Commvault has bagged the top-rating in GigaOm’s Sonar report for cloud-native data protection covering emerging technologies and market segments.

The Cloud-Native Data Protection Sonar looks at suppliers providing both SaaS and pure-play software to protect SaaS, hyperscaler-native, and private cloud workloads. These typically operate with a pay-as-you-go model, often based on consumed capacity. Customers may pay the supplier for the storage or bring their own, paying for it through their own cloud provider.

GigaOm analyst Chester Conforte said: “Commvault Cloud Platform delivers the broadest and deepest set of capabilities to address data threats, attack tactics, continuous validation, forensic analysis, and recovery needs across legacy on-prem, shared storage, endpoint, VM, public, private, and SaaS clouds all in a unified and extensible platform.”

The surveyed suppliers are Acronis, AWS, Backblaze, Clumio, Commvault (Metallic), Druva, Elastio, HYCU, KeepIt, Microsoft, N-able, Rubrik and Veritas. Cohesity was not included. The suppliers were evaluated across a number of dimensions, including cloud-native data plane architecture, management plane durability, retention and recoverability, end-to-end encryption, granularity, data movement optimization, data management and analytics, storage capacity efficiency, cyber resilience and diversity of data sources. They were rated on each of these (exceptional, capable, limited, no-applicable) and an average score computed:

- Commvault – 2.9

- Veritas -2.8

- Druva – 2.6

- HYCU – 2.6

- Acronis – 2.4

- Clumio – 1.9

- Rubrik – 1.9

- AWS – 1.5

- Elastio – 1.5

- KeepIt – 1.5

- N-able – 1.4

- Microsoft – 1.3

- Backblaze -1.2

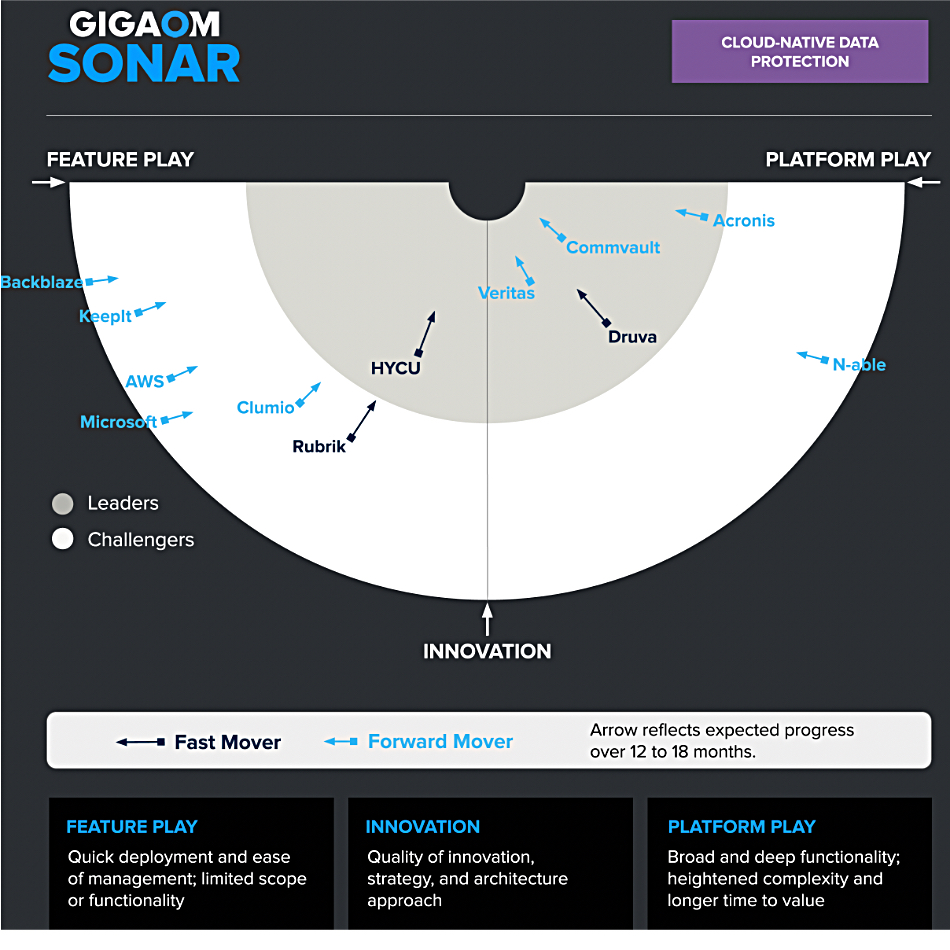

The Sonar chart is a semi-circle which ”assesses each vendor on its architecture approach (Innovation), while determining where each solution sits in terms of enabling rapid time to value (Feature Play) versus delivering a complex and robust solution (Platform Play).”

Commvault leads the pack, placed in the inner Leaders’ semi-circle with Veritas, Druva and HYCU, and Acronis accompanying it there too. All these suppliers are in the platform play side of the chart.

The outer Challenger’s half-ring has MSP-supplier N-able out on its own in a platform play start, with the rest clustered as feature-centric players on the opposite side of the chart.

GigaOm’s Conforte reckons Druva, HYCU and Rubrik are developing their offerings at a faster rate than all the other suppliers.

He points out that vendors in general “are leveraging AI and ML to enhance threat detection, automate data classification, and optimize backup processes. This allows for proactive identification of potential threats and efficient data management.”

Conforte says: ”Comparing the current Sonar graphic with the previous year’s chart reveals several notable changes. Some vendors have progressed as anticipated, moving closer to the Leaders band due to their continuous innovation and expanded capabilities. For example, vendors like Clumio and Druva have shown significant improvement, aligning with the expectations they set in the previous year.”

There is a SWOT type analysis of each supplier’s offerings in the body of the report.

Commvault has provided access to the full GigaOm Sonar report here.