WANdisco’s 2022 financial results show that every dollar of revenue generated in 2022 cost it $3, as turnover was $9.7 million and the net loss was $29.7 million.

These are the belatedly filed accounts for the twelve months ended December 31, delayed after the replication SW supplier WANdisco discovered that “illegitimate purchase orders” it claims were associated with one senior sale rep. The fabricated sales led to a supposed revenue total of $24 million for 2022 and inflated sales bookings of $127 million instead of the actual $11.4 million. In turn this led to extra expenditure in staff to service all the expected business.

When the shortfall was discovered in March, the firm’s shares were suspended from the AIM stock exchange. WANdisco then postponed publication of its 2022 financial accounts, replaced chairman, CEO and CFO, laid off staff, and hired forensic accountants to find its true financial position. As the business is due to run out of cash this month, it’s making an emergency $30 million cash call on shareholders.

CEO Stephen Kelly said in a statement: “The irregularities which came to light in March 2023 shattered the view that the Company had passed an inflexion point and secured significant orders from large corporate companies in some of our chosen market segments. In reality, in 2022 we achieved little growth in sales bookings and revenue as compared to 2021. In addition, we pivoted some functions within the Company towards supporting prospective customers, who failed to materialize.”

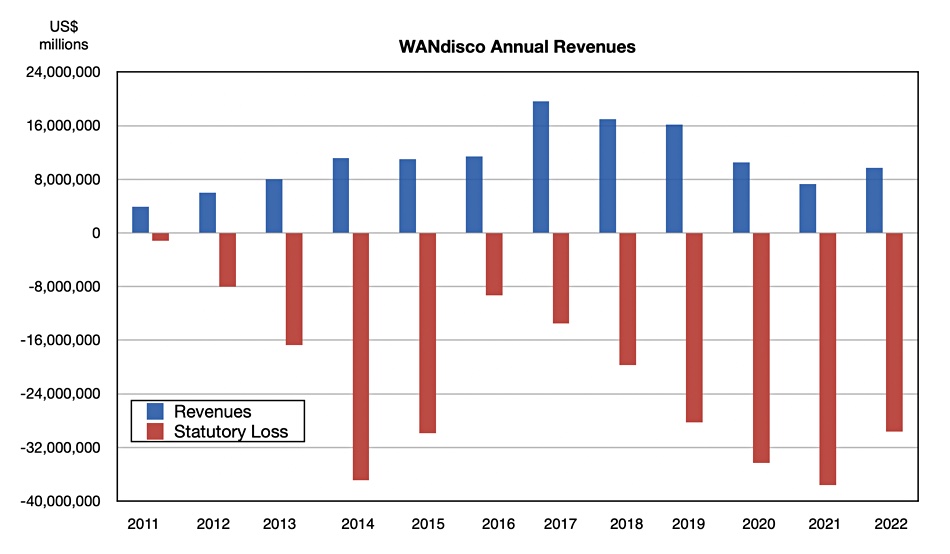

The loss of $29.7 million is higher than the $28.2 million loss identified in the preliminary accounts for 2022. A glance at WANdisco’s revenue and profit loss history shows that it has never made a profit:

What now?

The company’s turnaround plan is based on WANdisco having differentiated technology with a good fit to a growing market that needs data moved from edge locations to the public cloud

Kally added: “Our technology is different because it has the capability to seamlessly move large amounts of data at speed with zero downtime or business disruption. It is cloud-agnostic, offering our customers the choice of multiple cloud providers, for hybrid and multi-cloud environments and live data can be moved even whilst it is changing.”

Growth is expected to come from capitalizing on the existing Data Migrator, Data Migrator for Azure, and Edge to Cloud products for cloud data movement. WANdisco thinks its product portfolio can also help with data lake migrations, continuous IoT sensor data transfer, and new hybrid cloud data environments and use cases.

The sales pipeline has to be rebuilt and sales organized, monitored and incentivized to go after these opportunities. Kelly has said that the sales function was “severely inadequate” in the past.

Publishing these accounts is another step towards normality. Much of the report discusses recovery of the company’s weak sales order processing system, as well as board and executive oversight. The report has pages and pages on board responsibilities and effectiveness, and on describing the BDO audit process. These involve specific measures to prevent any overstatement of revenue.

The immediate future concerns re-admission to the AIM stock exchange and settlement of the fund-raising so WANdisco has cash to continue trading as it rebuilds its sales function and go-to-market activities. Issuing the 2022 annual report is a necessary step towards AIM readmission.

Unless AIM trading resumes and the $30 million fundraising, tied to AIM re-admission, completes on July 25, the firm could have problems paying its bills. As the auditors’ note in the accounts formally states: “a material uncertainty exists which may cast significant doubt on the Group’s ability to continue as a going concern and therefore its ability to realise its assets and discharge its liabilities in the normal course of business.“

We’ll have a clearer picture in the next fortnight.

Download the 2022 Annual Report here.