Venture Capitalists invested $1.3 billion in 17 storage startups in 2023, yet the bulk of that cash injection went to just four businesses that are weaving AI into their product portfolio.

Update. Volumez fund raise corrected from $12.5 million to $20 million. 12 January 2024.

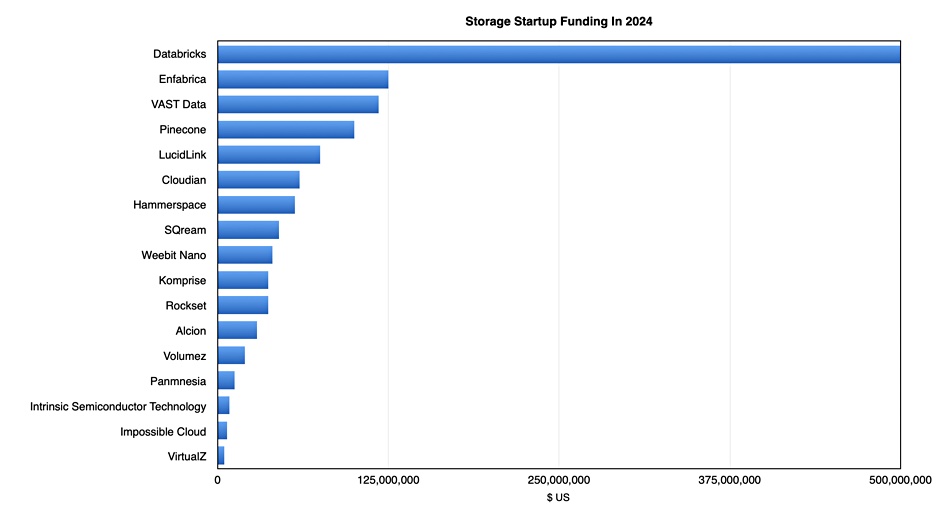

Some 38.6 per cent went to Databricks in a huge $500 million infusion, its ninth or I-round of VC funding, taking its total raised to more than $4 billion. Three other companies raised $100 million or more: Enfabrica – $125 million, VAST Data – $118 million, and Pinecone – $100 million.

Notice the common factor:

- Databricks is a data lakehouse supplier eagerly chasing the gen AI (generative Artificial Intelligence) data storage and supply business.

- Enfabrica is an AI interconnect chip startup, developing an Accelerated Compute Fabric switch chip to combine and bridge PCIe/CXL and Ethernet fabrics.

- VAST Data provides fast and scalable all-flash storage roughly at the cost of disk, with an AI data management and execution superstructure being layered onto it.

- Pinecone is developing a vector database for AI applications.

That means $843 million of the entire year’s storage startup funding, went into just four businesses, all focused on AI; three software startups and one hardware business.

And the rest

The fifth largest recipient was LucidLink, which is developing large file collaboration software technology, and which pulled in a C-round worth $75 million.

Twelve year-old object storage supplier Cloudian raised $60 million in a late-stage F-round, five years after a $94 million E-round.

David Flynn’s data orchestrating startup Hammerspace jacked up its funding total with a $56.7 million in the year as the business rolled out slew of business development announcements. These included an AI reference architecture.

GPU-focused relational database supplier SQream raised $45 million in a C-round to help its AI/ML-focussed software business.

Resistive RAM storage hardware technology developer Weebit Nano announced a $40 million injection to boost HW development and trade.

Data management specialist Komprise is the equal tenth startup in our list, adding $37 million to its coffers in a D-round, with database developer Rockset also enlarging its bank account by $37 million, with a B-round extension, supported by $7 million in debt financing.

Alcion’s investors gave it $29 million in two stages; an $8 million seed round followed a few months later by a $21 million A-round. It is developing backup software for SaaS applications. Alcion’s founders previously founded the Veeam-acquired Kasten, a Kubernetes-orchestrated container backup company.

Cloud-native and cloud-orchestrated block storage software startup Volumez raised $20 million in an A-round. It has been quiet for a few months but announced a customer and partnership relationship with Anodot, an AI-powered business and cloud optimization supplier in December.

Korean CXL hardware startup Panmnesia raised $12.5 million, and is only the third hardware-based startup in our group, along with Enfabrica and Weebit Nano. Intrinsic Semiconductor Technology is a fourth HW startup, and attracted $8.7 million in the form of a VC round and a grant. It is developing a ReRAM chip, like Weebit.

That totals $213.1 million of hardware-focused startup investment, just 16.7 percent of the total invested in storage startups this year. Truly software is eating hardware in the storage startup world,

Germany’s Impossible Cloud raised $7 million in a seed round for its decentralized Web3 storage, while IBM mainframe data access startup VirtualZ had $4.9 million given to it by seed round investors.

The total storage startup investment we recorded for 2023, $1.3 billion, is less than half of the $3.1 billion invested in the sector in 2022. Investing fashion moves on and AI is all the rage now. But $1.3 billion isn’t small change. Also, storage is a pretty mature industry, as shown by the relatively small amount of funding going to array and chip-level technology. The bulk of the money is going into the storage AI interface area. We’ll see if that continues throughout 2024.