Atempo is like a data protection and data management iceberg – some of its activities are in view but the bulk are hidden underneath the waterline – because it has, so far, chosen not to market itself with much energy.

Attendees at an IT Press Tour briefing in Sunnyvale were given an introduction to the whole company, its strategy and roadmap, and found it had a focussed and disciplined plan to improve its branding and product set capabilities in today’s multi-hybrid cloud environment.

Geographically Atempo does not have a strong presence in the North American market, having built its customer base in Europe and the Far East from its France-based HQ. This adds to its general lack of visibility. It also has a relatively large number of products which contribute to a level of brand confusion – this is being addressed.

Ferhat Kaddour, VP sales & alliances, and Louis-Frederic Laszlo , director of product management, briefed tour attendees and provided the initial introduction. Atempo sells its products to enterprise and mid-size organisations and has more than 2,000 customers in the media and entertainment, HPC-research, healthcare and public sector markets. It had 20 per cent year-on-year revenue growth in 2021 and hired 100 more employees.

Atempo has built separate products for different data protection market niches – Lina, Tina and YOO Backup – with its Miria data management product set also offering a backup capability. In fact Miria was an enterprise data backup, archive and migration suite which is now becoming Atempo’s data management product technology with added AI smarts.

- Lina (Live Navigator) – backup for workstations and laptops;

- Tina (Time Navigator) – on-premises and SaaS backup/restore physical and virtual server systems, apps including 365 and file data;

- Backstone Appliances – data protection of data, systems, apps and files with disaster recovery and business continuity;

- YooBackup – DRaaS and virtualisation backup;

- Miria Data Management with Miria modules for analytics, migration, backup, archiving and synchronisation and supporting billions of files, all based on core data moving technology.

This multi-product set will, Kaddour said, be slimmed down to two brands: Atempo Data Protection (Lina, Tina, Backstone and YooBackup), and Atempo Data Management (Miria’s 5 modules). Atempo DP will focus on cyber crime, hybrid infrastructures and something called data atomisation – which we understand to refer to silos. Atempo DM’s focus is on massive data growth, regulation and compliance.

Laszlo said the rebranding should be complete this year but the technology convergence could take two years.

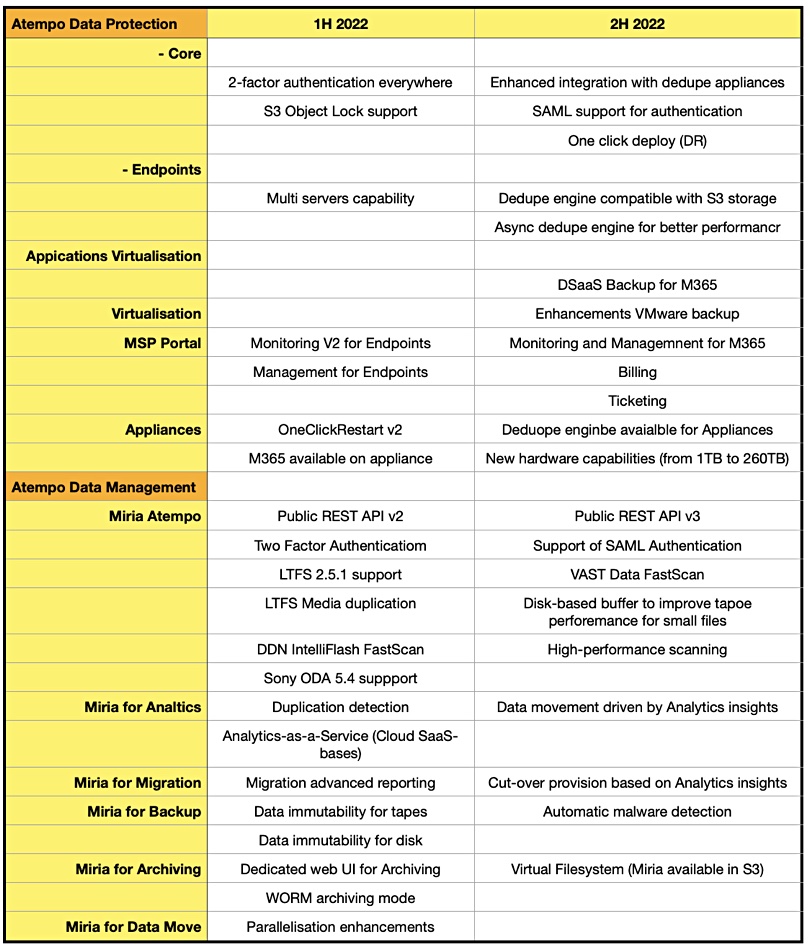

Atempo roadmap

Atempo DP will be 100 per cent MSP-driven with a multi-services portal and a multi-storage service from SaaS to on-premises and to the appliance. We have condensed three separate roadmap slides from the briefing into a single table and it shows an impressive body of work to be done:

