Analyst house GigaOm reckons Cohesity is the leading supplier of infrastructure unstructured data management, having upped its game with its DataHawk threat intelligence and data classification suite.

GigaOm puts out two unstructured data management (UDM) reports, this one focused on infrastructure UDM and the second looking at business-oriented UDM. Business UDM products look at compliance, security, data governance, big data analytics, e-discovery and the like. Infrastructure UDM feature automatic tiering and basic information lifecycle management, data copy management, analytics, index, and search.

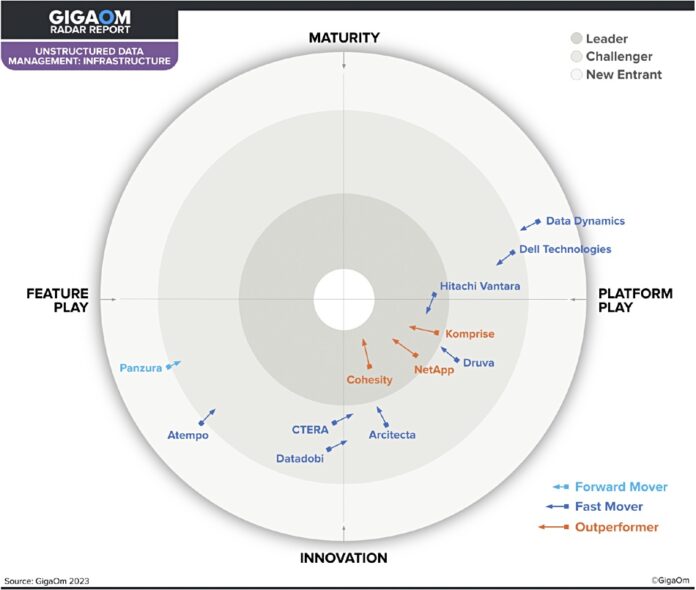

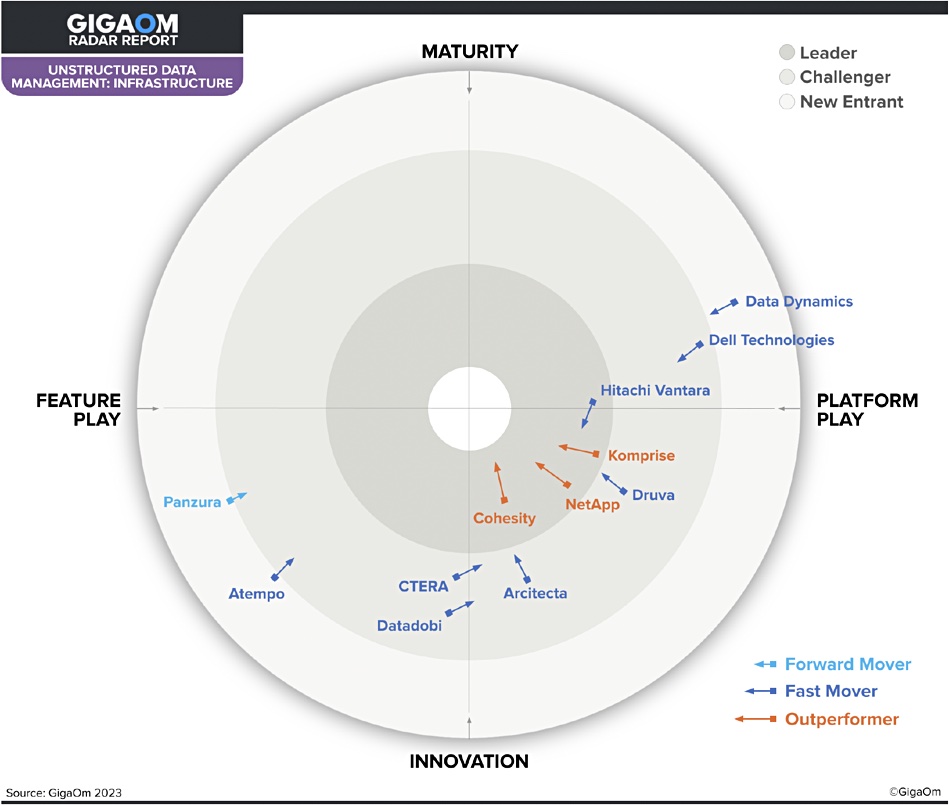

The report authors write: “As you can see in the Radar chart [below] vendors are spread across an arc that lies primarily in the lower half of the Radar, denoting a market that is particularly innovation-driven.”

There are 12 vendors included, with four leaders: Cohesity, followed by NetApp and Hitachi Vantara and the Komprise. Three: Cohesity, NetApp and Komprise, are fast movers.

No other suppliers are expected to reach the Leader ring any time soon.

There are five Challengers: CTERA, Druva and Arcitecta, Datadobi (StorageMap) and Dell (DataIQ). We find Panzura and Atempo (Miria) moving from new entrancy into the Challengers’ ring and DataDynamics moving towards it.

Five suppliers are placed in the lower right quadrant; the innovation-platform play area, with three more set to join them: CTERA, Datadobi and Hitachi Vantara. Product tech is developing fast and general platform appeal is more important than having extra features.

Hitachi Vantara has made the report available to interested readers, saying the report highlights the exceptional performance of HCP (Hitachi Content Platform) across a wide range of metrics and criteria. You can get a copy here.

Absentees

We asked ourselves why Nasuni and Hammerspace were not included? We were curious about Nasuni because competitors CTERA and Panzura were included. Ditto Hammerspace as Komprise was included. Did they not meet the criteria for entry?

So we asked GigaOm, and Arjan Timmerman, one of the report authors, told us: “We have an Infrastructure as well as a Business-oriented report [and] we made the following decisions.”

“Hammerspace does not have a UDM solution that would fit in either report. Nasuni has a decent business-orientated offering, but that does not really fit on the infra side.”

“CTERA is working hard on their Unstructured Data Management solution and [we included] Panzura although it didn’t brief us or provide a questionnaire response. But it was in both in reports last year so we decided to add them in both reports as well. We reached out to them on multiple occasions.”

Analysts rely on vendor co-operation and analytical life gets harder if vendors decide not to play nice.

By the fours

The GigaOm Radar Screen is a four-circle, four-axis, four-quadrant diagram. The circles form concentric rings, for new entrant, challenger, or leader, and mature tech (inner white ring). A supplier’s status is indicated by ring placement and product/service type relates to axis placement.

The four axes are maturity, horizontal platform play, innovation and feature play.

There is a depiction of supplier progression, with new entrants growing to become challengers and then, if all goes well, leaders. The speed and direction of progression is shown by a shorter or longer arrow, indicating slow, fast and out-performing vendors.

Supplier placement does not take into account vendor market shares.