Commvault reached a quarterly sales record, with revenue growth accelerating, with the company claiming its focus on cyber-resilience paid off.

Revenues for the data protector in the quarter ended June 30 were up 13 percent year-on-year to $224.7 million, beating guidance by $10 million, with an $18.5 million profit, up 46.8 percent. Revenues also increased sequentially, by just 0.6 percent. Although the increase is tiny, seasonally Q1 revenues have not surpassed prior Q4 revenues since at least 2011.

Sanjay Mirchandani, president and CEO, said in prepared remarks: “Q1 was an outstanding quarter and start to our fiscal year. We saw great momentum across all our primary KPIs (Key Performance Indicators) this quarter.”

- Total ARR rose 17 percent to $803 million;

- Subscription ARR accelerated 27 percent to $636 million;

- SaaS ARR jumped 66 percent to $188 million;

He pointed out: “And we did this profitably while investing in growth initiatives and hitting record Q1 free cash flow margins.”

The cyber-resilience focus resonated with customers. “Commvault Cloud platform continues to accelerate our growth as more companies turn to us for industry-leading cyber-resilience.” He emphasized attack recovery testing: “Our Cleanroom Recovery offering enables businesses to easily, frequently, and affordably test their cyber recovery plans in advance in good times, across workloads, at scale, on demand! Nobody else does this.”

Financial Summary

- Gross Margin: 82.3 percent

- Operating cash flow: $44.7 million

- Free cash flow: $43.8 million

- Cash and cash equivalents: $287.9 million

- Stock repurchases in quarter: $51,400,000

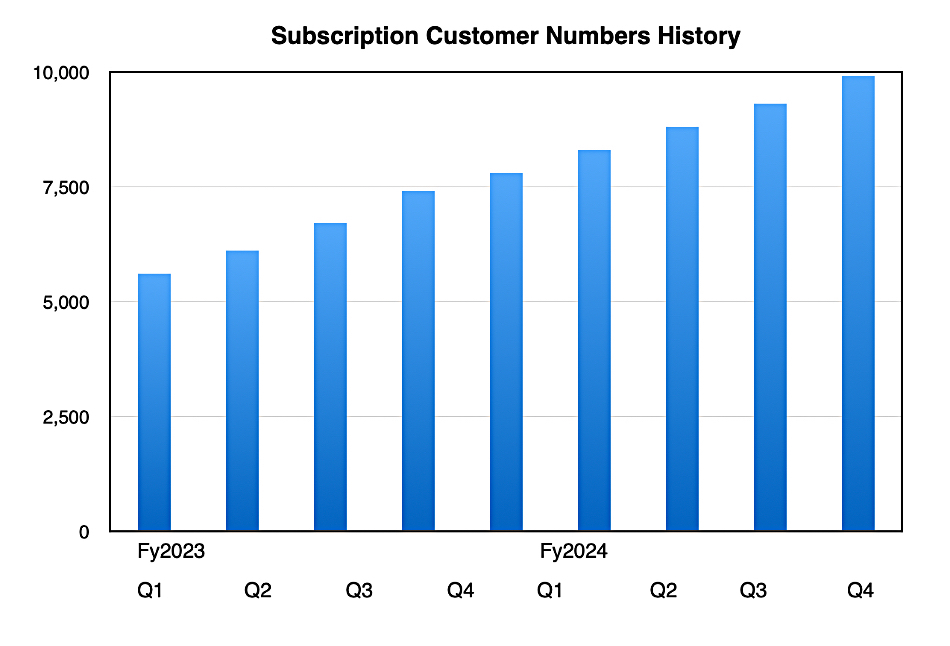

Commvault’s large customer subscription count reached 9,900, up 26.9 percent annually and 6.5 percent from the prior quarter, with steady growth in that count. Subscription customers now represent 65 percent of Commvault’s customer base.

William Blair analyst Jason Ader told subscribers: “Revenue from term software deals over $100,000 grew 13 percent year-over-year, driven by a steady stream of larger deals.”

He said: “The solid first-quarter performance was attributed to an accelerated volume of larger deals, strong subscription momentum, and continued go-to-market improvements (specifically around SaaS and cyber-resilience messaging).”

The outlook for FY2025’s second quarter is for revenues of $220 million +/-$2 million, an 8.4 percent rise Y/Y at the mid-point. The full year outlook is for revenues between $915 million and $925 million, a 9.3 percent increase at the mid-point. Commvault’s aspiration for FY2026 is $1 billion in ARR and $310 million to $340 million in SaaS ARR, a ~40 percent CAGR.

Ader said: “The company … raised full-year ARR growth guidance by one point, to 15 percent, with full-year subscription ARR growth expected to be 24 percent at the midpoint. Management’s confidence in accelerating growth is based on a more material contribution from cyber-resilience offerings (Air Gap Protect, Threatwise, etc.), solid renewals, improving sales execution, increasing pace of legacy vendor displacements (Veritas called out), and growing cross-sell opportunities (management specifically pointed to its autonomous recovery and cyber recovery bundles). Management also remains confident in its fiscal 2026 goal of $1 billion in ARR (with subscription ARR at 90 percent of this total).”

He pointed out a future revenue growth driver: “Commvault also received FedRAMP High authorization (enabling the company to sell into the defense and intelligence sector), pointing to the still untapped federal government opportunity for the company (CVLT Cloud now available on AWS Marketplace for US federal government).”