Acronis‘ latest cyberthreats and trends report for the second half of 2022 has found that phishing and the use of MFA (Multi-Factor Authentication) fatigue attacks are on the rise. The report provides an in-depth analysis of the security landscape including ransomware threats (number 1), phishing, malicious websites, software vulnerabilities and a security forecast for 2023. Threats from phishing and malicious emails have increased by 60%, and the average cost of a data breach is expected to reach $5 million in 2023. Download a copy of the full Acronis End-of-Year Cyberthreats Report 2022 here.

…

AWS has announced Amazon S3 Block Public Access that works both at the account and bucket level, and enables an AWS customer to block public access to existing and future buckets. This feature can be accessed from the S3 Console, the CLI, S3 APIs, and from within CloudFormation templates. More info is here.

…

Druva has replaced Code42 at Alector, a San Francisco startup aiming to slow the progression of neurodegenerative diseases like Alzheimer’s and Parkinson’s. Druva’s case story claims Code42 wasn’t meeting Alector’s demands and plagued the IT team with tickets. Alector also suffered from data sprawl with data residing across a variety of environments, including the data center and Microsoft 365. This made it difficult to track the status and location of workloads and their security, we’re told. Here is the case study.

…

Molly Presley, Hammerspace’s SVP of Marketing, predicts 2023 will be the year distributed organizations can realize the value and insights of unstructured data faster and more efficiently. Unstructured data will – she reckons – be able to have the same unified access, management, utilization, and rationalization as structured data thanks to unified data management with a unifying metadata control plane and automated data orchestration. Trends for the year include:

- IT supply chain challenges will compel new approaches to data management.

- To access sufficient compute resources, organizations need the ability to automate Burst to the Cloud.

- Access to software engineering talent must be possible from anywhere in the world.

- Edge will no longer be used only for data capture but also for data use.

- The use of software-defined and open-source technologies will intensify.

- Metadata will be recognized as the holy grail of data orchestration, utilization, and management.

- A shift away from hardware-centric infrastructures toward data-driven architectures.

- Data Architects will be the upcoming King of the IT Jungle.

- True storage performance that spans across all storage tiers.

…

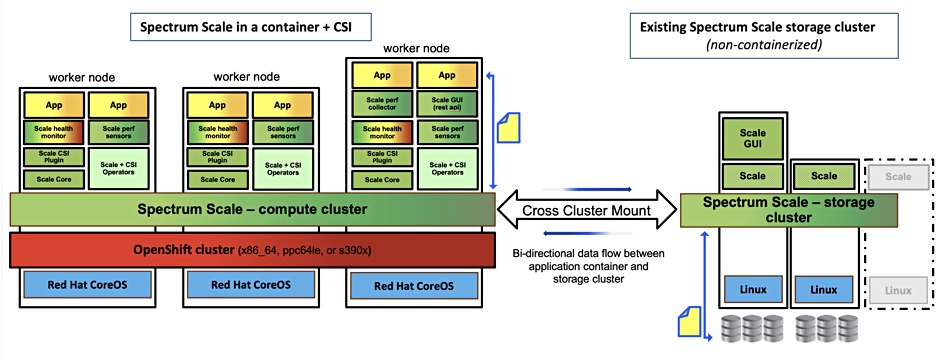

IBM has produced a Spectrum Scale Container Native Version 5.1.6.0. Spectrum Scale in containers allows the deployment of the cluster file system in a Red Hat OpenShift cluster. Using a remote mount attached file system, it provides a persistent data store to be accessed by the applications via a CSI driver using Persistent Volumes (PVs). This project contains a golang-based operator to run and manage the deployment of an IBM Spectrum Scale container native cluster.

…

High-end array supplier Infinidat has hired Dave Nicholson as a new Americas Field CTO to replace the retiring Ken Steinhardt. Nicholson’s experience includes being a member of the Wikibon/Silicon Angle/theCube storage and IT analyst firm, GM for Cloud Business Development at Virustream, VP & CTO of the Cloud Business Group at Oracle and Chief Strategist for the Emerging Technology Products Division at EMC. He has roughly 25 years of experience in enterprise storage.

