Active data replicator WANdisco’s CEO Dave Richards and CFO Erik MIller have quit, with interim chair Ken Lever running the company.

The company said in a statement this morning: “The Board changes are not connected to the findings to date of the independent investigation.”

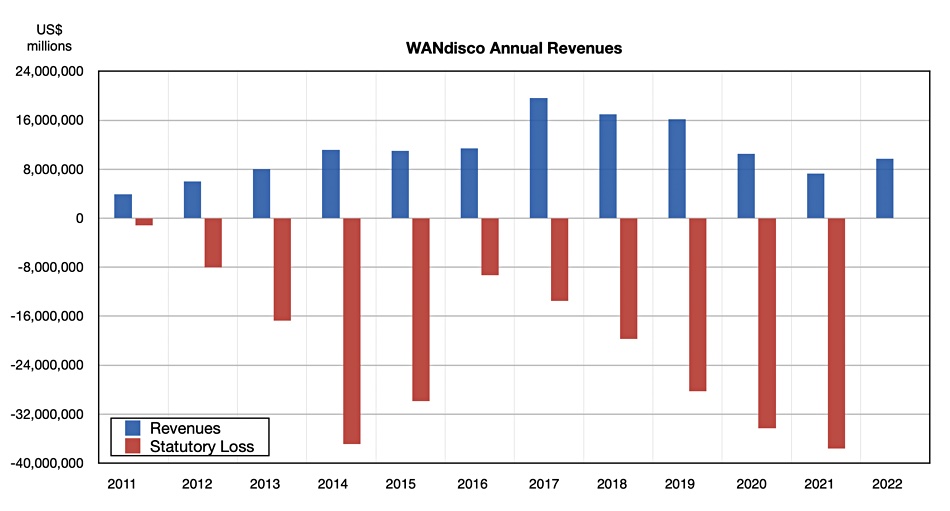

It also confirmed the probe had found “purchase orders giving rise to recognised revenue of $14,936,215 for FY22 are false and that sales bookings of $115,461,616 recorded in

FY22 are also false.”

Accordingly, “revenue for the financial year to 31 December 2022 should have been $9.7 million (unaudited) as compared with” the $24 million it forecast and bookings should have been $11.4 million

rather than $127 million, it said.

“The results of the independent investigation to date continue to support the initial view that the irregularities are as a result of the actions of one senior sales employee. FRP Advisory is continuing to pursue the investigation to reach a conclusion.”

This is WANdisco co-founder Richards’ second departure. He was axed in September 2016 by the then-chairman Paul Walker for under-delivering. Back then he resisted the move, with institutional shareholders backing him, and was reinstated as CEO and also chairman, with Walker walking away.

WANdisco was started up in 2005 with technology to replicate live data from the sites where it was generated to a datacenter in real time. It went public on the AIM part of the London Stock Exchange in June 2012 at £199 ($246) /share. Six months later the share price had soared to £1,520 (c $1,879) and WANdisco’s market capitalization went past $500 million. But then a string of poor results depressed the share price to £284 (c $350) in March 2015 and then down to £176.50 (c $218) in October 2016. That caused Walker to act by pushing out Richards, with the-then CFO Erik Miller resigning at the time. Yes, the same Erik Miller who has just resigned; it’s the second departure for him too.

The current troubles at the company started on March 9, with WANdisco announcing its AIM share trading suspension due to discovering sales reporting irregularities concerning purchase orders, revenue and bookings, and even “potentially fraudulent” irregularities concerning purchase orders by a senior sales employee. Forensic accounting firm FRP Advisory was hired to investigate and two independent directors formed a board committee to oversee this.

After investor unrest, Richards stepped down from the chairmanship on March 22 with Ken Lever appointed as interim and non-exec board chairman. He’s now executive chairman. According to its latest regulatory filings, WANdisco said Richards and Miller’s departures were due to a need for new leadership, so as to progress to lift the share suspension, and were not connected with the FRP Advisory findings. Professional services and turnaround firm Alvarez and Marsal is working on getting the share price suspension rescinded.

Lever will be act CEO for the time being and Ijoma Maluza becomes the interim CFO, starting on April 11. Lever said: “Over the years David and Erik have contributed significant time and effort to establishing and developing WANdisco. They remain meaningful shareholders in the business and continue to believe in the long-term, successful future for this company and its unique technology.”

