Omdia, a tech analyst firm, forecasts the global hyperconverged infrastructure (HCI) market will grow from $11bn in 2019 to more than $60bn in 2023.

Update: Omdia analyst Roy Illsley replies to question and adds market analysis charts and comments, 15 July 2020.

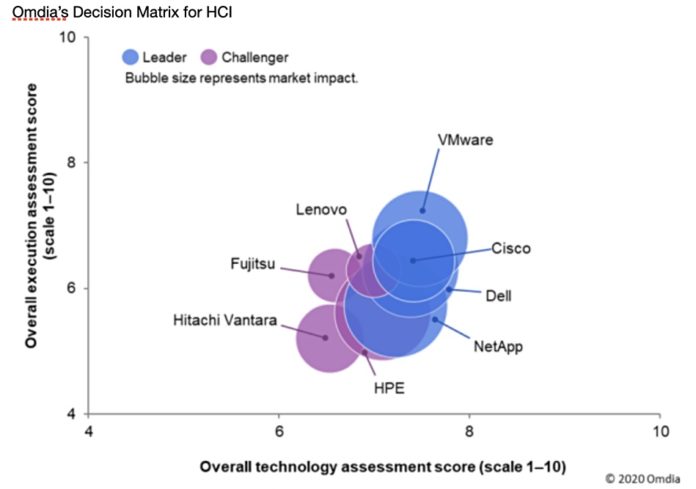

It has a taken a new slant on rating hyperconverged infrastructure (HCI) vendors, dividing suppliers into leaders and challengers. Omdia classifies Cisco, Dell, NetApp and VMware as leaders because they “recorded more than 60 per cent of sub-category scores above the cohort average compared to challengers with less than 50 per cent.”

Also, the “clear observation is that the difference between a hardware or software approach to HCI does not show one is better than the other, says Roy Illsley, Omdia chief analyst, IT & enterprise.

Little sets Cisco, Dell, and VMware apart at the moment, according to Omdia NetApp, the fourth leader, slightly separated from this group. But where is Nutanix in this assessment? It seems an odd omission and we have asked Omdia why Nutanix has been excluded.

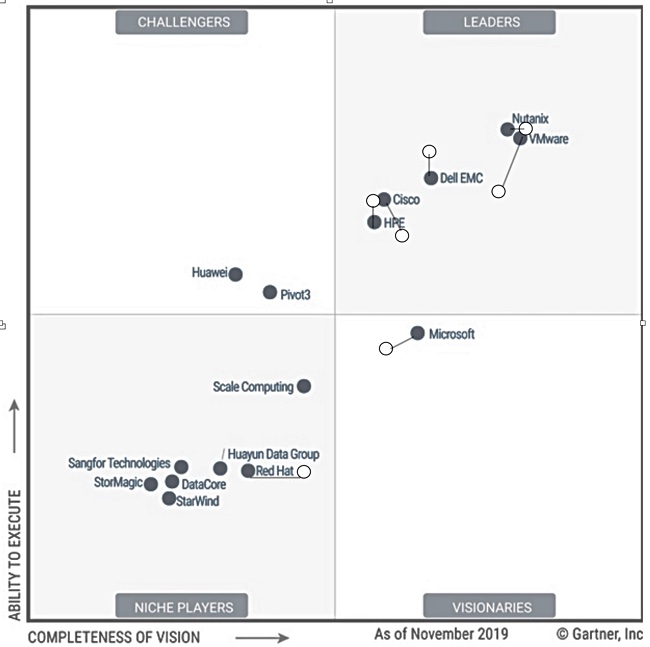

Update: Illsley said: “Nutanix and Huawei both said they were taking part, but both had resource issues and could not complete the data gathering phase. From the previous market radar in 2019 I would have expected Nutanix to be a rival to VMware.”

Omdia’s chart shows vendors positioned in a 2D space by assessments of their overall execution and technology, with the circle or bubble size denoting their market impact.

