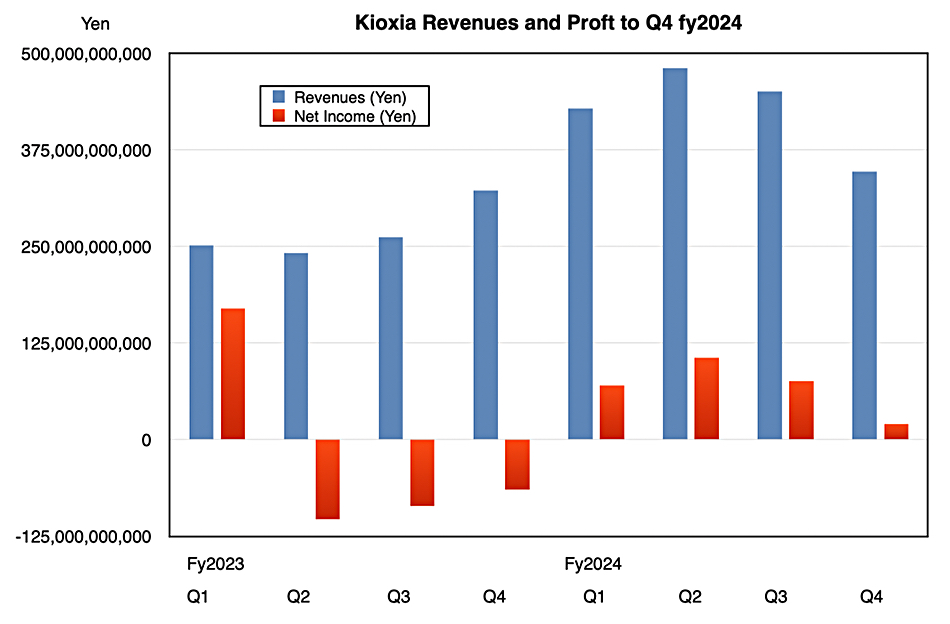

Kioxia announced fourth quarter and full fiscal 2024 year results with revenues up slightly but set to decline as rising datacenter and AI server sales fail to offset a smartphone and PC/notebook market slump and an expectation that the future exchange rate will look bad.

Q4 revenues were ¥347.1 billion ($2.25 billion), up 2.9 percent annually, but 33 percent down sequentially, with IFRS net income of ¥20.3 billion ($131.8 million), better than the year-ago ¥64.9 billion loss.

Full fy2024 [PDF] revenues were ¥1.706 trillion ($11.28 billion), up 58.5 percent annually, with an IFRS profit of ¥272.3 billion ($1.77 billion), again much better than the year-ago ¥243.7 billion loss.

CFO Hideki Hanazawa said: “Our revenue exceeded the upper end of our guidance. … Demand from enterprises remained steady. However ASPS were down around 20 percent quarter-on-quarter, influenced by inventory adjustments at PC and smartphone customers.” The full year revenue growth “was due to an increase in ASPS and bit shipments resulting fro recovery in demand from the downturn in fiscal year 2023, the effect of cost-cutting measures taken in 2023 and the depreciation of the yen.”

Financial summary

- Free cash flow: ¥46.6 billion ($302.6 million)

- Cash & cash equivalents: ¥167.9 billion vs year-ago ¥187.6 billion

- EPS: ¥24.6 ($0.159)

Kioxia’s ASP declined around 20 percent Q/Q with circa 10 percent decrease in bits shipped. It said it has had positive free cash flow for five consecutive quarters.

It’s NAND fab joint venture partner Sandisk reported $1.7 billion in revenues for its latest quarter, 0.6 percent down Y/Y, meaning that Kioxia performed proportionately better.

