NetApp shares fell 13 per cent last night on the back of disappointing third quarter results and lower guidance for the next quarter.

The storage giant recorded its fourth quarter of declining revenues in a row as large enterprise customers slowed on-premises product purchases, public cloud revenue growth was anaemic, and sales force growth has yet to bear fruit.

Q3 fy20 revenues of $1.4bn were 10.4 per cent lower than a year ago. Net income was up 11.3 per cent to $277m – equivalent to 19.8 per cent of revenues. The Q4 revenue outlook is $1.53bn at mid-point – a 3.8 per cent decline. The full fy2020 revenue outlook is a 10 per cent decline on fy2019’s $6.15bn to $5.53bn.

CEO George Kurian said in statement: “Our third quarter results, highlighted by strong gross margins, cash flow and operating leverage, reflect our continued operational discipline.”

The company may be run more efficiently. But its customers are hesitant about moving to the cloud and the all-flash array boom looks to be over.

NetApp has a Data Fabric strategy of helping customers move to a multiple public cloud, hybrid on-premises model. But cloud data services annualised recurring revenues of $83m are low. Wells Fargo MD Aaron Rakers estimates this translates to $15m to $18m in the quarter. As we said, NetApp’s enterprise customers are cautious about moving to the public cloud.

Revenue trend

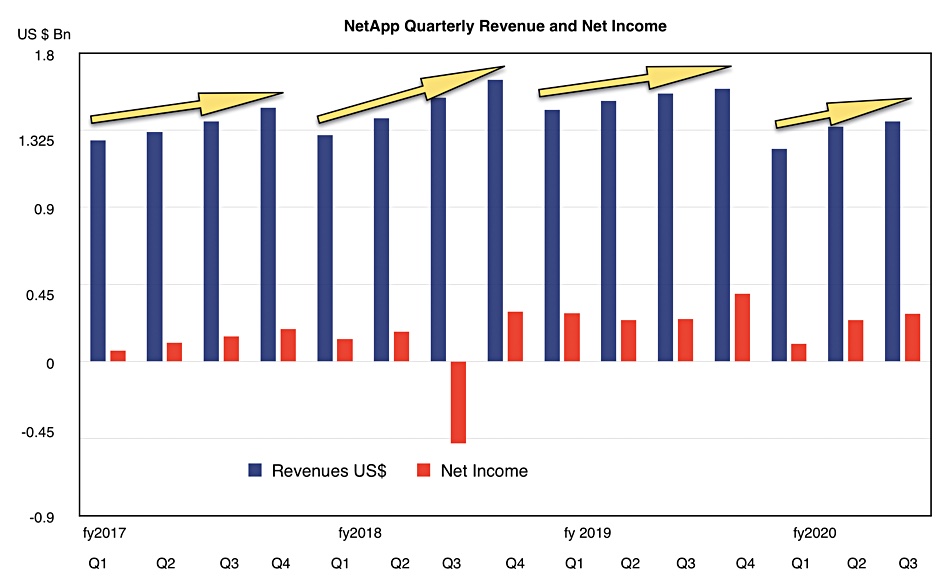

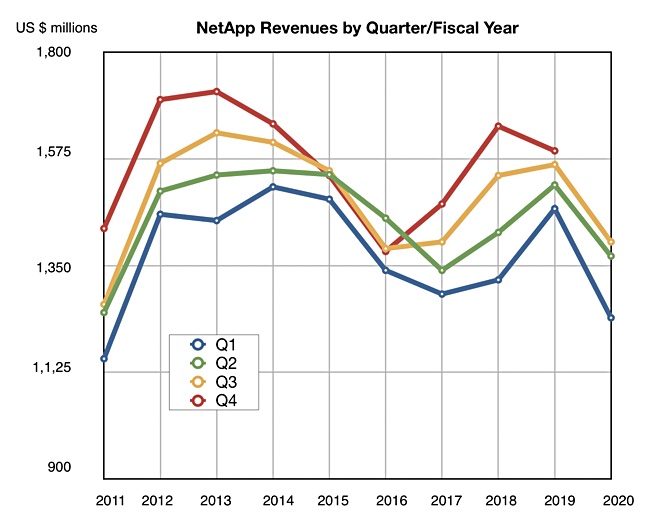

NetApp has a strongly seasonal revenue pattern, as this chart shows:

The current fiscal year’s quarterly revenues are tracking lower than last year, indicated by the yellow arrows on the chart. By charting the quarterly revenues against fiscal years we can see the revenue decline more clearly.

Kurian said: “We see significant opportunity ahead and are focused on replicating the areas where we have proven success. Our strong business model enables us to navigate the market dynamics, while making the strategic investments necessary to position the company for long-term growth.”

Large account problem

The earnings call revealed a large account issue. Outgoing CFO Ron Pasek said: “We had zero ELA (Enterprise License Agreement) revenue in the quarter, although we had expected approximately $50 million. Product revenue of $787 million, decreased approximately 19 per cent year-over-year.” He pointed out the all-flash array run rate was $2.3bn. Wells Fargo MD Aaron Rakers said this is down 1 per cent y/y.

Kurian said: “It is in our largest accounts, which have the greatest exposure to the macro that the demand environment is the least predictable.” The macro” refers to the uncertain overall economic environment and NetApp’s customers are buying to mostly satisfy short term needs only as a result. Kurian pointed out: “Buying cycles are longer and the amount of spend per transaction is smaller.”

He added: “Our largest customers who were most impacted by the macro were heavily all-flash customers… our biggest accounts underperformed or bought less impacted our all-flash business more substantially than it impacted pretty much every other product in the Company. the ELAs were also heavily all-flash-oriented. So, both of those have been contributing factors to the year-on-year declines in the all-flash category.”

Sales fix

Kurian said NetApp is “focusing our compensation plans and our sales objectives on returning to growth in the all-flash category. … we have every confidence that we should be able to meet or beat the market next year.”

Rakers told subscribers that will coincide with a “more aggressively competitive landscape with the long-awaited Dell EMC midrange refresh cycle now expected in 1HC2020,” referring to Midrange.next.

NetApp’s prime fix is to increase the sales headcount, mainly in America, to increase sales outside large accounts and get a larger share of the spend in large accounts. Kurian said: “We are on track to increase sales capacity by approximately 200 primary sales resources by the end of Q1 fiscal year ’21, without adding to the total operating expenses for the Company.

“The majority of the sales headcount will be deployed in our Americas geography. They will be focused on acquiring new accounts and engaging new buyers like cloud architects in existing accounts.”

It takes three to four quarters for new sales reps to become productive and NetApp sees the results starting to appear in the financial year. Therefore the next quarter’s results are likely to be down as well as this one.

However, Pasek noted: “We are seeing early signs of success from our strategic investments in sales coverage, which provides confidence in our ability to return the Company to long-term growth.” Also Kurian said there have been good early results in gaining new customer accounts.