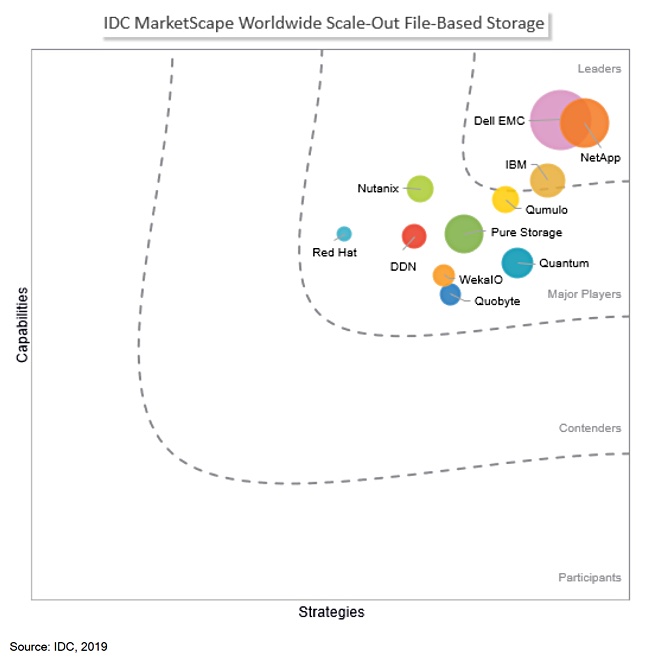

NetApp has topped IDC’s new Marketscape, the Worldwide Scale-Out File-Based Storage 2019 Vendor Assessment. Dell EMC and IBM are also awarded leader status.

Qumulo is pleased with its ranking and has helpfully mailed out an extract of IDC’s inaugural report for this Marketscape category.

A cluster of major players trails the leaders’ group and there are no suppliers in the Contenders or Participants sections. Qumulo heads the major players’ pack.

The IDC report says: “Qumulo’s partnership with HPE gives it a wide reach across several regions via channel partners and local sales teams. Qumulo is taking advantage of this partnership to increase its customer base.“

IDC has included just 11 vendors in this Marketscape. Several notable names fail to make the cut for the Scale-out File-based storage vendors, with HPE (StoreEasy and 3PAR File Persona) the biggest example. Infinidat, Nasuni and Panasas are also absentees. No cloud file service suppliers are included.

IDC’s inclusion criteria include a requirement for more than $10m revenue from the file product in 2018 or customer deployments of 600TB or greater in support of high-performance workloads in addition to traditional file-based workloads (such as home directories).

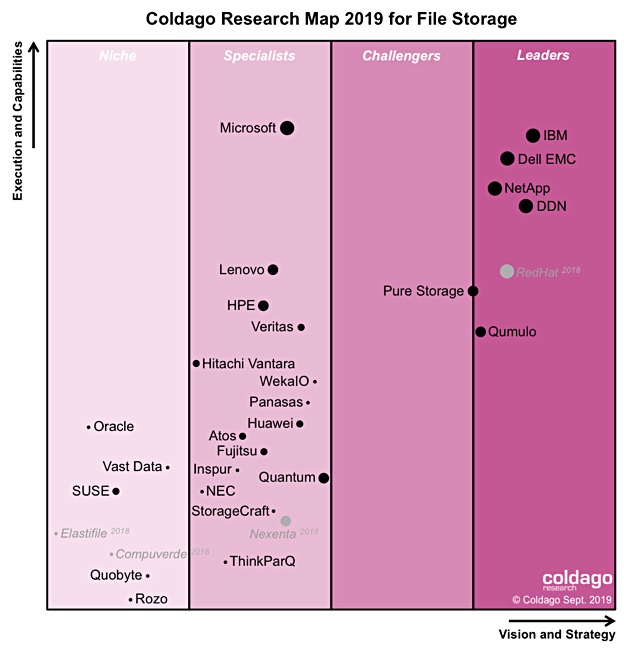

Coldago comparison

Let’s compare this Marketscape with Coldago’s Research Map for File Storage, published last month.

The Coldago study encompasses many more file system suppliers and positions several differently from IDC. DDN and Qumulo are both in Coldago’s leaders’ section, for example, and there is only one Major Player (Coldago’s Challenger section) – Pure Storage, which is halfway to being a leader, vs IDC’s eight suppliers in this category.

We recommend prospective file software purchasers should examine IDC and Coldago reports in tandem if they are looking for analyst assessments of prospective suppliers and products.

Marketscape explainer: IDC’s Marketscape is a 2D square chart with two axes; Capabilities from low to high on the vertical axis and Strategies (low to high) on the horizontal axis. Suppliers are placed in sections called Leaders, with the highest ratings in capabilities and strategies, Major Players with the next-highest ratings, Contenders with the next highest, and Participants which has the lowest ratings. A supplier’s spot or bubble on the chart increases in size with their object-based revenue.

Coldago explainer: The Coldago map columns are labelled Leaders, Challengers, Specialists and Niche. They correspond well to the Gartner Magic Quadrant (MQ) categories: Leaders, Challengers, Visionaries and Niche Players. The two axes are Execution and Capabilities on the vertical axis and Vision and Strategy on the horizontal one. They correspond well to the MQ axes; ability to execute and completeness of vision.