FADU is a fabless SSD drive and controller company making screamingly fast NVMe technology, such as these coming PCIe 5 drives with 14.6GB/sec write and 10.4GB/sec read bandwidth. Where does it come from, and how has it achieved this?

It was founded in South Korea in 2016 by four co-founders:

- Jackie Lee – first CEO and an investor;

- Lee Ji-hyo (Jihyo Lee) – current CEO and ex-Bain partner;

- Nam Eyee-hyun (Peter Nam) – CTO;

- Lee Dae-keun (Dae Keun) – COO.

The NAND technical smarts came from Peter Nam – Eyee Hyun Nam on LinkedIn – who has a PhD in computer science from Seoul National University, spent two years at SK hynix as a project leader, and then started working on FADU ideas with the others.

Jihyo Lee was a manager and then partner at Bain & Company in Korea where he initiated and then led Bain Seoul’s tech sector operations. Jackie Lee was, we understand, also a Bain partner and consultant for memory companies. He is a FADU investor and left about two years after it was started.

FADU is funded by South Korean investors, all private, and there have been three rounds of funding with a fourth expected soon. In May it was reportedly seeking ₩200 billion ($157 million) for global expansion. It raised ₩30 billion ($38 million) in February this year.

The report said FADU’s business partner, SK hynix, signed a deal to supply SSDs to Meta (Facebook as was) earlier this year. FADU reported revenues of ₩5.2 billion in 2021 with an operating loss of ₩33.7 billion.

The company opened a Mountain View office in 2019, and John Baskett (ex-Memblaze and Broadcom), VP business development & strategic partnerships, and Anu Murthy (ex-Seagate and Toshiba), VP marketing, are both based there.

In 2022 FADU expects to ship around 300,000 controllers. There should be a million-plus shipped in 2023 as FADU’s production ramps up for hyperscaler customers.

Technology

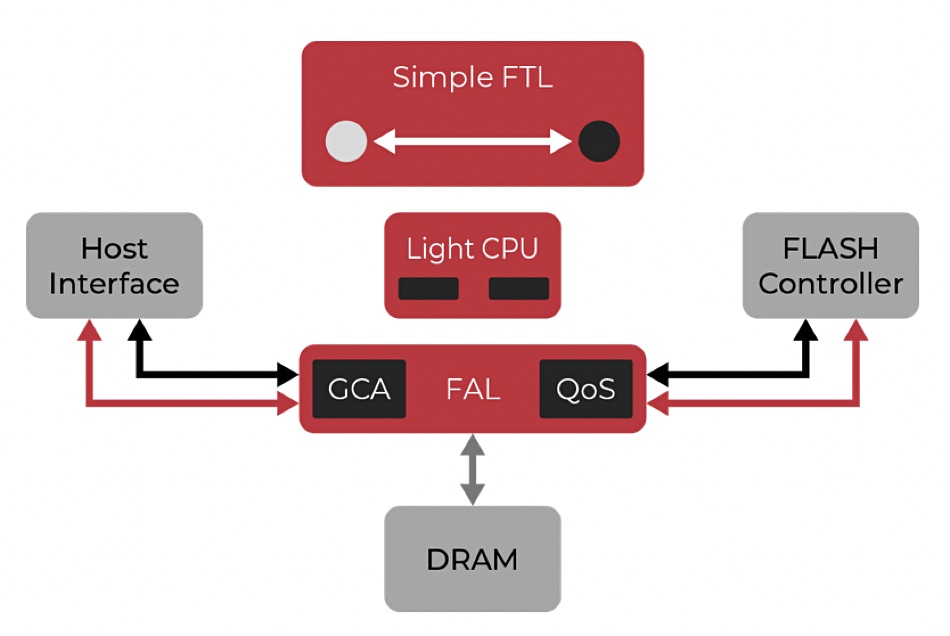

FADU’s controllers are based on ASIC technology with a RISV-V CPU core and hardware accelerators. We’re told the controller architecture features minimal shared bus traffic. The company optimizes three SSD controller attributes: increasing performance (IOPS, bandwidth and lower latency); lowering active power consumption by 30 percent or so compared to competitors; and increasing reliability and consistency with better quality of service. The drives are pre-conditioned to prevent any fresh-out-of-the-box performance spikes.

The design also addresses heat issues and enables SSDs to meet heat limitations (thermal design power enevelope) without throttling performance.

FADU also claims it delivers a rich and widening feature set with each new generation. We know of three generations of its controller technology:

- FC3081 – PCIe 3 and 100,000 IOPS per watt, 8 channels, TLC, used in Bravo SSD. In mass-production;

- FC 4121 – PCIe 4–12 channels, TLC, OCP-compliant, ZNS support, used in Delta SSD, and in mass production. Doubles FC3081 performance. EDSFF E1.S and U.2 form factors;

- FC 5161 – PCIe 5 16-channel interface, ZNS support, TLC, QLC, <5.2 W average power, used in Echo SSD, EDSFF and U.2 SSD form factors, availability in 2023. FAL in the diagram above stands for flash acceleration layer.

FADU competes with SSD controller companies such as Microsemi, Phison, and Silicon Motion. It sells specifically to OEMs and hyperscalers, will privately label its SSDs, and does not sell to consumers. SK hynix is the only customer we know about. FADU co-presented with Meta at FMS 2022 which indicates a close relationship, although FADU would not confirm specifics.

The firm has said it aims to go public in 2023 and move towards profitability. It has protected its technology with seven Korean patents and three in the US.

Comment

FADU came out of nowhere, so to speak, in 2016 and said it would build a better SSD controller geared for hyperscalers and OEMs. That’s what it has done, with eye-catching performance speed, consistently low latency, and lower power draw compared to the legacy competitors.

Its progress has been dramatic, and it has to carry on that way – with hyperscalers taking millions of its controllers – for its planned IPO to be successful. We think that if its controller technology is really solid, SSD suppliers may be casting potentially acquisitive eyes over its books. Then they could have all the FADU technology goodness just for their own SSDs and grab market share.