Increasing data fragmentation is hindering analytics and compliance, meaning it requires a data intelligence and governance remedy to provide data visibility and control.

According to IDC’s 2021 “Global Survey of the Office of the Chief Data Officer (CDO), some 79 percent of organizations are using more than 100 data sources, making it hard to manage the entirety of an organization’s data estate.

Data visibility means knowing what data you have and where it came from, and it enables compliance and security. You can’t comply with compliance regulations if you don’t know what data you have and nor can you secure data you don’t know you possess.

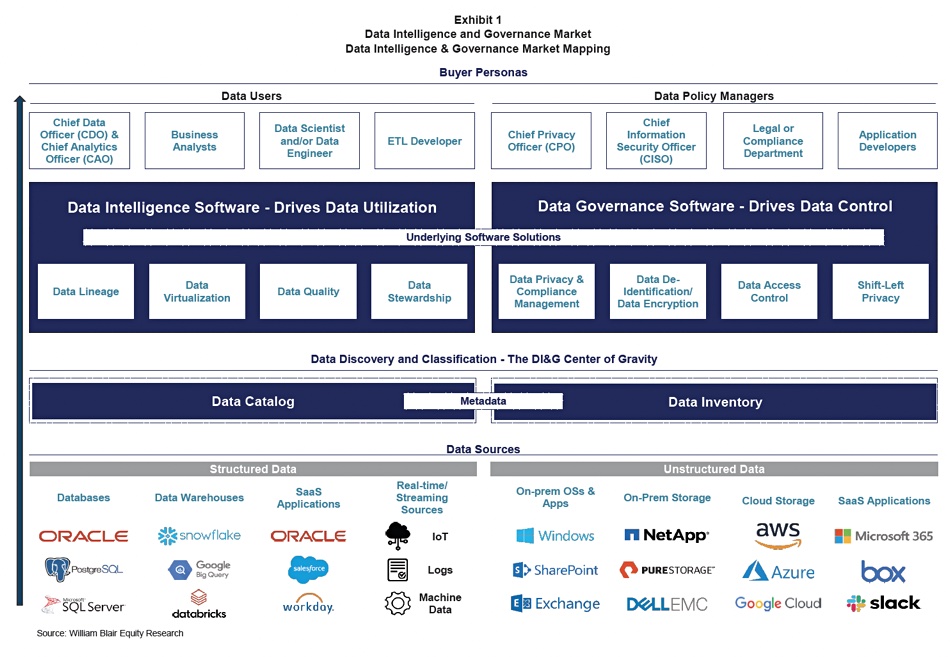

Financial analyst Jason Ader and his team at William Blair examined suppliers offering remedial products and services, noting an emerging ecosystem that is providing help for the different kinds of data users and data policy managers (as detailed in the chart below)

William Blair refers to this area as data intelligence and governance (DI&G) via a report entitled “Data Intelligence and Governance Market – Managing Data Duality in a Digital-First World”.

“The marriage of visibility and control in many ways defines the DI&G space and is the main catalyst driving convergence of previously disparate market segments like data catalogs, data quality, data lineage, data stewardship, master data management, metadata management, data integration, data privacy, data access governance, and data security.”

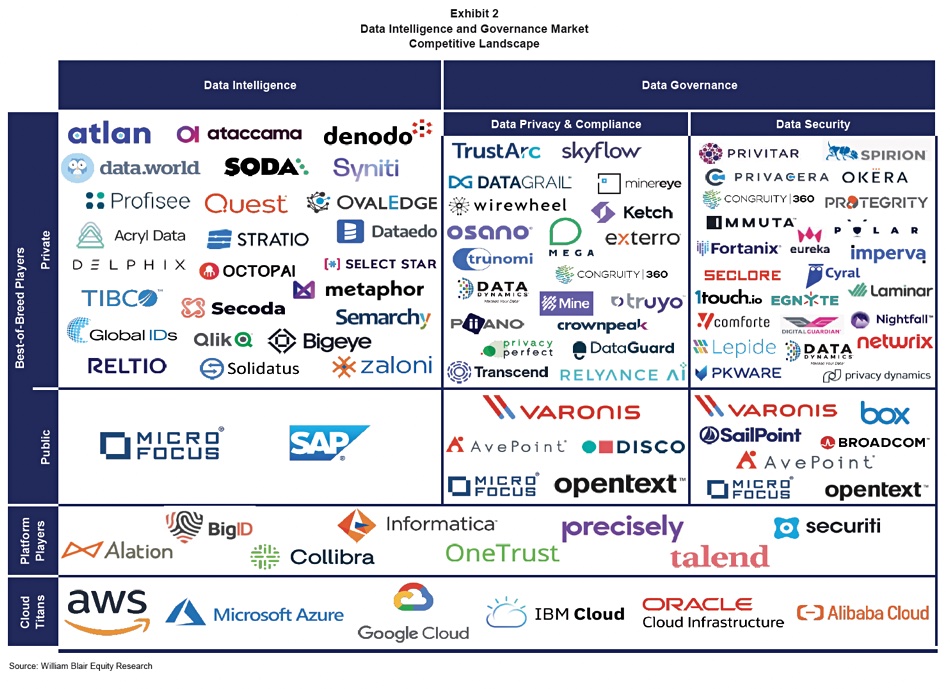

Over the past decade three separate groups of vendors have emerged:

- Data intelligence suppliers – analytics-centric, for example, finding and curating high-value data for business intelligence and analytics purposes.

- Data privacy and compliance – privacy-centric vendors concerned with the EU’s General Data Protection Regulation (GDPR), HIPAA, and the California Consumer Privacy Act (CCPA).

- Data security – security-centric businesses trying to protect sensitive data from internal and external threats.

Ader says via the report that “these three worlds are naturally and inevitably converging into one consolidated market.” The DI&G market, he says, will be worth $26 billion in 2025. This means that centralized DI&G platform products will develop with initial convergence and consolidation in each of the three categories above. The report lists suppliers in each of the three categories:

We have previously written about Delphix and its data ops characteristics, also Egnyte with its secure enterprise collaboration features, and Quest.

Ader suggests the convergence “puts point product vendors at risk of disintermediation as the features they offer become consolidated into broader suites and platforms.” He also says that best-of-breed vendors will find it “more likely that they will be ripe acquisition targets for consolidators.”

Customer organisations are themselves fragmented in how they deal with data, with William Blair detailing the different parts of an organisation dealing with different types of data:

- Chief Data Officer – buys data catalogs

- Chief Information Security Office – buys security products

- Chief Privacy Officer – buys compliance products

Customer organizations will need to centralize their data intelligence and control roles under a CDO. The report says “we are seeing CDOs emerge as the top executive in charge of utilization and governance of data across the organization (which often includes responsibility for data security and privacy).”