NetApp is buying Spot.io, an Israeli startup that specialises in cloud cost controls, for an undisclosed sum. The price is said to be $450m, according to Calcalist, an Israeli publication.

Amiram Shacher, Spot CEO and co-founder, said in a blog post about the deal: “We are going to build the next game-changing business unit at NetApp.”

Spot claimed more than 500 customers, including Intel – a backer – Sony, Ticketmaster and Verizon, in a 2017 funding round. The company was founded just two years earlier and has amassed $52.6m in venture funding in total.

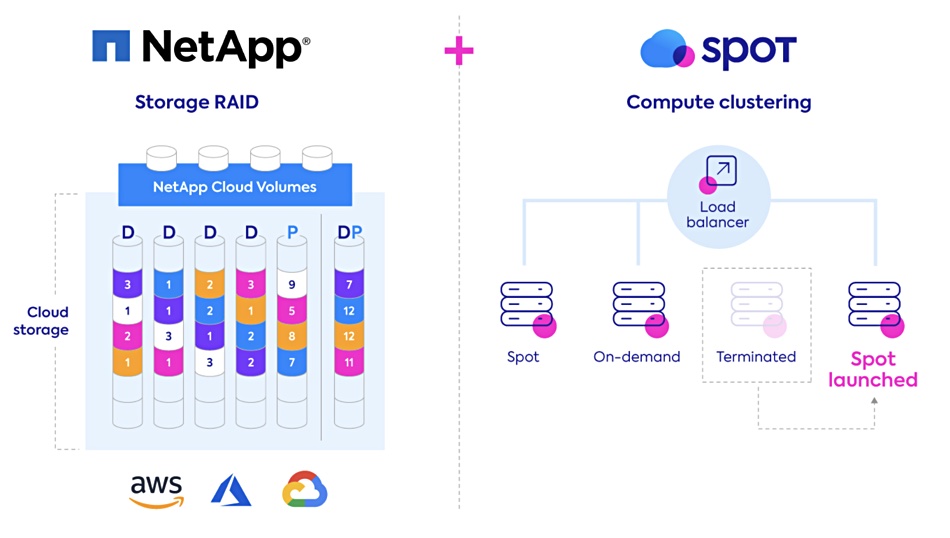

So what is NetApp buying? In effect, Spot is a cloud compute broker or virtual cloud provider that works with all three cloud giants. Spot’s Elastigroup product runs business applications on the lowest cost, discounted cloud compute instances, while maintaining service level agreements.

NetApp claims the technology can save up to 90 per cent of public cloud compute and storage cloud expenses. These typically account for up 70 per cent of total cloud spending.

Push these numbers through a mental spreadsheet and assume $1,000 per month public cloud spend and that compute and storage costs $700. By NetApp’s reckoning, Spot technology would saves $630, leaving total spend of $370 per month. If this technology works it’s a no-brainer.

NetApp will use Spot to establish an “application driven infrastructure” to enable customers to deploy more applications to public clouds. Spot’s as-a-service will provide continuous compute and storage optimisation of legacy enterprise applications, cloud-native workloads and data lakes.

Anthony Lye, head of NetApp’s public cloud services business, said in a canned quote: “Waste in the public clouds driven by idle resources and over-provisioned resources is a significant and a growing customer problem slowing down more public cloud adoption.

“The combination of NetApp’s… shared storage platform for block, file and object and Spot’s compute platform will deliver a leading solution for the continuous optimisation of cost for all workloads, both cloud-native and legacy. Optimised customers are happy customers and happy customers deploy more to the public clouds.”

NetApp and the public cloud

Here we have an on-premises storage array supplier encouraging customers to consume its storage services in the public cloud. That seems significant.

NetApp bought CloudJumper at the end of April and gained technology on which to base a NetApp Virtual Desktop Service providing virtual desktop infrastructure from the public cloud to work-from-home office staff. This will involve cloud compute and storage and Spot technology could be used to optimise the associated costs.

In its latest results (Q4 fy2020) NetApp’s public cloud business contributed 7.9 per cent of the revenue in the quarter. There was a $111m annual recurring revenue run rate in the business, up 113 per cent. This is good growth but from a small base and William Blair analyst Jason Ader thinks the “ramp has been well below management targets”.

In short, NetApp need grow its public cloud business.

“The Public Clouds have become the default platforms for all new application development,” Lye writes in a company blog. Application developers “don’t want to have to understand infrastructure details to be able to develop and deploy their code… Why shouldn’t the infrastructure be able to determine how to optimise performance, availability and cost, even as demands change and evolve?”

The deal should close by the end of October subject to the usual conditions. Spot will continue to offer and support its products as part of NetApp.

Elastigroup tech

Elastigroup creates a public cloud virtual server compute instance composed of Spot Instances, reserved instances and on-demand instances. This virtual instance is always available and dynamic, changing the actual instance type to continually find and use the lowest cost instances available.

The number of servers is scaled as demand requires and as public cloud billing periods start and terminate. Spot Instance pricing operates in a spot market and the company’s algorithms predict spot market price fluctuations and provisions on-demand instances when the spot market price goes above them.

Spot background

Spot was established in Tel Aviv in 2015 by Shachar, Liran Polak and Ahron Twizer, who has since left the company.

Shachar and Polak were members of the MAMRAM or ‘cloud infrastructure’ unit of the Israel Defense Forces and responsible for managing IDF’s data centres and virtualization systems.

They later pursued degrees in computer science and their academic research focused on addressing data centre inefficiencies by utilising Spot Instances in the Amazon cloud.

Spot Instances were excess compute capacity sold by AWS with discounts up to 90 per cent compared to normal compute instance pricing. They could be turned off with two minutes notice if AWS needed the capacity for its normal business.

Shachar and Polak designed a machine learning model to predict when AWS would want the spot instances terminated and Shachar’s employed moved to AWS Spot Instances for its IT compute needs. From there, they extended the service to Azure and Google Cloud.