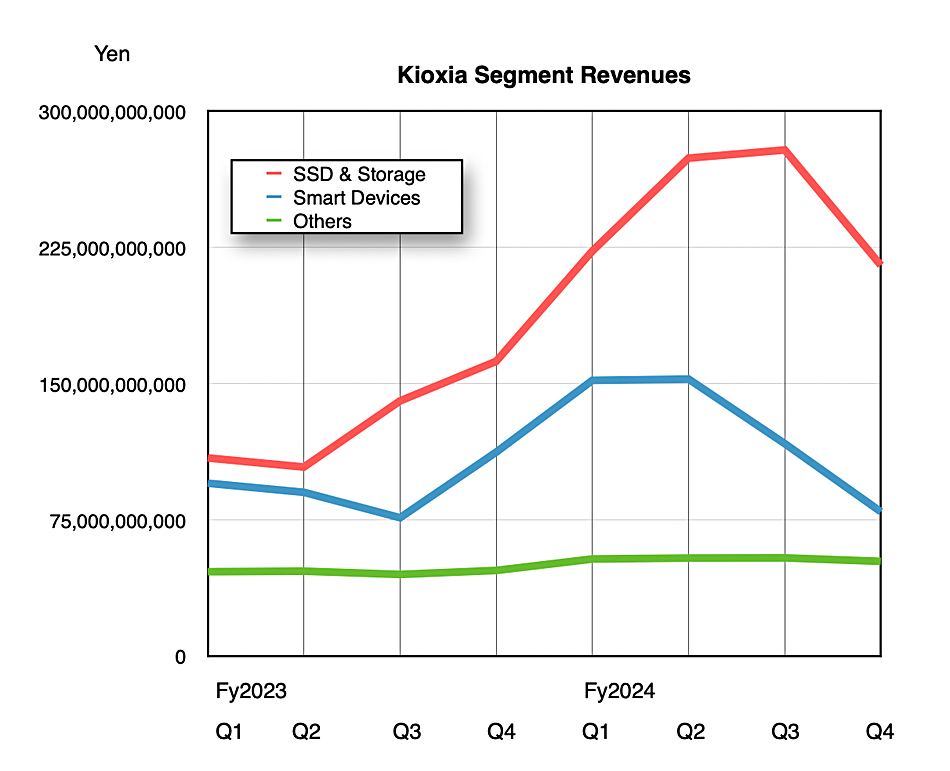

Kioxia ships product to three market segments and their revenues were:

- Smart Devices (Phones): ¥79.6 billion ($516.8 million), up 29.2 percent Y/Y

- SSD & Storage: ¥215.2 billion ($$1.4 billion) up 32.5 percent

- Other (Retail + sales to Sandisk): ¥52.3 billion ($339.6 million) up10.7 percent

Smart devices Q/Q sales decreased due to lower demand and selling prices as customers used up inventory. The SSD and storage segment is divided into Data Center/Enterprise, which is 60 percent of its revenues, and PC and Others which is 40 percent. Demand remained strong in Data Center/Enterprise, driven by AI adoption, but Q/Q sales declined mainly due to lower selling prices. There was ongoing weak demand in the PC sub-segment and lower selling prices led to reduced Q/Q sales.

Overall there was strong demand in the quarter for Data Center/Enterprise product with continued softness in the PC and smartphone markets. There was around 300 percent growth in Data Center/Enterprise SSD sales in the year compared to last year.

Kioxia had an IPO in the year and has improved its net debt to equity ratio from 277 percent at the end of fy2023 to 126 percent at fy2024 year end, strengthening its balance sheet. The company has started investing in BiCS 10 (332-layer 3D NAND) technology for future growth. This has a 9 percent improvement in bit density compared to BiCS 8 (218 layers).

The calculations for next quarter’s outlook assumes a minimal impact from US tariff changes, some improvement in smartphone and PC demand, accelerating AI server deployments and strong data center server demand, fueled by AI. However it anticipates a decrease in both revenue and profit on a quarterly basis. The corp believes the main reason for this sales decline will be the exchange rate, with the current assumed rate for June being ¥140 to the dollar. It was ¥154 to the dollar in the fourth fiscal 2024 quarter. A change of ¥1 to the dollar is expected to have an impact on Kioxia’s operating income of approximately ¥6 billion.

With this in mind, the outlook for the next quarter (Q1 fy2025) is revenues of ¥310 billion +/- ¥15 million; $2 billion at the mid-point and a 10.1 percent Y/Y decline. Kioxia says the potential for growth in the NAND market remains strong due to AI, datacenter and storage demand. If only the smartphone and PC/notebook markets would pick up!