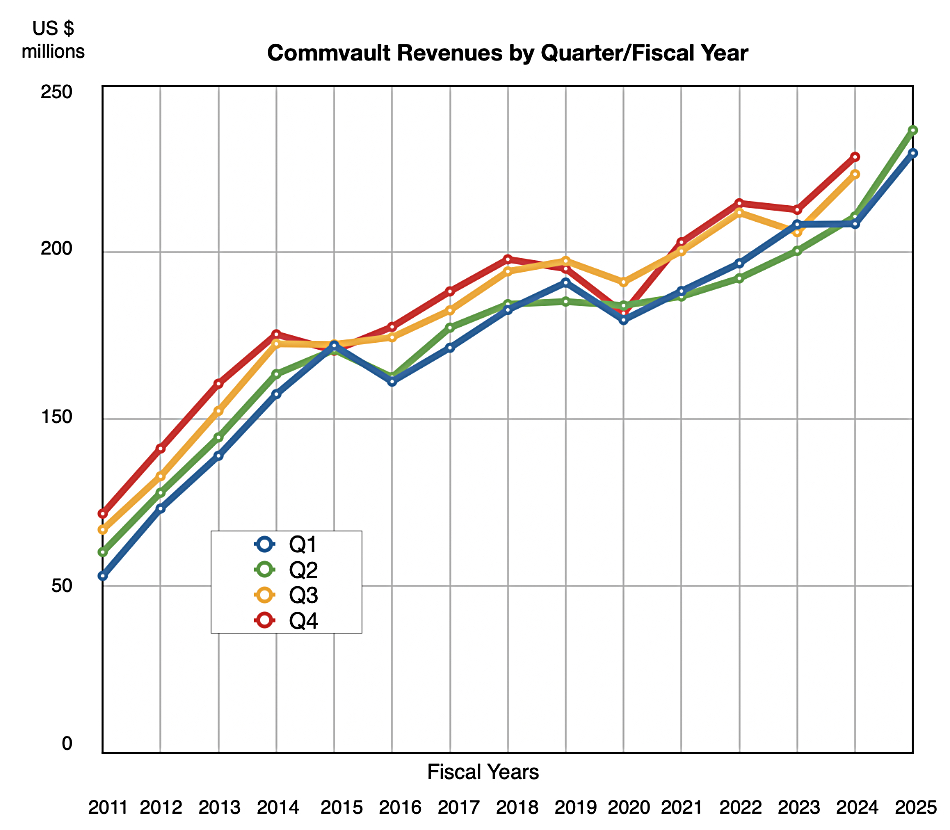

Commvault beat last quarter’s revenue outlook as its data security, subscription-focused business grew faster than anticipated.

Revenues in its second quarter of fiscal 2025 – ended September 30 – were $233.3 million, 16 percent higher than a year ago and beating its $222 million high-end guidance. This was its fourth consecutive quarter of double-digit growth.

It reported a $15.6 million net income, up 19.8 percent. Annual recurring revenue (ARR) rose 20 percent to $853.3 million with subscription ARR going up 30 percent to $687 million and SaaS ARR jumping 64 percent to $215 million, a record. The subscription revenue for the quarter was $134 million, up 37 percent year-on-year.

CFO Jen DiRico said in the earnings call: “We’re really proud of the execution that we saw in the first half of the year. It really does a testament to not only what we’re seeing from a product perspective, but overall execution by the sales team.”

Commvault now has 10,500 large subscription customers, up from 8,300 a year ago and 9,900 last quarter.

President and CEO SAnjay Mirchandani opened the earnings call by saying: ”Q2 was an exceptional quarter with momentum once again accelerating across all our primary KPIs,” meaning key performance indicators: ARR, subscription ARR, total revenue, subscription revenue, non-GAAP EBIT margin and free cash flow.

Financial summary

- Gross margin: 82.2 percent, up 20 basis points annually

- Operating cash flow: $55.6 million

- Free cash flow: $53.7 million

- Cash and cash equivalents: $303.1 million

- Stock repurchases in quarter: $51,600,000, equalling 97 percent of free cash flow

Commvault is now a data security company, with data protection being a major part of that. Mirchandani said: “In an age of nonstop threats and cyber-attacks, organizations need to be ready. And once that moment comes, they need to be able to quickly recover without missing a heartbeat.”

“This is even more important in the cloud-first world that we live in today. … IDC reported that 73 percent of all new data that will be stored in the cloud and that spending on public cloud services is expected to double in the next four years.”

Hence Commvault’s emphasis on its Metallic – now Commvault Cloud – SaaS protection in the cloud business and its recent acquisitions of Clumio and Appranix. He said: “We expect to release an enhanced Active Directory offering shortly” and: “We’re bringing the breadth of the Commvault Cloud Cyber Resilience platform to AWS customers.”

He emphasized: ”We’re serious when we say no workload, no cloud and no application left behind.”

As well as onboarding 600 new customers in the quarter, DiRico said: ”Existing customer expansion remained healthy with a Q2 SaaS net dollar retention rate of 127 percent, driven by both upsell and cross-sell.” That’s: “one third cross-sell and two-thirds upsell.”

Hinting at acquisitions, DiRico said: “We remain opportunistic around technologies that further the depth and breadth of our platform.”

Analyst Aaron Rakers asked about the status of the Commvault-Dell Data Domain partnership, and Mirchandani said: “When we announced it, Aaron, I was very clear that this is not a short-term thing. Taking out entrenched sort of incumbents needs an overall strategy, needs Cyber Resilience end-to-end, and that’s exactly the kind of wins we’re having. This is work in progress. We’re working together. It’s moving along well. We’ve got lots and lots of good stuff happening, but I’m not putting out a number in any way around that specifically.”

Mirchandani was asked about consolidation in the backup supplier business and said: ”I’ve been saying this for a while that there is a platform consolidation required in the industry. Just over the years, there have been too many big part programs. There have been too many best-of-breed ‘capabilities’ that have been inserted into enterprises, which – and I think I’ve said – I said last quarter, I’d say again, in this case, more is not necessarily better.”

And: “having an end-to-end capability that really allows you to see every single workload every application and every cloud and one pane of glass is the right approach. Now – it’s a journey. This is not easy.”

Commvault is: “going to go the entire distance and [our] one platform allows customers to do any workload, any cloud, any application, whether it starts on-premise, on the edge or in the cloud and wants to move between them. So, that’s been our stated direction. And we are putting every ounce of engineering energy we’ve got into that.”

He went on to claim the company was taking market share from some of the other incumbents.

Next quarter’s revenues are being guided to be $245 million +/- $2 million, up 13 percent annually at the mid-point. The company is lifting its full year revenue guidance to $954.5 million +/- $2.5 million, 13.7 percent higher than last year at the mid-point. It was projecting $920 million +/- $5 million. The full year guidance rise is quite large, reflecting the third quarter’s outlook. Commvault still expects to have more than $1 billion in ARR in its fy2026 (>15 percent CAGR) and more than $330 million in SaaS ARR (>40 percent CAGR).