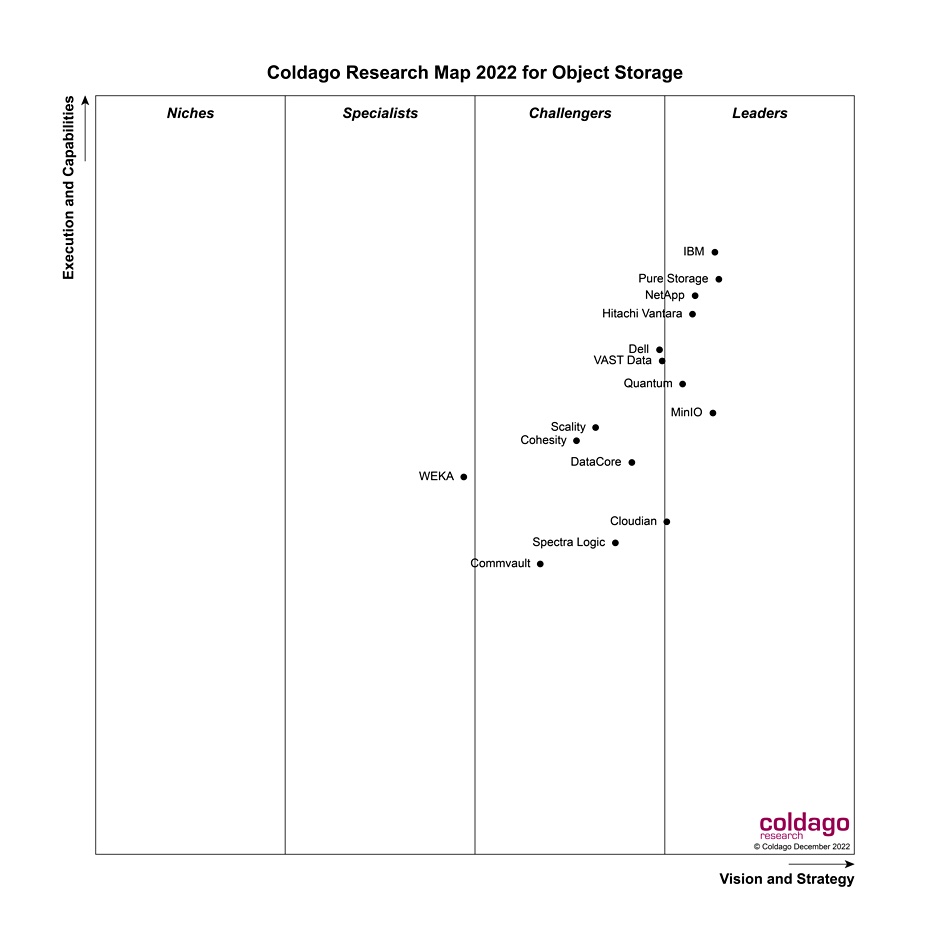

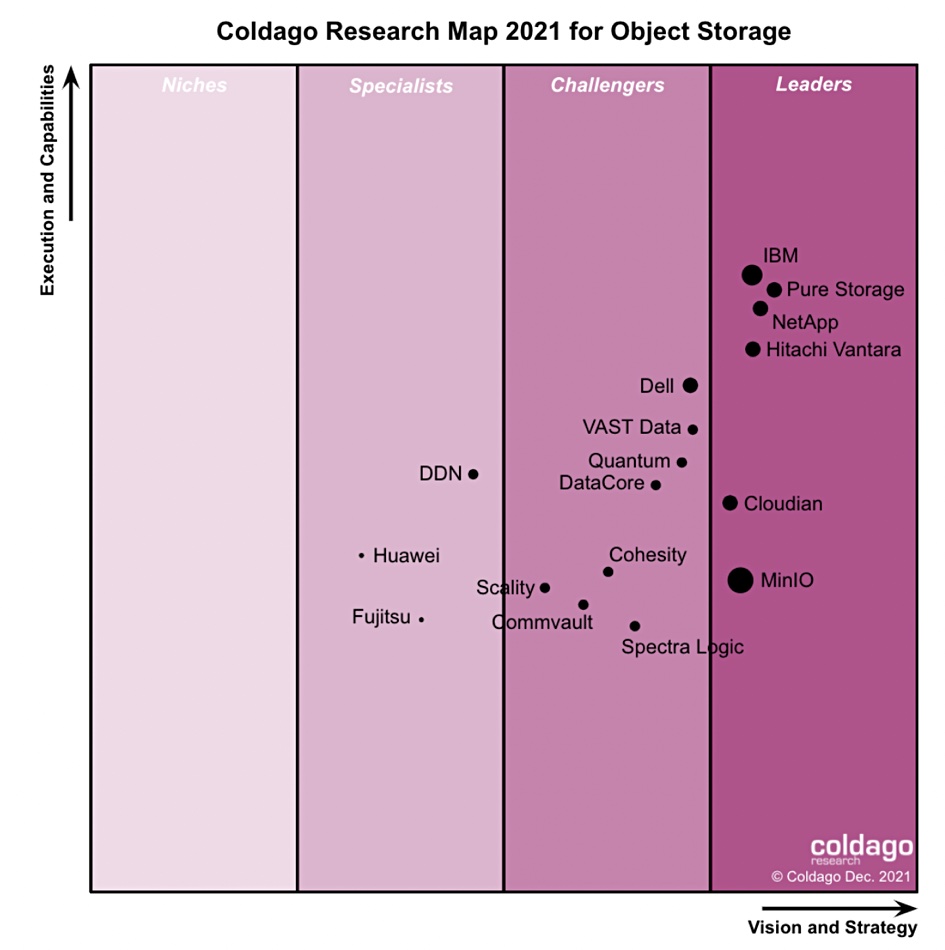

Research firm Coldago has released a 2022 object storage map, moving Quantum into the Leader’s area from last year’s Challenger’s ranking, and giving Cloudian a lower Execution and Capabilities score than in 2021.

The Coldago Research Map 2022 for Object Storage lists and ranks 15 vendors playing in the object storage market segment. They are, in alphabetic order: Cloudian, Cohesity, Commvault, DataCore, Dell, Hitachi Vantara, IBM, MinIO, NetApp, Pure Storage, Quantum, Scality, Spectra Logic, VAST Data and WEKA. There are seven leaders: Cloudian, Hitachi Vantara, IBM, MinIO, NetApp, Pure Storage and Quantum, in alphabetic order.

DDN, Huawei and Fujitsu, which all appeared in Coldago’s 2021 object storage map, disappeared from the 2022 supplier rankings while WEKA is a new entrant.

We asked Coldago analyst Philippe Nicolas questions about about this year’s map.

Blocks & Files: Could you describe the basic Map concept please?

Philippe Nicolas: A Coldago Map has essentially 2 dimensions: one – Vision and Strategy, and two – Execution and Capabilities. A leader is recognized by its position to the right but also to the top. Coldago doesn’t only compare products … but analyzes companies playing in a domain. This includes company profile, business and strategy, products, solutions and technologies. I recognized that the product part occupied a large piece and our features matrix uses more than 50 criteria or attributes.

Blocks & Files: What are your data sources?

Philippe Nicolas: We have collected lots of data during this period from end-users, partners and vendors meetings, watching companies and products announcements, cases studies, integrations or partnerships. These informations could be positive like number of deployments, large configurations, application integrations or negative like product un-installations, data integrity and sales behaviors. Of course negative info could have serious impacts. All these data are then digested, segmented, grouped and normalized to make comparison and ranking easier.

Blocks & Files: Talk us through some of the vendor highlights.

