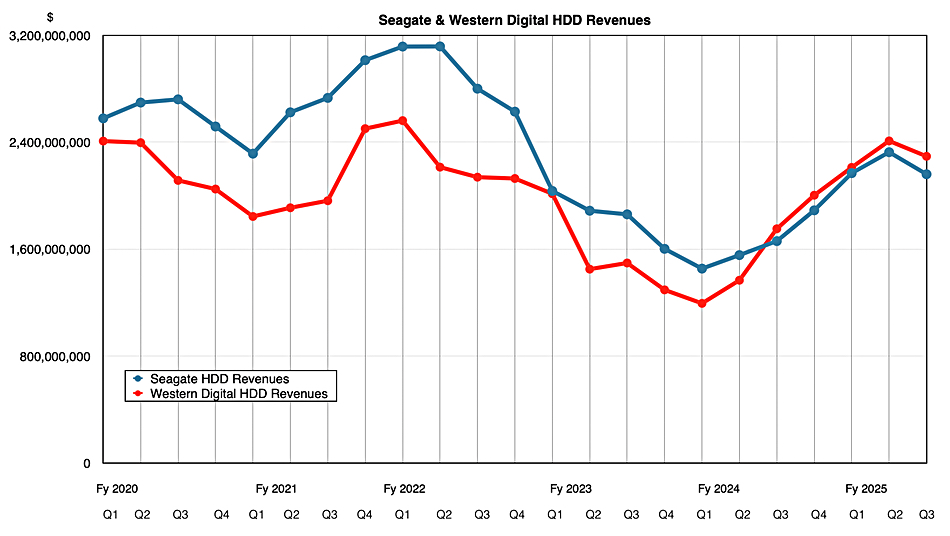

Western Digital reported a 31 percent year-on-year revenue increase in its first incarnation as a disk-drive-only company following its spin-out of the Sandisk NAND and SSD business on February 1.

The company reported revenues of $2.29 billion for its third fiscal 2025 quarter, ended March 28, up on a Y/Y basis but down 5 percent quarter on quarter. It also announced a quarterly dividend program with an $0.10/share payment this quarter. There was a GAAP profit of $520 million, compared to a year-ago $135 million, around 285 percent higher.

CEO Irving Tan stated: “Western Digital executed well in its fiscal third quarter achieving revenue at the high end of our guidance range and gross margin over 40 percent.”

He was at pains to point out that disk drives have a great future: “From enterprise workloads to the explosion of AI-generated content, such as the millions of images and viral videos generated through AI, data generation is accelerating at an unprecedented pace. Even in a world marked by geopolitical uncertainty and shifting tariff dynamics, one thing remains constant: the exponential growth of data. When it comes to storing that data, at scale, no technology rivals the cost-efficiency and reliability of HDDs.”

Financial summary:

- Gross margin: 40.1 percent

- Operating cash flow: $508 million vs $403 million in Q2

- Free cash flow: $436 million vs $335 million in Q2

- EPS: $1.36 vs $1.18 in Q2

- Cash & cash equivalents: $3.5 billion

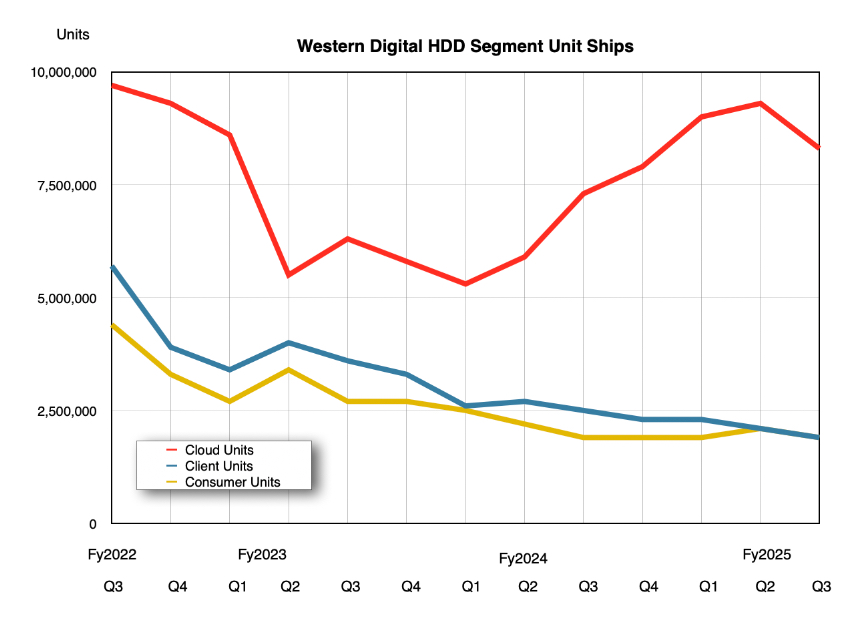

Exabyte shipments decreased 6 percent Q/Q due to lower unit shipments than last quarter. Although unit ships of 12.1 million drives were up 3.4 percent Y/Y they were down 10 percent sequentially. The damage was not felt evenly in WD’s three market segments, with cloud, the largest segment, suffering the most:

