Pure Storage is a struggling legacy vendor while NetApp is powering ahead. So says NetApp in a corporate blog entitled Will the real legacy storage vendor please stand up? published this week.

John ‘Ricky’ Martin, director of strategy and technology at the Office of the CTO APAC, NetApp, penned the article in response to November 2020 blog by Pure that asserts NetApp is a legacy vendor following behind Pure.

Proclaiming it’s “time to put complex legacy storage solutions in your rearview mirror”, the unnamed writer outlines Pure’s view of NetApp’s Insight 2020 virtual event.

The company criticises NetApp’s products for being complex, for example: “NetApp added S3 protocol support to its later version of ONTAP and claims that it’s been simplified (again). Adding more features to an operating system born in 1992 doesn’t simplify it in my book. Just ask NetApp how many parameters are available on the volume create operation. Try more than 30. It’s the opposite of simplicity.”

The blog writer says: “From our perspective, NetApp is:

- Playing catch up on the hardware front

- Adding even more complexity to existing software solutions

- Announcing “projects” instead of products

- Adding more management tools to an already long and complex list

- Providing limited public information about a true utility consumption model

- Offering no clear program for technology refreshes.

Ouch.

NetApp’s reply

In his riposte, Martin writes: “The new NetApp is already where Pure needs to be. Cloud led, data-centric, software first.”

And he goes on the attack. “After ten years of profitless business, Pure is desperately gambling large chunks of its dwindling funds at the R&D and M&A casino, hoping for a payoff that may never come.”

His blog is filled with zingy one-liners.

- In the early 2010s “Pure Storage was rocking up the charts building the kind of business growth that comes from selling twenty-dollar bills for fifteen bucks a piece and telling everyone it was because of its radical differentiation.”

- “Purity is over ten years old, and STILL looks a lot like ancient versions of ONTAP 7.3.”

- Pure is “a box pusher stuck in the past, looking in its rear mirror while blindly heading down a path dominated by datacentres and storage media, still obsessed with simplistic proprietary hardware offerings as a road to differentiation”

- ““All Flash” isn’t disruptive anymore. It’s ubiquitous, leaving Pure looking like nothing more than a Dell mini-me.”

- “Pure doesn’t get cloud, Pure can’t do real data management, and when Pure does get software, it seems the first thing it tries to do with it is to shove it inside of a box full of proprietary tin.”

Where’s the referee?

We think NetApp and Pure are excellent companies with great products and services. NetApp is a legacy vendor with a substantial incumbent base, making remarkable strides to stay relevant in today’s hybrid, multi-cloud and pandemic-stricken environment. Pure is a newer vendor whose disruptive technology and business models have spurred NetApp and others to upgrade their own technology and business models, to customers’ benefit.

But in our view, Martin was intemperate in his attack against Pure and we disagree with the some of the points he makes. We might note that NetApp was late getting into all-flash arrays, and its efforts were spurred by Pure’s success. We might also consider that NetApp’s Keystone storage subscription service, introduced in October last year, was in part a response to Pure’s Evergreen and Pure-as-a-Service offerings.

Also we think Martin’s “proprietary tin” gibe rings hollow. Proprietary storage hardware in itself is of little or no concern when data access is through standard protocols; there is no lock-in here. All vendors have proprietary technology of some description, be it hardware or software. NetApp has its proprietary approach to hardware, using Pensando accelerators, for example.

Martin says: “We’ve worked hard to get where we are, we didn’t take shortcuts, we didn’t claim stuff we couldn’t do, we didn’t over-hype stuff, or spread baseless FUD.”

Pure also worked hard to get where it is. It didn’t take shortcuts either. Designing its own hardware to speed its data access services and make them more efficient over time is not taking a shortcut. And we’ll mention that Pure overtook NetApp in Gartner’s Magic Quadrant for Primary Arrays in December.

N.B. Revenue performance

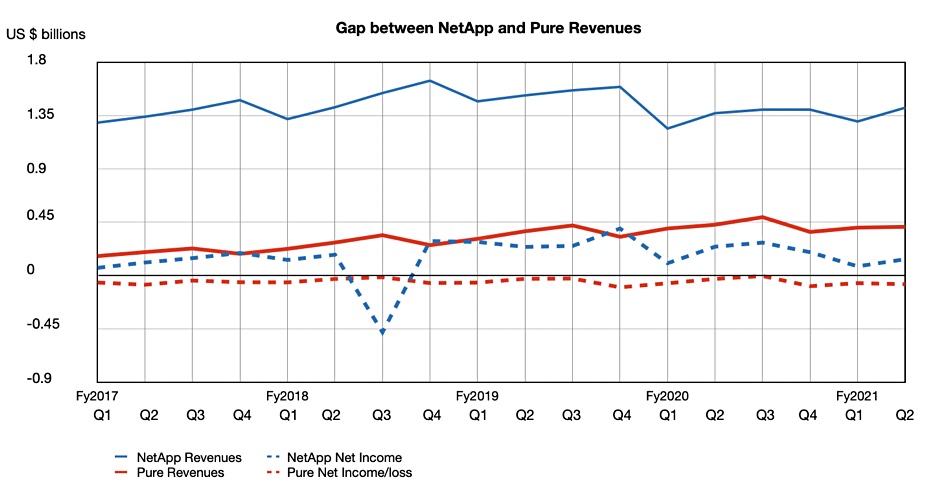

The verbal energy that Martin puts into his blog post could be seen as a tribute to Pure’s competitive threats. Of course, NetApp is a much bigger company than Pure Storage. But if we compare the two company’s quarterly revenues we can see that Pure has reduced the gap somewhat, albeit from a long way behind.

The chart compares the two companies quarterly revenues normalised to NetApp’s fiscal year scheme. It also shows their net income with Pure consistently making losses as it pursues growth over profitability.

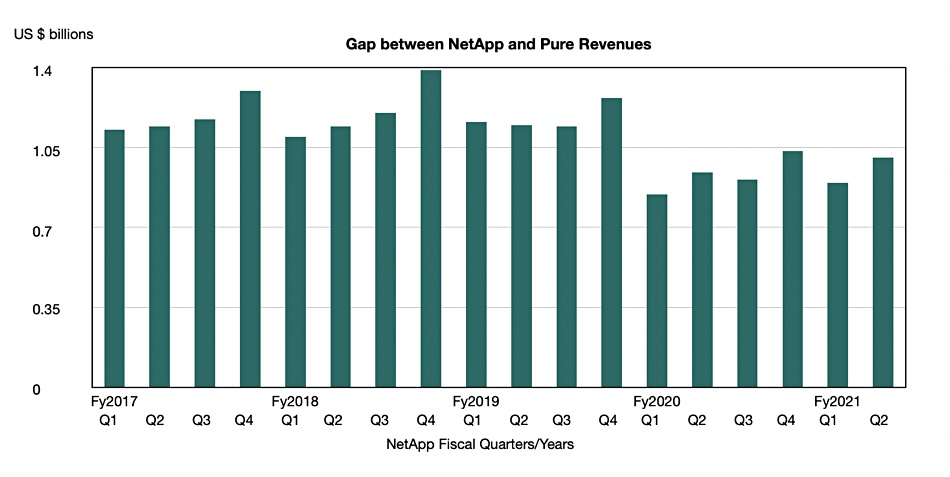

We can focus more closely on the revenue difference between NetApp and Pure by charting the gap between their revenues. (Note, there is a pronounced seasonal effect as NetApp’s Q4 persistently shows the highest quarterly revenue in any fiscal year.)