Dell’s revenues have finally grown after six successive quarterly drops, led by AI-driven server sales.

Revenues in the first quarter of Dell’s fiscal 2025 ended May 3, 2024, were up six percent year-on-year to $22.2 billion. The PC-centric Client Solutions Group (CSG) was flat at $12 billion: Commercial client revenue was $10.2 billion, up 3 percent year-on-year; and Consumer revenue was $1.8 billion, down 15 percent. The Infrastructure Solutions Group (ISG) pulled in $9.2 billion, 22 percent higher, driven by AI-optimized server demand and traditional server growth. Servers and networking booked $5.5 billion, up 42 percent. Storage sales didn’t grow and remained flat at $3.8 billion. The Texan tech corp reported $955 million net profit, up 65 percent.

COO and vice chairman Jeff Clarke said: “Servers and networking hit record revenue in Q1, with our AI-optimized server orders increasing sequentially to $2.6 billion, shipments up more than 100 percent to $1.7 billion, and backlog growing more than 30 percent to $3.8 billion.”

Quarterly financial summary

- Gross margin: 21.6 percent vs 24 percent a year ago

- Operating cash flow: $1.0 billion

- Free cash flow: $0.6 billion vs $0.7 billion last year;

- Cash, cash equivalents, and restricted cash: $7.3 billion vs $? billion last year

- Diluted earnings per share: $1.3, up 67 percent y/y

Dell returned $1.1 billion to shareholders through $722 million share repurchases and $336 million dividends.

Within ISG, trad server demand grew sequentially for the fourth consecutive quarter and was up Y/Y for the second consecutive quarter. But AI servers led the charge, and the PowerEdge XE9680 server is the fastest ramping new server in Dell history. Storage was left behind. There was demand strength in HCI, PowerMax, PowerStore and PowerScale. The new PowerStore and PowerScale systems should help lift sales next quarter.

Dell is convinced a storage AI demand-led increase is going to happen. Clarke said in the earnings call: “our view of the broad opportunity hasn’t changed around each and every AI server that we sell. I think we talked last time, but maybe to revisit that, we think there’s a large amount of storage that sits around these things. These models that are being trained require lots of data. That data has got to be stored and fed into the GPU at a high bandwidth, which ties in network. The opportunity around unstructured data is immense here, and we think that opportunity continues to exist.”

He added: “We expect the storage market to return to growth in the second half of the year. And for us outperform the marketplace. … I would call out PowerStore Prime. The addition of QLC allows us to be more competitive, our performance and have a native … sync replication … allow us to be more competitive in the largest portion of the storage marketplace. And our storage margins need to improve and will improve over the course of the year.”

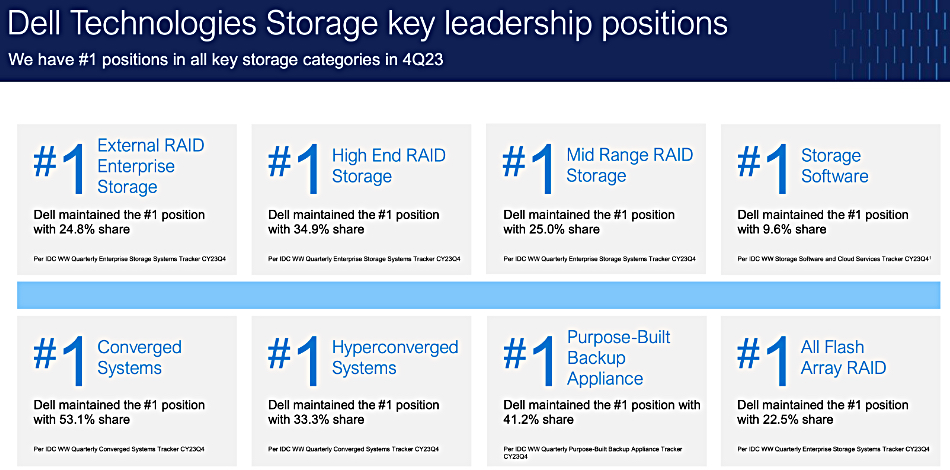

Dell wants us to know that, even with storage revenues flat, it retains its storage market leadership:

Bothe HPE and VAST Data have new disaggregated shared everything (DASE) block amd file storage systems, claiming more efficient scale-out than their compretitors. Dell will be hoping that its new QLC flash-aided PowerStore and PowerScale, especially the coming parallel file system extension for PowerScale, will stop any inroads into its market leadership.

In CSG, Dell introduced five NextGen AI PCs but sales have yet to take off. Clarke said: “We remain optimistic about the coming PC refresh cycle, driven by multiple factors. The PC install base continues to age. Windows 10 will reach end-of-life later next year. And the industry is making significant advancements in AI-enabled architectures and applications.”

Dell’s focus on AI, with its AI Factory series of announcements, gives it a near pole position in the market for helping customers adopt AI. The amount of AI adoption will depend on the technology delivering accurate and relevant results without going off into hallucinatory lies and mis-statements. AI has to stand for artificial intelligence and not artificial idiocy.