Richards said: “I am sad to be leaving WANdisco after 18 extremely enjoyable years. I remain a passionate supporter and significant shareholder of the Company.”

WANdisco customer sales announcements

WANdisco has habitually announced sales contracts with unidentified customers. Here’s a WANdisco timeline and contract reporting list based on FT information:

- June 2012: WANdisco floated on London’s AIM with a market capitalisation of £37 million.

- November 2012: WANdisco buys California startup AltoStor and its Haloop open-source SW for synchronising information for $5.1 million.

- November 2014: WANdisco announced a contract with an unidentified US-based financial services firm.

- January 2015: WANdisco announced a contract extension price $750,000 with British Gas for smart meter analytics.

- December 2015: WANdisco announced a contract with a brand new buyer in financial services and a scale-up contract with a telco customer. Neither were identified.

- June 2016: WANdisco raised $15 million with a share operation

- September 2016: David Richards fired.

- October 2016: Richards reinstated and much of board resigns.

- September 2018: WANdisco announced an preliminary $200,000 contract win with a serious automotive buyer which is not identified.

- November 2018: WANdisco announced a $1 million contract with an unidentified Chinese communications supplier.

- December 2018: WANdisco announced a $700,000 contract with an American ealthcare firm, again not identified.

- February 2019: WANdisco raised $17.5 million with a share operation.

- April 1019: WANdisco announced a contract worth $2.15 million with an undisclosed Chinese ICT infrastructure supplier.

- June 2019: WANdisco announced a contract worth $750,000 with unidentiofied CHinese mibile phone handset supplier.

- November 2019: WANdisco announced a distribution contract of with African Micro-D but no sales value was revealed.

- November 2019: WANdisco announced a contract valued over $500,000 with an unidentified Fortune 500 customer.

- December 2019: WANdisco announced contracts valued at round $1 million with an unidentified big US finance business and an unidentified a worldwide hi-tech firm .

- December 2019: WANdisco announced a c$1 million contract with a China-based customer it doesn’t identify.

- November 2020: WANdisco announced a deal worth up to $1 million with an unidentified British grocery retailer.

- November 2020: WANdisco announced a contract worth $3 million with unidentified global telco.

- September 2021: WANdisco announced a contract worth a minimum of $1 million with one world’s largest but unidentified telecommunications firms.

- December 2021: WANdisco announced a contract valued at a minimum of $6 million over 5 years with a big but unidentified European automotive parts provider.

- December 2021: WANdisco announced a contract with an unidentified UK banking group.

- December 2021: WANdisco announced a $3.3 million contract with an undisclosed big North American multinational financial institution.

- March 2022: WANdisco announced a contract worth $1.5 million with a unidentified international telecommunications firm.

- March 2022: WANdisco announced a follow-on contract for $1.2 million with another undisclosed international communications firm.

- April 2022: WANdisco announced a contract worth $630,000 with one of largest insurance firms in Europe, with an unrevealed identity.

- April 2022: WANdisco announced a contract worth $720,000 with an international retailer it doesn’t identify.

- April 2022: WANdisco announced a contract worth $213,000 with a PC vendor it doesn’t identify.

- June 2022: WANdisco announced a contract worth $11.6 million with an international communications firm it doesn’t identify.

- June 2022: WANdisco announced two contracts for a total of $2.5 million with unrevealed information and communications suppliers.

- July 2022: WANdisco announced a contract valued at $1.1 million with an undisclosed Canadian financial services business.

- September 2022: WANdisco announced a contract worth $25 million with an international communications firm it doesn’t identify.

- October 2022: WANdisco announced a follow-on contract for $7.1 million with a big European automotive parts provider it doesn’t identify.

- December 2022: WANdisco announced a follow-on contract for $13.2 million with another large European automotive parts provider it doesn’t identify.

- December 2022: WANdisco announced a contract worth $31 million with an unidentified international teleco.

- December 2022: WANdisco announced a contract worth $12.7 million with a worldwide European automotive producer it doesn’t identify.

- January 2023: WANdisco announced a contract worth $6.6 million with an undisclosed European-based international telco service supplier.

- March 2023: WANdisco announced its share suspension.

Some of the 2022 claimed contract wins will now be null and void, but we don’t know which yet.