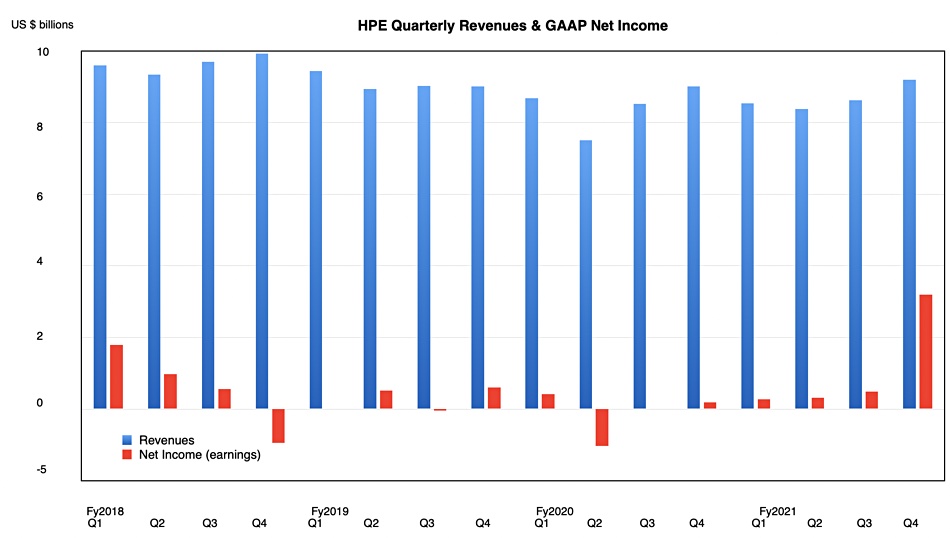

HPE grew revenues in its fourth fiscal 2021 quarter at an anaemic two per cent rate — compared to Dell’s 21 per cent rise in its most recent quarter — but HPE’s profits rocketed up.

Overall HPE revenues in the quarter were $7.4 billion, with profits of $2.55 billion. That is hugely more than the year-ago $157 million. Full year revenues were $27.8 billion — up three per cent on the year — with profits of $3.43 billion. Compare that to a loss of $322 million in the prior year and again it’s a majorly impressive turnaround.

President and CEO Antonio Neri’s announcement statement said: “HPE ended fiscal year 2021 with record demand for our edge-to-cloud portfolio, and we are well positioned to capitalise on the significant opportunity in front of us.” EVP and CFO Tarek Robbiati added his two cents: “HPE executed with discipline and exceeded all of our key financial targets in FY21. The demand environment has been incredibly strong and accelerated in the second half of the year, which gives us important momentum headed into next year.”

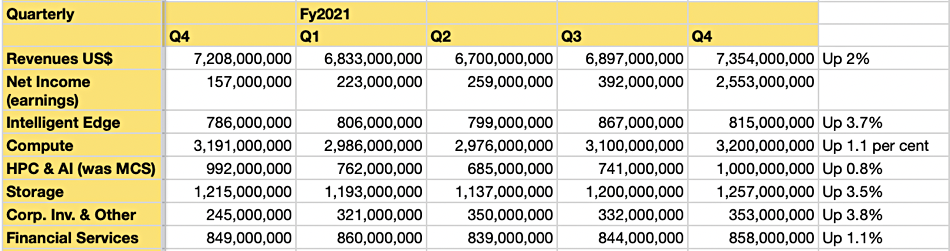

HPE divides its business into segments and we’ve put the segment revenues into a table to show what’s happened over the last five quarters:

Compute and storage are regarded as core businesses by HPE, with the Intelligent Edge and HPC-plus AI regarded as growth segments. However the segment annual revenue growth percentages were not that much different:

- Compute — $3.2 billion and 1.1 per cent

- Storage — $1.26 billion and 3.5 per cent

- Intelligent Edge — $815 million and 3.7 per cent

- HPC + AI — $1 billion and 0.8 per cent

We would expect to see a lot more growth in the growth segments. That’s why they are called growth segments.