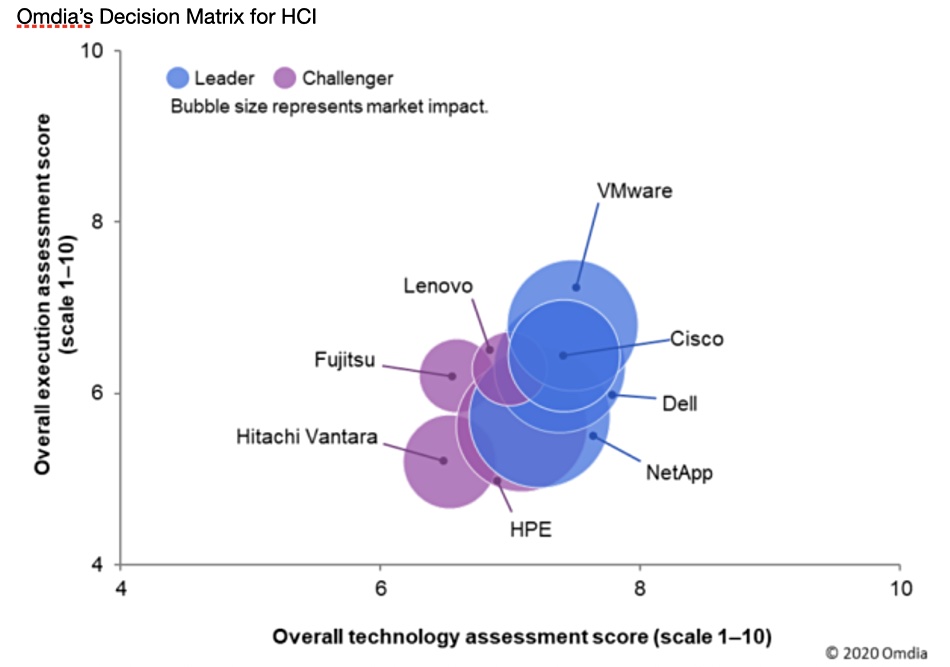

In terms of market impact as generally understood – i.e. revenue share – Omdia’s assessment is quite different from IDC’s storage tracker findings.

Update: Illsley said: “Market impact is a combination of the market share, NPS, and some other measure such as global coverage by region and vertical.”

Omdia classifies Fujitsu, Hitachi Vantara, HPE and Lenovo as challengers. HCI vendors such as DataCore, Scale Computing and Pivot3 do not appear. There is no distinction in the chart between HPE’s SimpliVity and its Nimble dHCI products.

Update: Illsley said: “Scale and Pivot3 were invited, but both said they failed to meet the inclusion criteria in terms of the number of customers.”

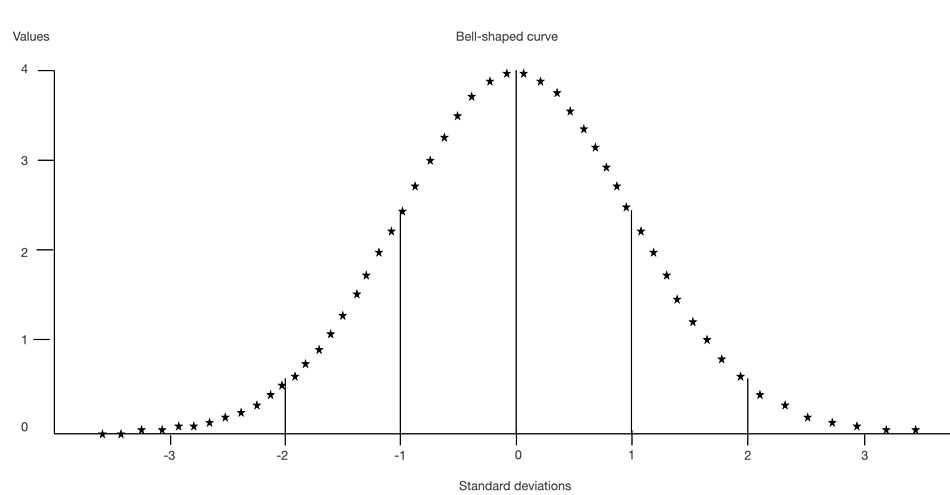

We’re told the separation between the leaders and challengers in the HCI solutions market was a maximum of 1.2 standard deviation on average, demonstrating that the HCI market is differentiated by a number of small features and capabilities.

