Commvault, the data management vendor, missed analyst revenue estimates for the fourth quarter ended March 31, citing the effects of covid-19.

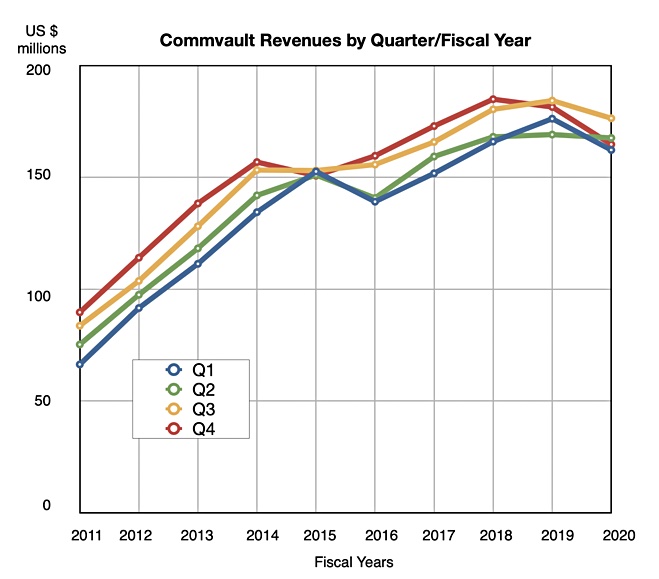

Revenues fell nine per cent to $164.7m. Full fy2020 revenues were down six per cent to $670.9m and net loss was $5.6m (2019: $3.6m net income).

CEO Sanjay Mirchandani expressed confidence in the “long-term opportunities for the company, our strategy, and our return to profitable growth. Our products are mission critical; our large enterprise customer base remains strong; and our employees are resilient.

“All of this, when combined with our financial stability, will enable us to weather these challenges and continue to deliver industry-leading solutions to our customers.”

Software and products revenue in Q4 was $66.4m, down 18 per cent. Services revenue in the quarter declined two per cent to $98.3m. For the full year, software and products revenue was $275.3m, a decrease of 11 per cent, and services revenue eased one per cent to $395.6m.

The quarter’s operating cash flow was $32.5m, down a tad from the year-ago $36.6m. Full year operating cash flow was $88.5m, down a tad more from fy2019’s $110.2m. Total cash, restricted cash and short-term investments were $339.7 million at quarter end.

In the earnings call Mirchandani said the company experienced a “decline in the volume of smaller portfolio transactions, due to – likely due to this SMB customers that may be disproportionately challenged. Additionally, we believe customers may differ routine capacity add-ons until economic conditions … begin to stabilise. Even with the mission critical nature of our products, we expect new customer signings to remain challenged, because they require a higher touch sales process.”

Growing pains

Mirchandani joined Commvault just over a year ago, with the remit to return the company to growth impatient for growth. In the earnings call he said: “I joined Commvault with a commitment to return the company to responsible growth and this continues to be our number one priority.” He is convinced Commvault will weather the storm and succeed in the long run.

However, the company has reported three declining quarters in a row and it has the additional complication of having to deal with the activist investor Starboard Management, which sank its claws into the company last month.

Mirchandani said: “We’ve had a number of constructive conversations with [Starboard] …And I think … their expectations and their wants are the same as ours. We’re aligned in terms of the long-term shareholder value and a balanced growth profile for the business and we’re excited

Comment on subscriptions

Commvault is experiencing a triple whammy: a prolonged switch from perpetual licenses to subscriptions; a switch from on-premises to SaaS-delivered services; and intensified competition, led by Veeam, Cohesity and Rubrik. Earlier this month it sued Cohesty and Rubrik for patent infringement.

Mirchandani is bullish about the switch to recurring revenue from subscriptions: “They are [a] growth driver for us in fiscal year 2021. In Q4, we added approximately150 subscription customers and revenues now represent over 40 per cent of our software and product revenue. With fiscal year 2021 as our first full renewal cycle, we are focused on this opportunity.”

Commvault started its move to subscriptions in 2018, with three-year contracts. These come up for renewal in the current fiscal year, fy2021. Wells Fargo analyst Aaron Rakers told subscribers: “Commvault’s shift to subscription (now around 40 per cent plus of software revenue) has been a headwind on top-line revenue growth given the pricing difference vs. traditional perpetual licenses.”

He added: “The company estimates $50m of software renewal opportunity for fy2021 – mostly weighted to 2H fy2021; company noting conservatism at this point on upsell opportunity.”

In other words the next quarter and the one after that may still show revenue decline but then, at long last, revenues could increase and go on increasing: “We think Commvault’s ability to sustain an approximate 90 per cent subscription renewal rate, coupled with upsell opportunities … should be viewed as positive growth drivers into 2021 plus.”

CFO Brian Carolan said next quarter’s revenue outlook is $150m to $155m, a six per cent decline from a year ago at the $152.5m mid-point. He said: “Our revenue outlook is underpinned by the successful renewal of two of our largest subscription customers. These renewals were signed in Q4 before their contract expirations and will represent combined software revenue of approximately $10m in Q1, FY 2021. We are working diligently to exceed our guidance and to deliver year-over-year software revenue growth.”