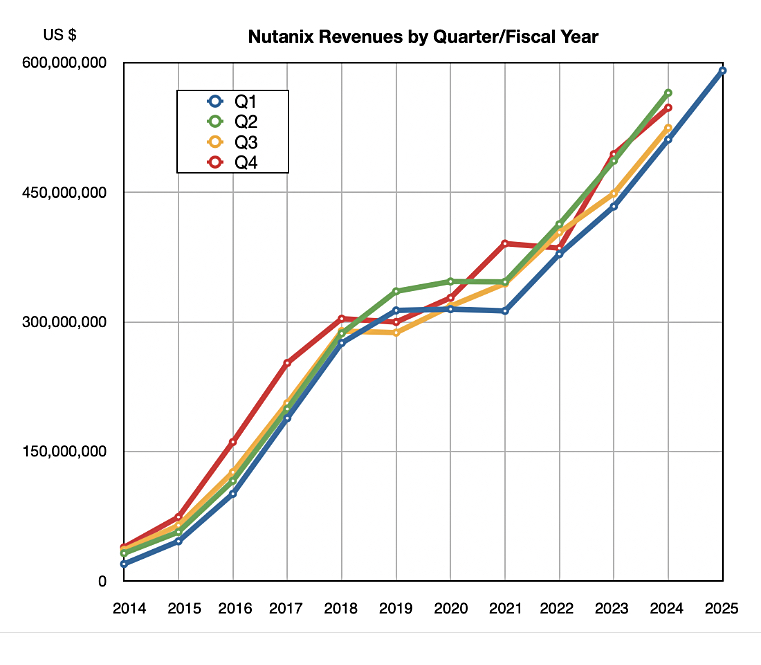

Nutanix revenues grew 16 percent year-on-year to $591 million as it comfortably beat its $575 million high point outlook.

It made a GAAP profit of $29.9 million in its first fiscal 2025 quarter, ended October 31, the second profit in its history; the previous one being $32.8 million in the second fiscal 2023 quarter.

Nutanix president and CEO Rajiv Ramaswami said in the earnings call: “We’re happy to report first quarter results that came in ahead of our guidance. We continue to see steady demand for our solutions driven by businesses prioritizing their digital transformation and infrastructure modernization initiatives and looking to optimize their total cost of ownership or TCO.”

He added: ”We also saw another quarter of strong year-over-year growth in new logos and solid free cash flow generation.”

CFO Rukmini Sivaraman said: ”Our first quarter results demonstrated a good balance of top and bottom line performance with 18 percent year-over-year ARR growth and strong free cash flow generation. We remain focused on delivering sustainable, profitable growth.

”The outperformance in revenue was driven by good renewals execution … We saw strength in landing new customers onto our platform, helped by more leverage from our OEM and channel partners from the various programs we have put in place to incentivize new logos, and from a general increase in engagement from customers looking at us as an alternative in the wake of industry M&A.”

The last point is a reference to Broadcom’s acquisition of Nutanix competitor VMware.

A relatively minor point was: “Our US Fed business performance was lower year-over-year relative to the strong comparison from Q1 a year ago.”

Financial summary:

- Gross margin: 86.0 percent vs 84.0 percent last year

- Free cash flow: $151.9 million vs $132.5 million

- Operating cash flow: $161.8 million vs $145.5 million

- Cash, cash equivalents and short-term investments: $1.08 billion compared to $994 million at the end of the prior quarter and $612.5 million a year ago.

Nutanix gained 530 new customers since the last quarter, taking its total to 27,160. It said new logo additions grew more than 50 percent year-over-year. Ramaswami pointed out: “Cisco has been a good contributor to our new logos this quarter as well as last quarter.”

Ramaswami talked about the Nutanix Dell partnership concerning Dell’s PowerFlex offering, saying: “We expect to have that in the market in the first half of calendar ’25. And we expect to see some revenue contribution from it in FY ’26.”

This deal involves PowerFlex external storage integrated with Nutanix’s AHV hyper-converged infrastructure (HCI) software system. More similar deals are in the air, with Ramaswami saying: “We do have plans to expand that selectively to other storage arrays over time … We also want to make sure that whatever we do is actually focusing on expanding the market opportunity for us and doesn’t cannibalize the existing HCI opportunity … We are focused specifically on working with storage array vendors with workloads that would not necessarily be easier to capture with HCI.”

Nutanix said it is seeing continued land-and-expand opportunities and a growing pipeline for its products. However, it expects uncertainty in the timing, outcome, and deal structure from the growing mix of larger deals in the pipeline, and ongoing elongation of average sales cycles relative to historical levels, which it believes is due to the uncertain spending environment.

Sivaraman said: “We believe the larger opportunities in our land-and-expand pipeline continue to involve strategic decisions and C-suite approvals, causing them to take longer to close and to have greater variability in timing, outcome, and deal structure.”

On that basis, next quarter’s outlook is for revenues of $640 million +/- $5 million; 13.2 percent year-over-year growth. The full year revenue outlook is $2.45 billion +/- $15 million – 14 percent growth year-over-year.

Bootnote

A point that came out in the call is that Nutanix’s HCI systems, with their server-attached storage, compete with external storage arrays. When customers with three-tier architecture approach hardware renewal time, particularly storage arrays, Nutanix’s selling partners will say that the customer can save money in a TCO sense by moving to Nutanix HCI and junking the external storage arrays. Even though Nutanix is integrating external storage into AHV, with the Dell PowerFlex deal, for example, it hopes to move such customers to HCI eventually.