There is no data protection support for Kubernetes-orchestrated containers. Kaddour said “It’s not the top priority of our customers.” They need their existing complex IT environments protected better first. We might suppose that Atempo’s customers do not have extensive DevOps activities.

The enhanced integration with dedupe appliances refers to Dell PowerProtect/Data Domain and Quantum with its DXi line. Kasddour didn’t mention any relationships with Veritas or HPE (StoreOnce) but did say Atempo has started talking to ExaGrid, with NDAs signed to ease the talks forward.

Atempo can already send VM backups to S3 but wants to go further with dedupe engine support for S3. That means that it could use S3-compliant systems such as those from Cloudian, MinIO and Scality as targets for its backup software, or, of course, AWS.

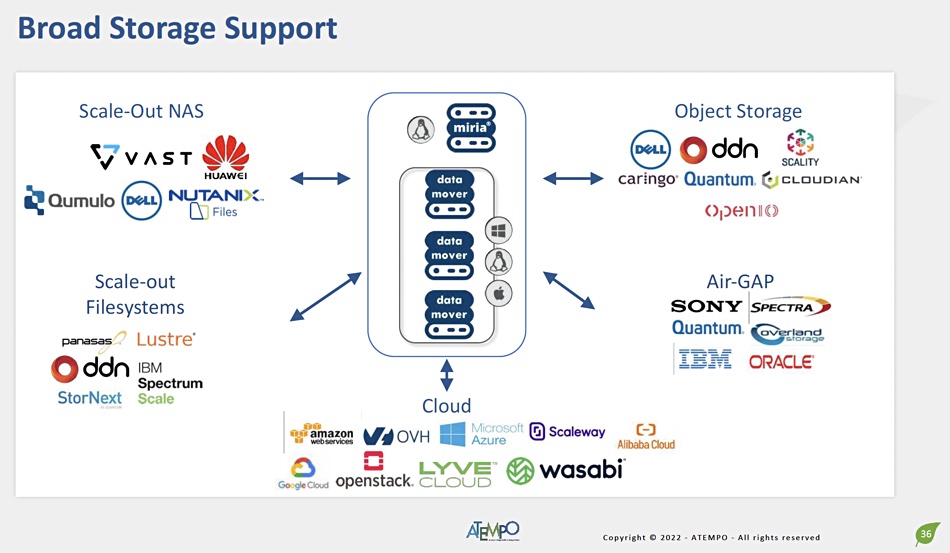

Miria software handles very large populations of files, in the billions, the PB to EB unstructured data area, and this is not something that the Tina product or other constituent technologies in what will become Atempo DP can handle. He said that combining the two backup technologies – Miria and Tina for example – was not in Atempo’s plans because it was simply not desirable to build a combined product that was not as well suited to the two separate workload classes as Tina and Miria are today.

Miria’s massive file handling capabilities explains why Atempo partners Qumulo and VAST Data. We should note that Miria has S3 Object Lock support already. It can also snap from Isilon to Qumulo, which must be an attractive capability for Qumulo to exploit.

We heard that Atempo wants to ensure that the automated malware detection, which will use third-party plug-ins, does not interfere with file transmission times across network links.

We note that, with its Data Management plans, Atempo will compete more strongly with Nasuni, Egnyte and Panzura (file sync), and Komprise (file lifecycle management).

We also heard that OVH and Atempo are developing an S3 Glacier alternative.

Comment

Atempo is undertaking a vigorous product development plan and should end up with a much cleaner and simpler branding and marketing message. There are some alliances that we could imagine it would like to have, such as certifications from NetApp and WekaIO. The company has a quite large and, we understand, loyal base of customers but has not, as we understand it, embarked in any substantial marketing activities to gain new customers. It works as it were in the shadows and relies on its products’ quality and support to impress customers and help word-of-mouth marketing and case studies.

We think this will change as this French-based company does more in the USA and adopts USA ways.