The latest SSD market figures from IDC show that Samsung continues to be the leading supplier, but that revenue is down sharply against last year while shipments have increased, showing that the market is still suffering from oversupply in the short term.

According to IDC, total SSD market revenue in 1Q19 hit $4.924bn, which is 30 per cent down o this time last year. It estimates that a total of 60.2m SSDs were shipped in the quarter, representing a 21 per cent increase on last year.

In terms of SSD capacity sold, IDC’s figures show 25.3 exabytes (EB) was shipped in 1Q19, which is a 33 per cent increase on last year.

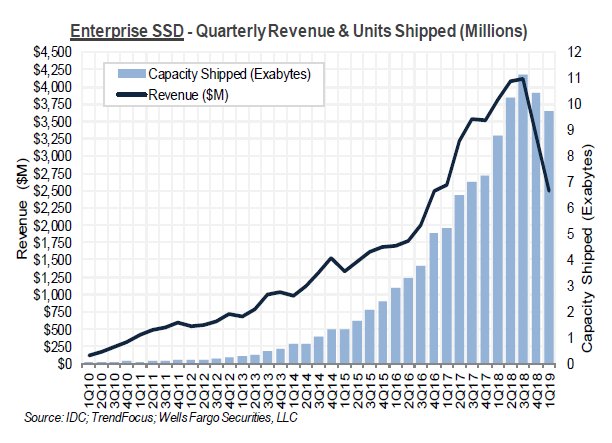

Looking at the enterprise sector, SSD revenue (the black line in the chart) was $2.494bn in 1Q19, which is 35 per cent down on the same quarter last year.

However, a total of 9.72EB of enterprise SSD capacity shipped in the quarter (the blue bars), an increase of 11 per cent year-on-year, which indicates that the price in terms of $/TB has fallen 41 per cent. IDC estimates this was made up by unit shipments of 6.8m SSDs, which is just 1 per cent up on this period last year.

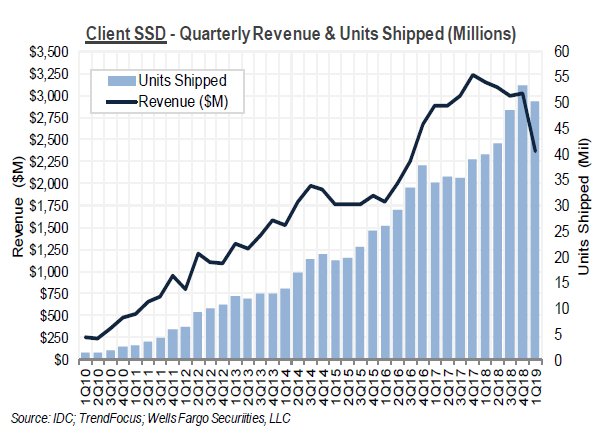

For client SSDs going into laptops and the like there is a similar picture, with revenue hitting $2.371bn for this quarter, 25 per cent down year-on-year.

This revenue was made up through the delivery of 15.6EB of SSD capacity, up 51 per cent year-on-year, and implies a fall in price per TB of 50 per cent. In terms of actual unit shipments, IDC estimates this represents 50.4m drives, an increase on this time last year of 26 per cent.

So what is causing this decline in revenue? Well, The Register reported last week that oversupply in the Nand flash component market has seen revenues slump there, which is good news for buyers, but not so good for the manufacturers.

Weakening demand in 4Q18 has pushed OEMs to begin adjusting their inventories, meaning that the system builders are likely to be buying in fewer SSDs while they use up supplies they have already ordered. Demand is expected to pick up again, however.

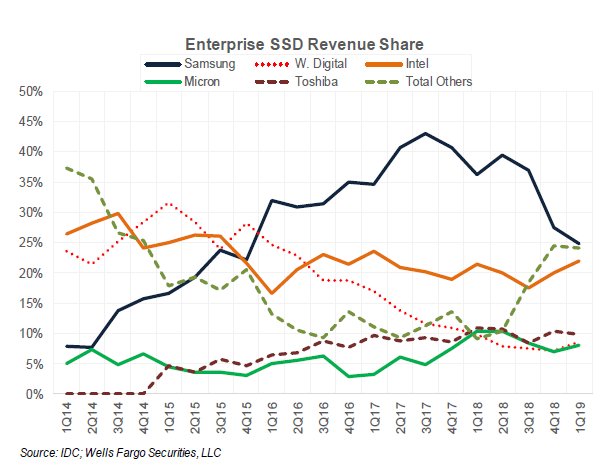

Meanwhile, IDC’s figures show that Samsung keeps its position as the top SSD vendor, followed by Intel and Western Digital, although Samsung’s share of the enterprise SSD market appears to be declining while Intel’s has held relatively steady over the past year.