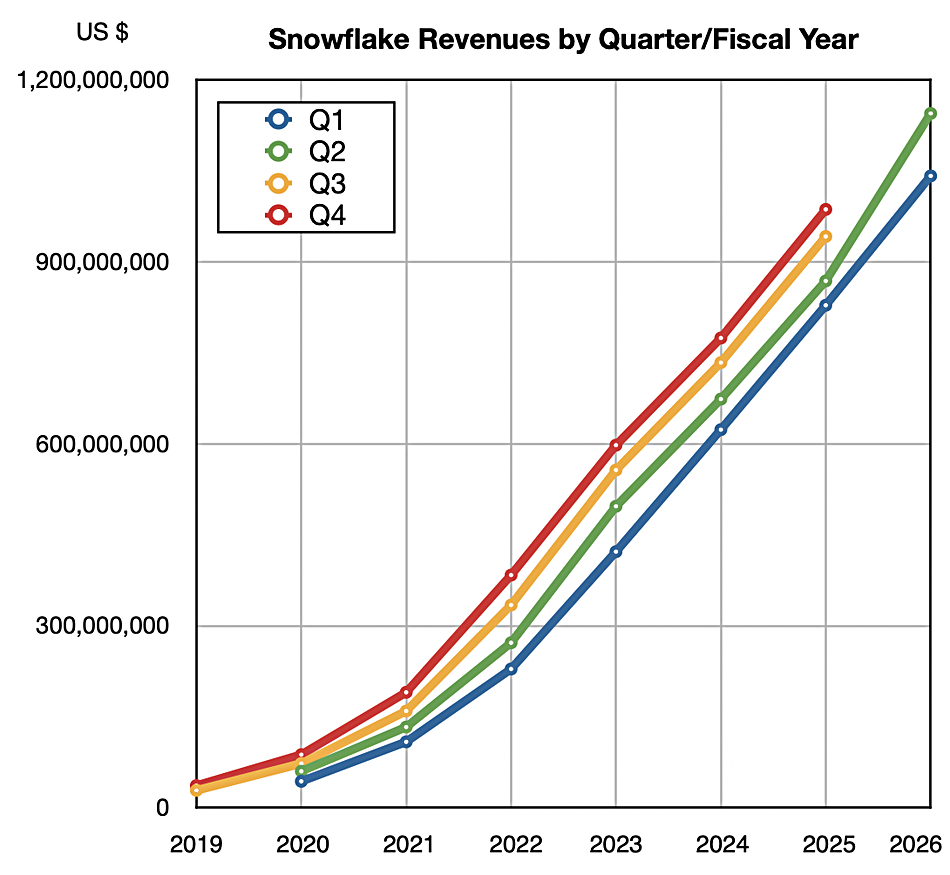

Cloud data warehouser Snowflake continued its breakneck growth with a 32% Y/Y increase in revenues to $1.14 billion, accelerating its growth curve (see chart). Its net revenue retention rate is 125%. There are 654 customers with trailing 12-month product revenue greater than $1 million and 751 Forbes Global 2000 customers, up from 736 in the prior quarter. Remaining performance obligations of $6.9 billion represent 33% year-over-year growth. It added 533 customers in the quarter taking its total to 12,062. William Blair analyst Jason Ader said its “second-quarter results handily beat consensus estimates across all key metrics, while management raised product revenue guidance above consensus for the third quarter and fiscal 2026.”

…

Multi-protocol storage array supplier StorONE is partnering Viking Enterprise Solutions such that Viking will supply its HW running StorONE’s storage SW offering primary storage, backup, archive, virtualization, and cloud integration from a single platform. Tests on Viking’s VSS2249RQ system running StorONE software delivered over one million 4K random read IOPS at sub-millisecond latency, with sustained sequential throughput exceeding 33 GBps. The platform also features HIPAA-compliant, AI-enabled auto-tiering, built-in ransomware protection, and full support for major protocols, including Fibre Channel, iSCSI, NVMe-oF, InfiniBand, NFS, SMB, and S3.

The combined StorONE and Viking system supports enterprise workloads at different tiers, empowering IT teams to scale non-disruptively using any combination of drive types, with no vendor lock-in.

…

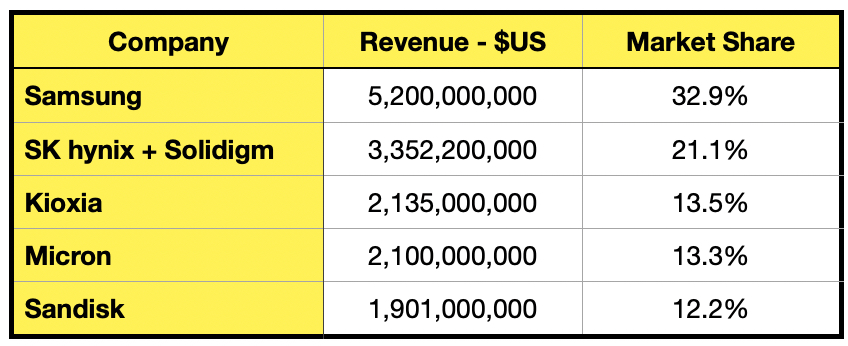

Trendforce supplied Top 5 NAND supplier data for the second 2025 quarter;

It said overall bit shipments rose significantly, driving combined revenue among the top five suppliers up 22% QoQ to US$14.67 billion. Looking ahead to 3Q25, demand is expected to stabilize as the effects of China’s subsidies and U.S. tariff-driven stockpiling begin to fade.

- Samsung’s revenue climbed 23.8% QoQ to $5.2 billion, driven by strong enterprise SSD demand for AI servers. Strategic adjustments to product mixes also helped reduce inventory, lifting Samsung’s market share slightly to 32.9% and keeping it firmly in the top spot.

- SK Group (SK hynix + Solidigm), being boosted by Solidigm’s surging enterprise SSD shipments in the second quarter as well as volume production of SK hynix’s 321L NAND Flash, saw its revenue soar to a record $3.34 billion, up 52.5% QoQ. The group’s market share jumped from 16.6% in 1Q25 to 21.1%, marking a historic high and securing second place.

- Kioxia’s revenue reached $2.14 billion, up 11.4% QoQ, ranking third. Growth was fueled by strong AI server demand and normalized inventory levels among PC and smartphone customers.

- Despite a 3.7% QoQ revenue increase to $2.1 billion, ASP declines weighed on Micron’s results. Still, shipment volumes grew sharply, leading to better-than-expected revenue. Micron’s overall market share dipped slightly to 13.3%, dropping to fourth place, though its client and data center SSD market shares both hit record highs.

- Sandisk’s revenue rose 12.2% QoQ to $1.9 billion, supported by price recovery in distribution channels and restocking of client SSD and retail products. However, utilization rates at its joint venture fabs with Kioxia have yet to fully recover, and limited penetration in enterprise SSDs continues to leave it trailing rivals in AI server and data center applications.