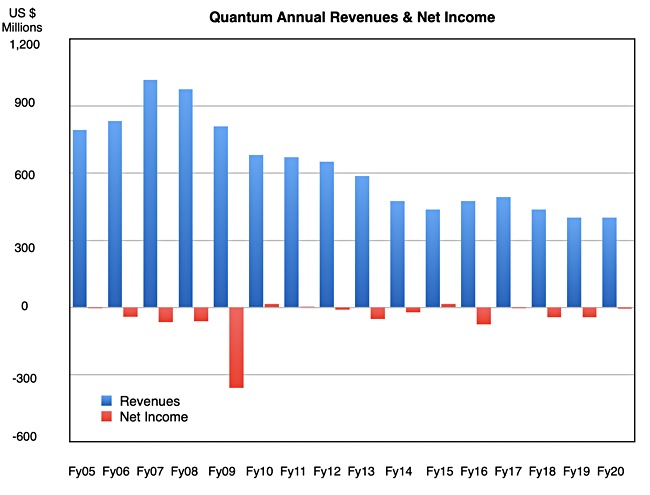

Full-year results from video workflow storage-focussed Quantum show stabilising revenues, improving gross margin and lower costs but the fourth quarter was hit by the pandemic and revenues slumped. Growth prospects in hyperscalers and the US public sector look great though.

Chairman and CEO Jamie Lerner has been reshaping and recovering Quantum’s business, refocussing the strategy on supporting video workflows and cutting costs whilst preserving R&D. The pandemic sent revenues down towards the end of the fourth fiscal quarter but the year as a whole was pretty satisfactory.

Lerner’s prepared quote declared: “Quantum delivered significantly improved performance in fiscal 2020, particularly in terms of profitability, despite a marked slowdown in revenue in mid-March when the outbreak of the COVID-19 pandemic halted professional sporting events and many of our customers in the media and entertainment sectors temporarily ceased filming operations.”

Full year revenues to March 31 2020, were $402.9m, a mere $220K more than last year but growth none the less. There was a net loss of $5.2m which was a pleasingly large improvement on last year’s $42.8m loss. Gross margins increased 120 basis points to 42.8 per cent and total operating expenses decreased $21.1m, or 12 per cent. Research and development expenses increased 13 per cent to $36.3m.

There was a 3 per cent increase in product revenue with growth in primary storage and devices and media partially offset by a decline in secondary storage systems. Quantum experienced a slight decline in service revenues, particularly from legacy tape backup customers as tape transitions from backup to archive.

Cash and cash equivalents of $6.4m at year end were down from the year-ago $10.8m. Quantum has secured an additional $20m credit facility help here.

The fourth quarter

Q4 fy20 revenues were $88.2m, down 15 per cent from the year-ago’s $103.3m. Product revenue slumped 20 per cent due to lower secondary storage demand and lower hyperscale demand, caused by the pandemic.

There was a $3.8m loss, better than last year’s $9.4m loss, and also creditable since product revenues were down by a fifth.

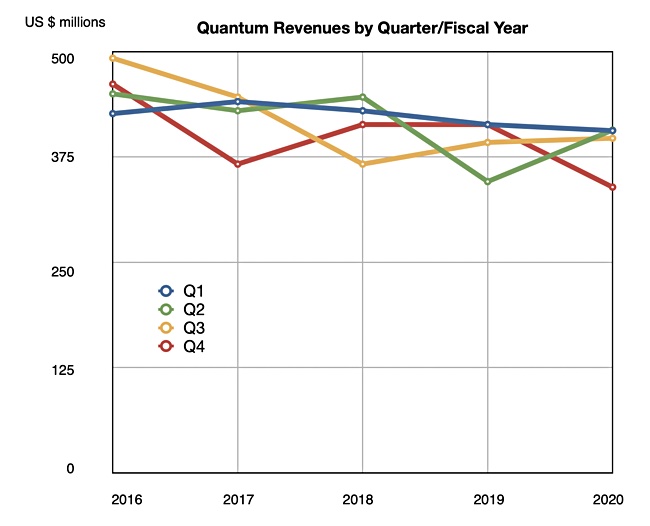

We can see by charting Quantum’s quarterly revenues by fiscal year that fy20 had seen a levelling of the downward revenue trend – until Q4 was affected by the pandemic which sent revenue abruptly down.

Earnings call

In the earnings call Lerner said: “Quantum is a healthy, cost-efficient innovator focused on higher-value and higher-margin solutions. The pandemic will subside or at least be contained, and our customers in sports and entertainment will return.”

Discussing the tape market, CFO Mike Dodson said: “The adoption of LTO-8 has lagged expectations primarily due to attractive pricing for LTO-7, and customer anticipation of the next-generation LTO-9 that is expected to be launched in the next six months.”

Blocks & Files also points to the shoddy dispute between tape media suppliers Sony and Fujifilm which limited LTO8 media supplies.

Lerner said a major release of the StorNext file system software is expected for the end of 2020, with a software-defined architecture. Quantum will “simplify and converge our product offerings, expanding the use cases we can address to include edge environments in small and post animation houses.”

Largest archive in the world

Tape is not dead. Both it and object storage are used for archives in hyperscale customers, enterprises, governments and service providers. Lerner said: “Our experience in the last few years in building the largest archive in the world has informed our product road map and new architectures.” What hyperscaler’s archive is that we wonder? Is it a glacial one, amazonian in size?

The hyperscale business is expanding, with Lerner saying: “Our hyperscaler business is actually starting to expand into very large telco, very large enterprise.”

The US public sector is a growth one for Quantum too, according to Lerner: “We are just becoming more relevant in unstructured data in the government, and that’s everything from the national labs to space programs with NASA. We want to go to Mars with NASA.

“There’s going to be a lot of imagery there. There’s a huge amount of work, whether it’s disease modelling, warfighter modelling. There’s just a huge amount of work happening in the national laboratories. And every single thing that we do in our military is video attached. So, I just think that is a big growth area for us.”

The guidance for the next quarter is for revenues of $73m plus/minus $1m, as Quantum expects the customer delays and disruptions experienced in the last two weeks of Q4 fy20 to have a more pronounced impact. That’s well down from Q1 fy20’s $106.6m.

But from then on, pandemic willing, things should pick up.