Philippe Nicolas: Pure Storage and VAST Data had an excellent year in many aspects; product release and features, deployments, revenues or market penetration. MinIO and Cloudian are leaders like last year even if their positions changed a little based on their 12 month’s operations.

Scality is still a serious challenger and it reflects their 12 month’s activity. Relatively, Scality has vertically a better position that Cloudian but it belongs in the challenger partition.

For MinIO, the company continues to confirm their ubiquitous presence with tons of integrations, large adoption and it has moved up vertically. Again, Cloudian is a leader which is not the case for DataCore and Cohesity. DataCore delivered a better job than Caringo – which it acquired in January 2021.

Cohesity had clearly some positive aspects on the execution side with strong channels, and a comprehensive product with multiple deployment flavors. WEKA is added this year, entering for the first time, as it provides an S3 interface like all others, but it belongs in the specialists’ section. We’ll carefully monitor WEKA’s S3 activity in 2023.

Blocks & Files: Any comments about the other suppliers?

Philippe Nicolas: The historical players, many of them, missed some opportunities and clearly lost some visibility except Hitachi Vantara or MinIO. Also, Quantum has made an interesting move with a product established for years and several developments; it now belongs in the leader’s section, thanks to an improved activity in many aspects during the 12 months. NetApp and IBM, Red Hat included, also occupied a leader’s position.

Blocks & Files: What has changed in the object storage market since last year?

Philippe Nicolas: What is important to realize is the shift in the market for a few years. Being internally an object storage with the few characteristics we know like flat address space… is no longer so important. In other words, the Map is not about object storage purists but more about the market reality. On the users’ side, they care about a S3 interface with a high degree of compatibility with the Amazon API but less on other aspects. They’re looking for ease of deployment, maintenance and support, scalability, capacity and a few other core features of course, especially in the data protection area.