- Cloud (hyperscalers and datacenters): 8.3 million and down 10.1 percent Q/Q

- Client (PCs and OEMS): 1.9 million vs 2.1 million last quarter and down 10 percent Q/Q

- Consumer (retail): 1.9 million vs 2.1 million last quarter and down 10 percent Q/Q

WD said it shipped 800,000 units of 11-platter drives with capacities up to 26 TB CMR and 32 TB UltraSMR.

Interestingly, Seagate also reported sequentially lower disk drive shipments a day or so ago, due to a production machinery foul-up. That was not the case with WD.

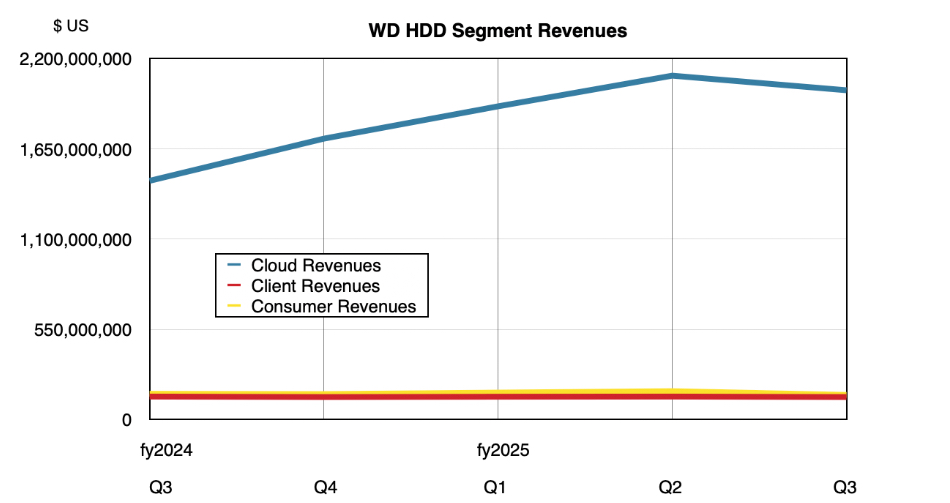

The three WD market segments had mixed results in revenue terms:

- Cloud revenue rose 38 percent Y/Y but decreased 4 percent Q/Q to $2 billion, due to a “slight reduction in nearline HDD shipments, reflecting variations in customer deployment timing and supply-demand tightness.”

- Client revenues of $140 million dropped 2 percent Y/Y and 2 percent sequentially, partly due to flat HDD performance amid pricing pressures.”

- Consumer revenue saw a 4 percent Y/Y decline and more significant 13 percent sequential decline to $173 million, driven by softer demand for HDDs in retail and end-user markets.

Cloud is the largest and most important segment, representing 87 percent of WD’s revenue. Its coming HAMR technology, supporting 40 TB and beyond capacity drives, will be important there and Tan said: “We are working closely on HAMR with two hyperscale customers and continue to receive encouraging ongoing feedback on our drives.”

He added: “We are looking to start qualification in the second half of calendar year 2026 and then ramping up production at scale in the first half of calendar year 2027.” The two hyperscalers have engineering sample drives.

Tan made the further point that: “There are some rack level changes that will be required for the deployment of HAMR. So, you’re not going to be able to mix and match the drives that easily. Similar to Ultra SMR, there are some whole site software changes that are required as well. But, these are very sophisticated customers. Their datacenter architects are very familiar with what’s needed to be done.”

WD expects to launch 28TB CMR and 36TB SMR drives in the next few months which should please data center customers.

Seagate’s acquisition of HDD platter coating machinery supplier Intevac shouldn’t impact WD. Tan said: “We have obviously two sputtering systems that we use. So, we have resiliency within our technology supply chains.”

And then this: “We’re obviously looking out for opportunities in which we can continue to capture even more value and accrete even more value to our products through potential acquisitions and vertical integration.”

Next quarter’s revenue outlook is $2.5 billion +/- $150 million, and a 24.8 percent increase from the year-ago fourth quarter. It is also up sequentially, “driven by sustained strength in data center demand.” That would produce $9.4 billion in full fy2025 revenues compared to $6.3 billion last year; a 49 percent increase.

Interim CFO Don Bennett said: “This guidance includes our current estimate of all anticipated or known tariff related impacts on our business in this period.” Tan emphasized: “We continue to maintain strong conviction in the business, and are confident that we will weather this uncertainty and come out even stronger.”