…

Unified data platform supplier MarkLogic’s MarkLogic 11 product version includes:

- Geospatial analysis – a more flexible model for indexing and querying geospatial data, scalable export of large geospatial result sets, interoperability with GIS tools; includes support for OpenGIS and GeoSPARQL

- Queries at scale – Improved support for large analytic, reporting, and/or export queries with external sort and joins

- Unified Optic API for reads and writes – write and update documents with the Optic API without having to write server-side code

- BI analysis – use GraphQL to easily expose multi-model data to BI tooling using an industry standard query language

- Docker and Kubernetes support – deploy MarkLogic clusters in cloud-neutral, containerized environments that use best practices to ensure your success

…

Effective January 17, Micron has promoted Mark Montierth to corporate VP and GM of its Mobile Business Unit. He is currently VP and GM of high-bandwidth and graphics memory product lines in Micron’s Compute and Networking Business Unit. Raj Talluri is still listed on Linked in as SVP and GM of Micron’s Mobile BU but he is leaving to pursue another opportunity, we’re told.

…

Amazon FSx for NetApp ONTAP now has FedRAMP Moderate authorization in US East (N. Virginia), US East (Ohio), US West (N. California), and US West (Oregon), and FedRAMP High authorization in AWS GovCloud (US) Regions. Additionally, Amazon FSx for NetApp ONTAP is now authorized for Department of Defense Cloud Computing Security Requirements Guide Impact Levels 2, 4, and 5 (DoD SRG IL2, IL4, and IL5) in the AWS GovCloud (US) Regions. NetApp said that, with this announcement, agencies at all levels of government can move data workloads to the AWS Cloud.

…

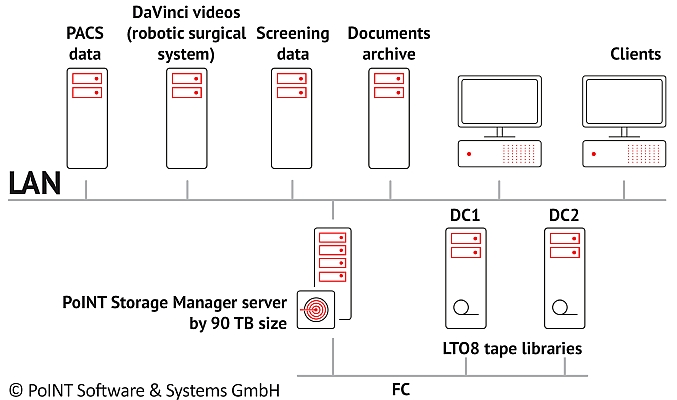

Germany’s Diakonie in Südwestfalen GmbH, which stores medical data from surgical robots, X-ray PACS and mammography screening, has countered rising storage HW (all-disk) costs by introducing automated archiving on tape with PoINT Storage Manager. This has a two-tier storage architecture with primary (disk) and archive (tape) storage tiers and automated transfer from the former to the latter. German-language case study here.

…

Digital insurance provider Allianz Direct is using Rockset’s cloud-native Kafka-based technology to deliver real-time pricing. An algorithm incorporates over 800 factors and adapting these rating factors to pricing models would previously have taken weeks. Rockset’s schema-less ingest and fast SQL queries allow Allianz Direct to introduce new risk factors into its models to increase pricing accuracy in 1-2 days, we’re told. Rockset’s native connector for Confluent Cloud enables Allianz Direct to index any new streaming data with an end-to-end data latency of two seconds, Rockset said. Allianz Direct also uses Rockset to power real-time analytics for customer views and fraud management.

…

Taiwan’s Digitimes reports that Samsung has raised its NAND prices by as much as 10%. This follows Apple terminating a NAND purchase deal with YMTC and YMTC getting placed on the US Entity list.

…

Samsung announced the development of its 16-Gbit DDR5 DRAM built using the industry’s first 12nm-class process technology, and the completion of product evaluation for compatibility with AMD. The new DRAM features the industry’s highest die density, Samsung said, which enables a 20% gain in wafer productivity. Its speed is up to 7.2Gbit/sec and it consumes up to 23% less power than the previous Samsung DRAM. Mass production is set to begin in 2023. The new DRAM features a high-κ material that increases cell capacitance, and proprietary design technology that improves critical circuit characteristics. It is built using multi-layer extreme ultraviolet (EUV) lithography.

…

SK hynix is showcasing a new PS1010 SSD at CES in January. The product was first unveiled at the October 2022 OCP summit. It is an E3.S format product, uses 176-layer 3D NAND and has a PCIe gen 5 interface making it, SK hynix claimed, 130% faster reading, 49% faster writing and 75% better performance/watt than previous generation. Its also showing CXL memory, GDDR6-AiM memory and HBM3 memory.

