Sk Hynix’s Q2 results were very good and the company’s prospects look positive, with growing market demand and Intel’s NAND business ready to boost results in 2022.

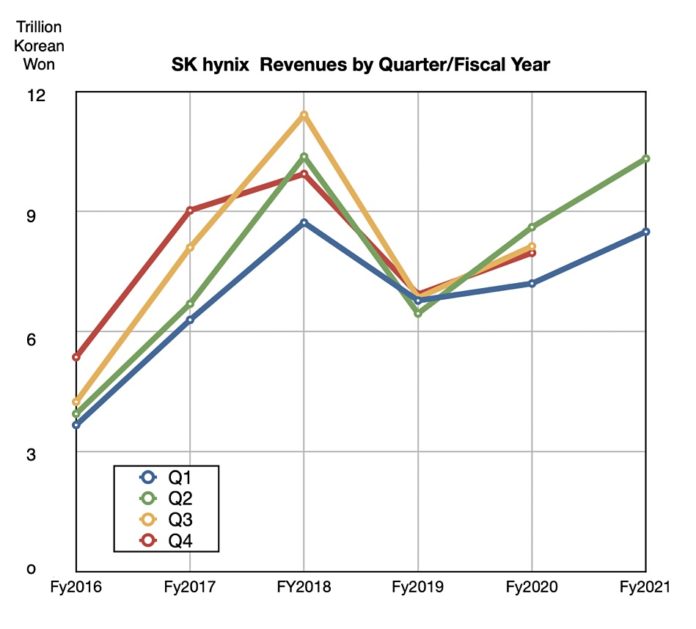

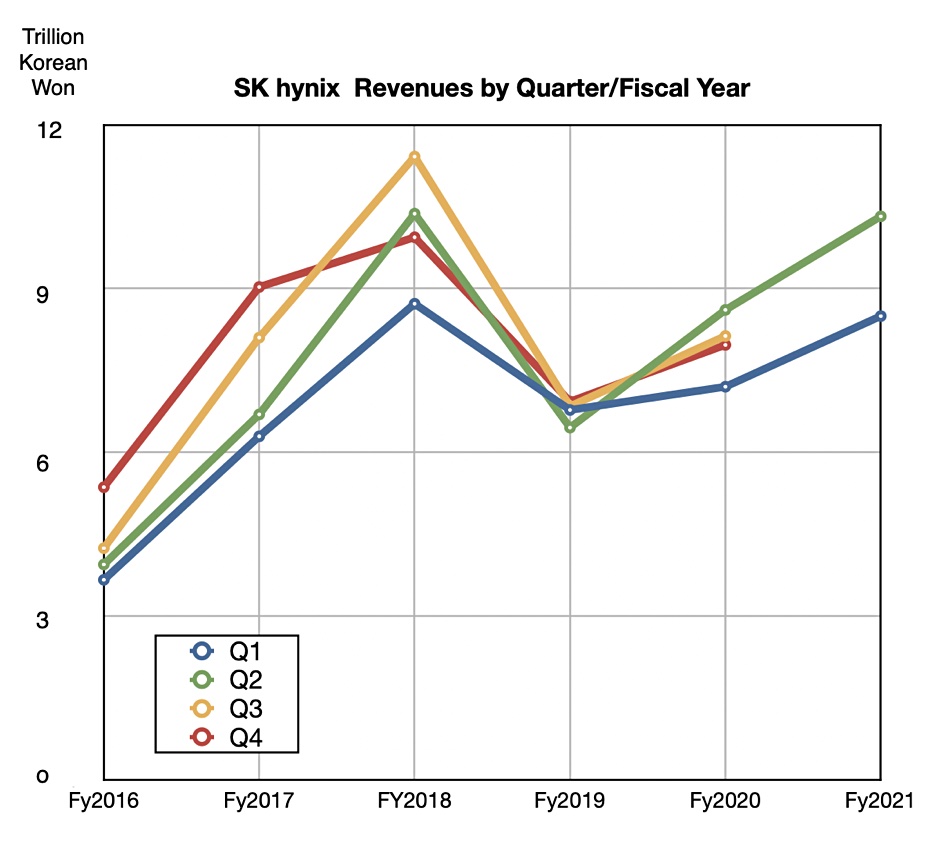

Our sibling publication The Register detailed SK Hynix’s quarterly results. We charted its revenues by quarter and by fiscal year to show its recovery from the DRAM and NAND gluts which severely affected its 2019 revenues:

It’s apparent that the Q2 revenues were almost back to the 2018 Q2 high point and quite possible that SK Hynix’s third quarter could exceed the 2017 Q3 high result. But they would have to accelerate markedly to reach the 2018 Q3 high-point.

The DRAM market is being driven by DDR5, smart phones’ 5G functionality requiring more DRAM, and new Intel servers. Both the phones and the servers will draw in more NAND as well. If SK Hynix’s Intel NAND business acquisition gets the nod from Chinese regulators by the end of the year then its 2022 NAND revenues could rocket.

Intel’s NAND represented a $5.6 billion run rate business in 2020, meaning 6.5 trillion Korean won. Assume that’s 1.63 trillion per quarter and SK Hynix’s quarterly revenues will increase by more than ten per cent.

Its NAND market share will rise to 23 per cent, eclipsing Micron’s 13.7 per cent, Western Digital’s 16 per cent and Kioxia’s 17 per cent — putting it second in the market behind Samsung’s 31 per cent. Micron becomes the smallest player in the NAND market and may look to grow through acquisition.

Were Kioxia to IPO in 2022, then the stage could be set for some acquisitive NAND supplier action.