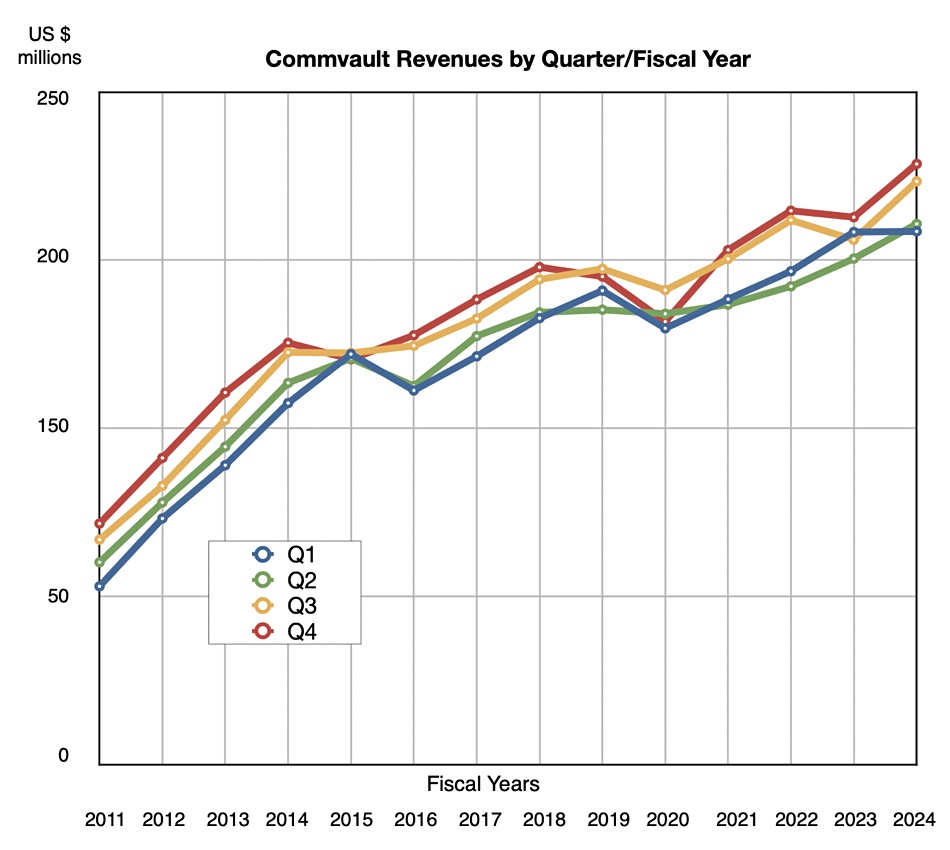

Solid customer and subscription growth sent Commvault quarterly revenues past forecasts and set the scene for continued growth.

Revenues in the quarter, ended March 31, were $232.3 million – 9.7 percent higher than a year ago, and soundly beating the $214 million high end of its guidance range. There was a profit of $126.1 million – a huge 56.5 percent of revenue, and a massive turnaround from the year-ago $43.5 million loss. The large profit rise was due to an income tax benefit of $103.1 million. Excluding that fillip, profits were $23 million.

Full fiscal 2024 revenues were up 7 percent year-over-year to $839.2 million, with profits of $168.9 million compared to FY 2023’s $35.8 million loss.

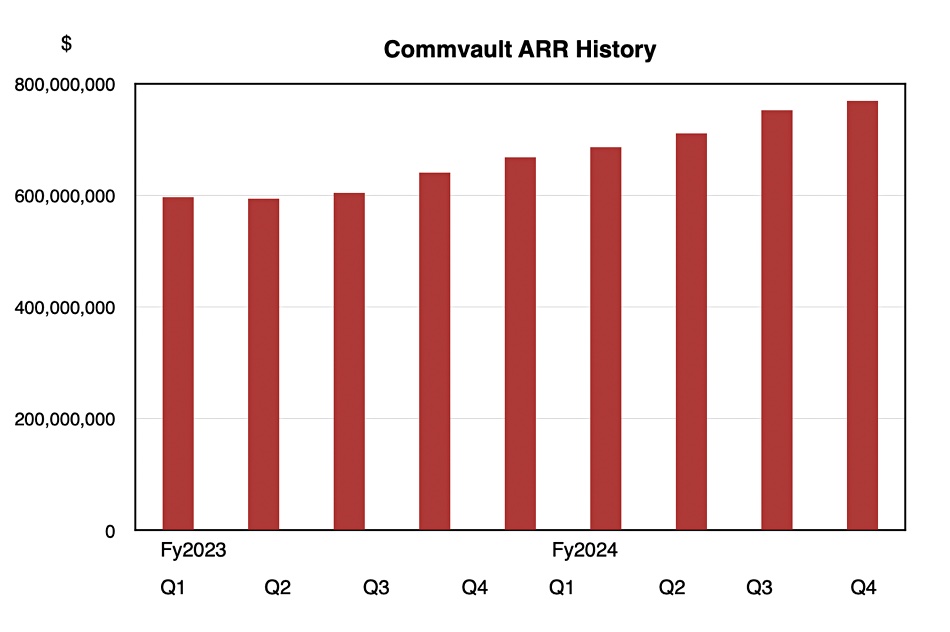

Sanjay Mirchandani, Commvault CEO, said: “We had an outstanding quarter and a breakout year, highlighted by 10 percent total revenue growth and 15 percent total ARR growth in the fourth quarter.” These results are “setting the stage for FY 2025 and beyond.”

Quarter financial summary:

- Gross margin – 83.2 percent

- Operating cash flow – $80 million

- Free cash flow – $79.1 million and up 18 percent

- EPS – $0.79

- Share repurchases – $50.4 million compared to none a year ago

Subscription-based revenue growth was solidly positive:

- ARR – $770 million and up 15 percent annually

- Subscription ARR – $120 million, up 27 percent

- SaaS ARR – $168 million, up 65 percent, and termed “explosive” growth

Commvault has 9,300 subscription base customers – up 26 percent annually and 5.7 percent sequentially. There are 5,000 SaaS customers and the SaaS net dollar retention rate was 123 percent, down slightly from 125 percent a year ago. CFO Gary Merrill said: “The penetration we saw in the Americas on new customers was one of the strongest quarters we’ve had in quite some time.”

Mirchandani said Commvault moved its focus from data protection to cyber resilience last November, introducing a Commvault Cloud cyber resilience offering. Announcements like the Appranix acquisition and Cleanroom Recovery strengthened that focus. In the earnings call he pointed out that: At the heart, cyber resilience is a customer’s ability to recover in the face of an attack.”

He added: “We continue to flesh out our capabilities and we don’t separate out artificially like some of our competitors do on-premise workloads from cloud workloads because, eventually in the hybrid world, workloads will move and they will live in different places at different times and in different clouds.”

The outlook for next quarter is for revenues between $213 million and $216 million, meaning a rise of 8.3 percent at the midpoint. Its full FY 2025 outlook is for $904 million to $914 million in revenues, with the $909 million midpoint 8.3 percent higher than the FY 2024 revenue number.

This does rather depend on Commvault recruiting a new sales boss. The previous CRO, Riccardo di Blasio, went to NetApp in January to become its SVP of North America sales.

Commvault presented its aspirations for fiscal 2026: $1 billion in ARR and 14 percent CAGR from FY 2024, and $310 million to $330 million in SaaS ARR, around 40 percent CAGR from 2024.