The 2020 era PE8010 uses 96-layer TLC NAND with a PCIe gen 4 interface and a 1TB to 8TB capacity range. It delivered random read of 1,100,00 IOPS, random writevof 320,000 IOPS, sequential read of 6,500 MB/sec and sequential write of 3,700MB/sec.

…

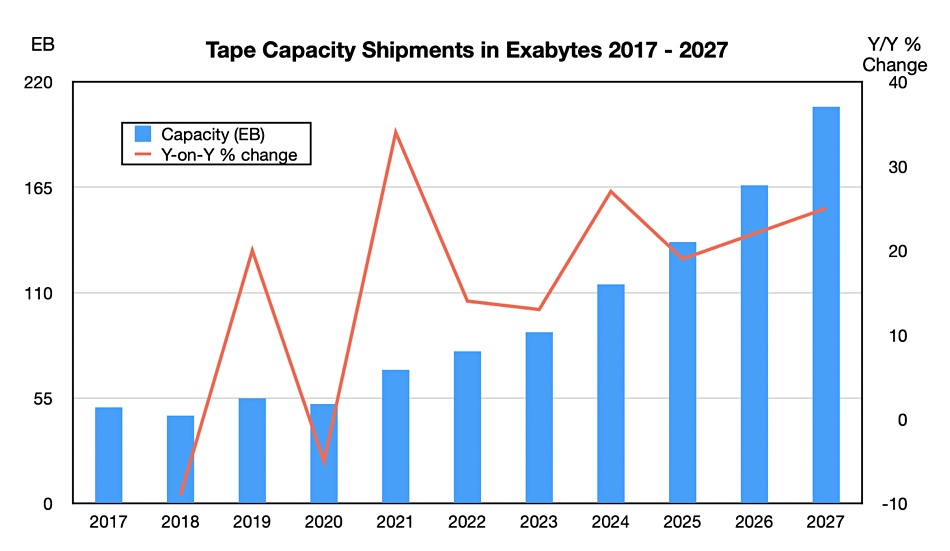

Research house Trendfocus has produced a native tape capacity ship table from 2017 to 2021 with a forecast out to 2027. We charted the numbers, reported by the Storage Newsletter, to show the annual exabyte shipments and year-on-year percent changes;

The 2021 percent change peak was due to the late arrival of the 18TB (raw) LTO-9 format in 2020. The 2022 to 2027 capacity ship CAGR is said to be 21 percent. Trendfocus sees an economic recovery in 2024 lifting the capacity ship growth rate. Over 80 percent of the shipments will be LTO-format tapes, with IBM 3592 format following. Tape still reigns supreme for archive data storage.

…

TrendForce further projects that the Client SSD attach rate for notebook computers will reach 92% in 2022 and around 96% in 2023. A demand surge related to the pandemic is subsiding, and the recent headwinds in the global economy have caused slower sales in the wider consumer electronics market. As such, client SSDs are going to experience a significant demand slowdown, which, in turn, will constrain demand bit growth. TrendForce projects that for the period from 2022 to 2025, the YoY growth rate of NAND Flash demand bits will remain below 30%. Eventually, enterprise SSDs will take over from client SSDs as a major driver of demand bit growth in the global NAND Flash market.

…

DataOps observability platform startup Unravel Data has confirmed that David Blayney has joined as Regional VP, Europe, the Middle East, and Africa (EMEA). Unravel raised a $50 million Series D round of funding in September led by Third Point Ventures, with participation from Bridge Bank and existing investors that include Menlo Ventures, Point72 Ventures, GGV Capital, and Harmony Capital, bringing the total amount of funding raised to $107 million.

…

WANdisco has announced a string of contract wins. It has signed an initial agreement worth $12.7m with a global European based automotive manufacturer for IoT data in the client’s data centre to be migrated to the cloud. This is a one-off migration. WANdisco has also signed a commit-to-consume agreement worth $31m with a second tier 1 global telco and IoT app supplier. Half of the $31m will be paid in advance following the commencement of the project. WANdisco now expects that FY22 revenues will be significantly ahead of market expectations and no less than $19m. Bookings for FY22 are expected to be in excess of $116m.

…