A standard deviation is a measure of how much an item or group of items differ from the mean value of the whole group on some measurement scale with a bell-shaped curve of values. It certainly sounds quantitatively and statistically rigorous, albeit being based on analyst’s qualitative assessments of a vendor’s position on whatever criteria were being used.

Omdia has not published its assessment criteria, but mention latency, data sovereignty and scale. It declares the HCI market remains immature, but leadership is forming. Both IDC and Gartner have identified HCI leaders in their research for many quarters.

The HCI report is part of Omdia’s IT Ecosystem & Operations Intelligence Service and is available to subscribers only.

Update: Market analysis

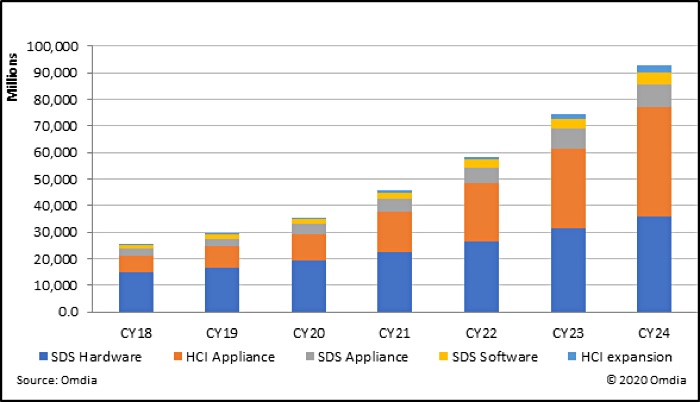

Omdia tracks the HCI market in two market trackers: the software-defined storage tracker and the server market tracker. In terms of the software-defined storage market, HCI (appliances + expansion) is a fast-growing segment and by 2024, approaching $44bn. Figure 1 below shows how the different sub-segments of the software defined storage market will change over the 2018–2024 period.

HCI appliances (Omdia defines HCI appliance as a single server and integrated software stack that typically includes multiple compute nodes) the dominant form of HCI and worth over $40bn by 2024. HCI expansion (Omdia defines HCI expansion as a storage device in an enclosure without a storage controller where data storing coordination is provided by an attached server) will become a $2.5bn market by 2024.

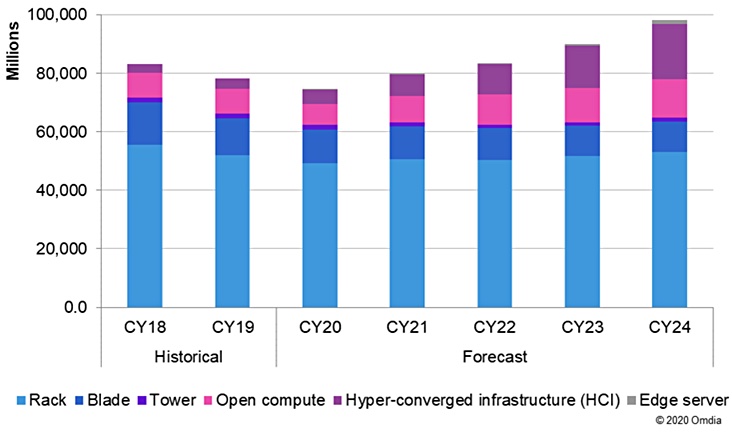

In terms of the server market, HCI server hardware remains a growing segment but will be less significant than it is in the SDS market. Omdia’s forecasts suggest that by 2024 the HCI server hardware will be approaching $19bn. By comparison, rack-mounted server hardware will be worth over $48bn in 2024, so while HCI server hardware is growing in importance within the server market, the standard rack-mounted server will remain the dominant form in the server market out to 2024 (see Figure 2 below).

Omdia is the newly rebranded name for various tech analyst businesses owned by Informa, the UK events and publishing giant. These include Ovum, Heavy Reading and Tractica and a technology research portfolio acquired from IHS Markit.