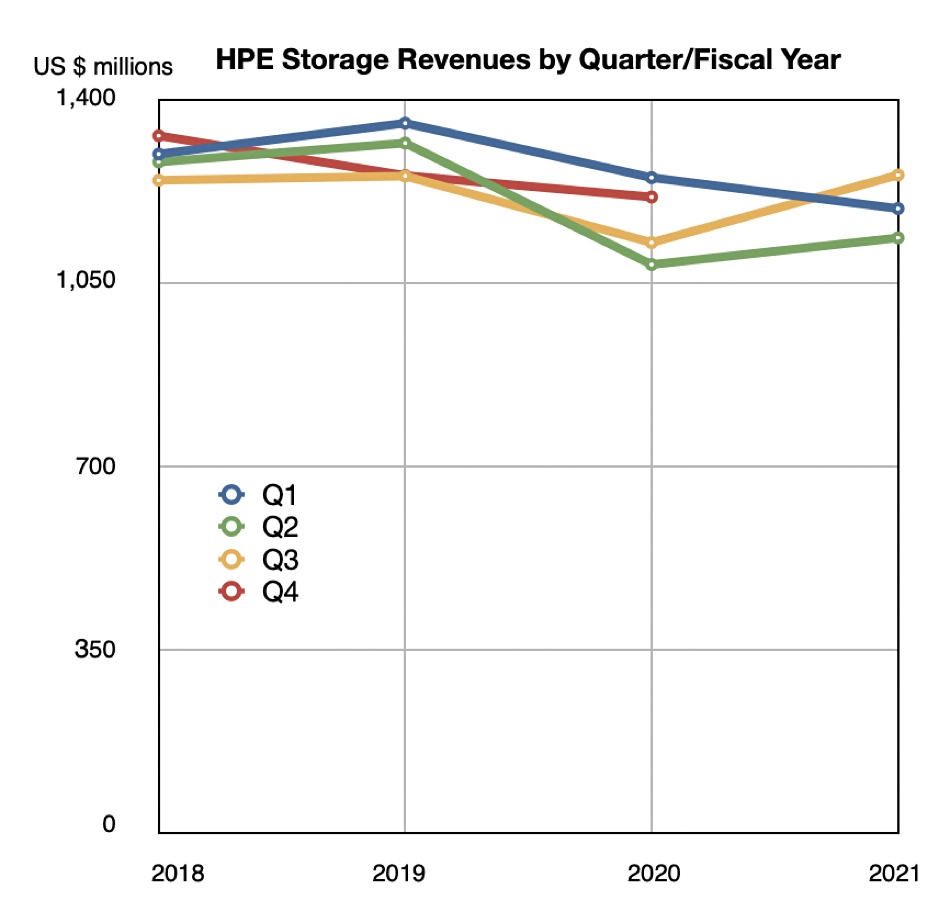

Storage revenue growth of 3.5 per cent in the fourth fiscal 2021 quarter — a second successive growth quarter — was better than HPE’s overall and fairly puny revenue increase of two per cent. But it is anaemic, comparing poorly to competitors like NetApp growing revenues 11 per cent and Pure Storage 37 per cent in the same period.

Within the storage segment the all-flash array (AFA) business increased seven per cent on the year, led by Primera arrays which grew revenues by “strong double-digits” suggesting 16–18 per cent. This was HPE’s sixth successive quarter of AFA revenue growth. However AFA revenues grew more than 30 per cent in the prior quarter.

NetApp AFA annual run-rate revenues just grew 22 per cent, while Pure’s AFA 37 per cent revenue growth is all AFA-based, so HPE’s success here is, again, somewhat limited to say the least.

Nimble array sales rose four per cent on the year and the dHCI section of that rose more strongly with double-digit growth.

Analyst view

Wells Fargo senior analyst Aaron Rakers summed HPE results up like this: “HPE’s F4Q21 results reflect continued solid execution with regard to the company’s as-a-service pivot. HPE as-a-Service orders grew 114 per cent year-on-year, which includes a large multi-million network-as-a-service win in F4Q21.”

There was momentum in the GreenLake/as-a-Service area as: “HPE exited F4Q21 with a total ARR at $796 million, up 36 per cent year-on-year and compared to +33 per cent year-on-year in the prior quarter.”

Overall Rakers thought HPE’s results were net-neutral. He said: “HPE reported that F4Q21 orders accelerated to +28 per cent year-on-year (vs +11% year to date through F3Q21) vs revenue growth at only +2 per cent year-on-year.”

It would appear that HPE’s financial discipline has generated terrific growth in profitability and its order presages well for the next quarter. What appears to be missing is overall growth acceleration, partly through, as Rakers notes, “the revenue headwind associated with HPE’s continued as-a-service pivot.”

We think Neri and his execs are looking to HPE’s customer base adopting GreenLake and everything-as-a-service in droves to drive up both revenues and profitability.