From time to time, vendors publish their Net Promotor Score (NPS) as a way to trumpet how great they are – and by extension how much better they are than their competitors.

For example, Nutanix, in an undated but presumably old blog post titled ‘Nutanix Blows Away Industry Net Promoter Scores‘, proclaimed that “Omega Management Group recognized 35 companies for “Delivering World-Class Customer Service” in 2013. Nutanix was honored to be included in this elite group of companies.”

To drive home the point, author Steve Kaplan wrote: “A high Net Promoter Score is notoriously difficult to obtain. Apple, for example, despite their reputation for sterling customer service received a +42 last year. The dominant virtualization player, VMware, received a +48. Dell achieved a very respectable +37. EMC garnered a +28 and NetApp a +25. And Nutanix? A whopping +73 (and it’s now over 80). The next highest on this list of 60 tech vendors was Intel with 53.”

Since then Nutanix’ score has risen to 90 and a spokesperson said it: “has been 90 for several years.”

So how well does NPS capture a snapshot of a company’s reputation with customers? And what do those numbers mean? Let’s take a look.

NPS mechanics

The Net Promoter Score is a number from -100 from 100. The idea was developed by a Fred Reichheld, presented in a Harvard Business Review article in 1993, and subsequently adopted by Bain & Company and Satmetrix.

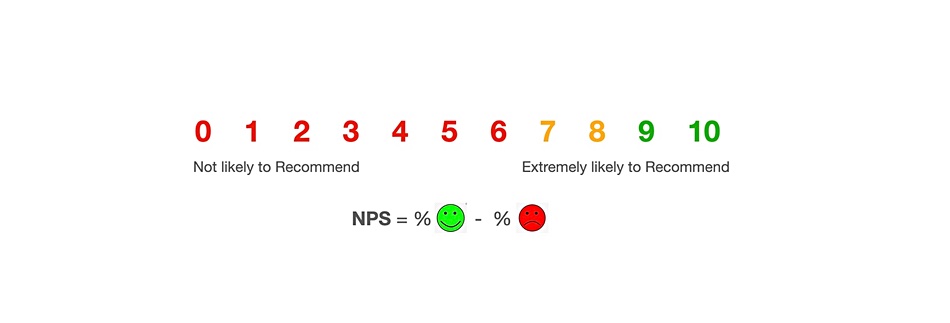

Scores above 0 are generally thought good and ones above 50 excellent. An organisation runs a survey of a supplier’s customers and asks one question: how likely on a scale of 0 (not at all) to 10 (extremely likely) to recommend the supplier to their peers.

A score between 0 and 6 is classed as a detractor. A 7-8 score represents a passive customer while a 9 – 10 score signals a customer who will promote the supplier to their peers.

The actual NPS score value is obtained by subtracting the percentage of 0 to 6 responses (detractors) from the percentage of 7 – 10 responses (promotors) and presenting this as a number between -100 and +100.

Here is a small sample of recent NPS’s in the data storage industry.

- Cohesity – 100

- HPE Nimble – 85

- HYCU – 91

- Nutanix – 90

- Pure Storage – 83.5

- Rubrik – 82

- Veeam – 73

Cohesity attained a +100 NPS score in January 2020. A company spokesperson said its NPS rating is: “currently in the low 90s, but I don’t think it’s dropped below 90 in two years.”

Pure Storage said that, for the sixth year in a row, it scored an NPS in the top 1 per cent of Medallia benchmarked B2B scores. A spokesperson told us it uses NPS data to actively improve customer experience through direct feedback and address specific customer pain points.

Actionable insights

In 2018 HPE interviewed its own customers. Dr. James Borderick, who led the Net Promoter Competitive Loyalty program at HPE Software at the time, said: “The numerical NPS value does not really matter. What matters is the actionable insight that you have learned, and where you stand relative to your competitors.” The company did not reveal its own NPS score.

Pure Storage states: “As a customer-first company, Pure places extreme emphasis on using NPS data to guide in improvements to our customers’ experiences.”

According to Pure, an independent third party should validate or certify the supplier’s NPS That way a spread of customers can be surveyed and not just a supplier’s own subset.

“Pure’s audited score, based on the Medallia platform, was more than twice the B2B average of 40,” it says, “and the highest among Medallia B2B scores in 2019. Specifically, we’re pleased to announce an Owen CX certified score of 82, as Pure has scaled to receiving nearly 1,000 surveys in the last year. “

NPS issues

An obvious problem for a supplier publishing NPS scores is what to do if the score goes down. Another is that the customers providing promoter ratings for a supplier may not actually promote the supplier to their peers at all.

This was discussed in a 2019 Harvard Business Review article, “Where Net Promoter Score Goes Wrong.” Christina Stahlkopf, a research analyst at C Space, an agency looking at suppliers’ customers, wrote: “We’ve come to believe that NPS offers mostly broad strokes, akin to a compass pointing companies in the right direction. This is not to say we think it’s irrelevant. A compass is still a helpful tool… Sometimes, what the compass indicates is the best direction to follow actually isn’t once you take into account the on-the-ground terrain.”

The “promise of NPS was elusive” for many companies, according to Stahlkopf. C Space’s study of 2000 consumers in the USA and UK found “52 per cent of all people who actively discouraged others from using a brand had also actively recommended it… Consumers who had both actively promoted and actively criticised the same brand.”

“While enthusiasts are happy to extol the virtues of a brand they love, that doesn’t mean they like every product in the lineup.”

Another finding: “50 per cent of customers in our … survey were promoters, but 69 per cent of customers had actually recommended a brand. So the NPS categorisation missed a big chunk of the actual promoters.”

Stahlkopf concludes:“We think that companies would do better with a framework that focuses on customers’ actual behaviour.”