Flash memory and storage producer Micron topped its own financial guidance for Q2 of fiscal ’25 ended February 29, on the back of ever growing demand for IT infrastructure that trains and powers artificial intelligence.

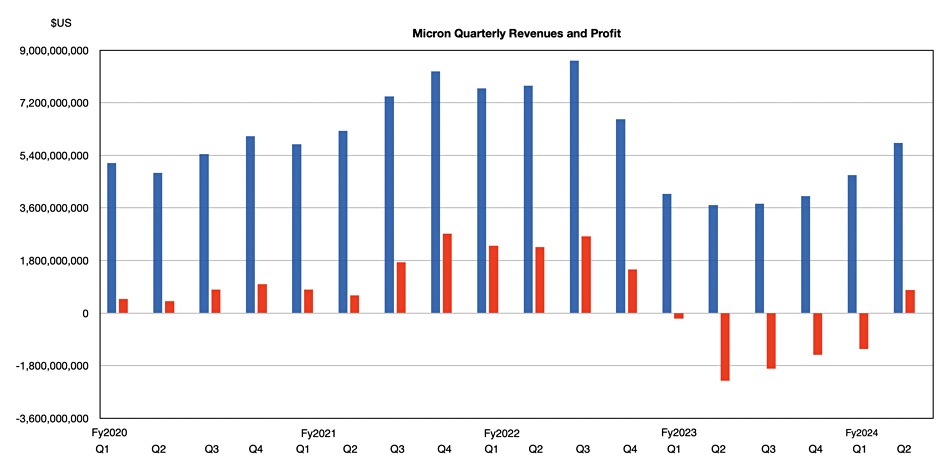

Revenues of $5.8 billion were 57.6 percent higher than a year ago and Micron brought home $793 million in net profit versus a $2.3 billion net loss in the corresponding quarter of the prior financial year.

Sanjay Mehrotra, president and CEO, said in statement: “Micron delivered fiscal Q2 revenue, gross margin and EPS (earnings per share) well above the high end of guidance. Micron has returned to profitability and delivered positive operating margin a quarter ahead of expectation.”

Wedbush financial analyst Matt Bryson commented: “We believe Micron earnings commentary ticked every box in the investor checklist (and then some).”

Mehrotra thinks Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI. This is due to memory and NAND demand for AI training and also inference both in the datacenter and at the edge.

In Micron’s results presentation, server demand is said to be driving rapid growth in HBM, DDR5, and datacenter SSDs, which is tightening leading-edge supply availability for DRAM and NAND. This is resulting in a positive ripple effect on pricing across all memory and storage end markets.

The price rises are unlikely to slow down or stop during Micron’s financial year, it indicated. Mehrotra said in prepared remarks: “Our current profitability levels are still well below our long-term targets, and significantly improved profitability is required to support the R&D and capex investments needed for long-term innovation and supply growth.“

Financial summary

- Gross margin: 18.5 percent vs -0.7 percent last year

- Operating cash flow: $1.22 billion vs year-ago $343 million

- Free cash flow: -$29 million

- Cash, marketable investments & restricted cash: $9.72 billion vs $12.1 billion last year

- Diluted EPS: $0.71 vs -$1.12 last year

- Dividend: $0.115/share

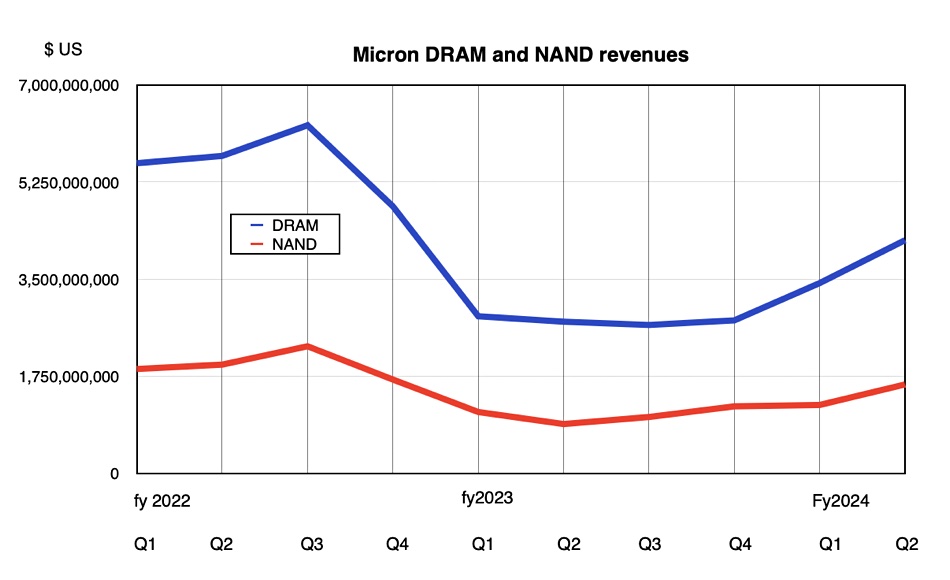

DRAM pulled in $42 billion, up 53.8 percent annually, while NAND revenues of $1.6 billion grew even faster at 80.7 percent. Mehrotra said: “We see strong customer pull and expect a robust volume ramp for our mono-die 128 GB product, with several hundred million dollars of revenue in the second half of fiscal 2024. We also started sampling our 256 GB MCRDIMM module, which further enhances performance and increases DRAM content per server.”

He discussed HBM3E memory, used in Nvidia GPUs, saying: “Industry-wide, HBM3E consumes approximately three times the wafer supply as [DDR5] to produce a given number of bits in the same technology node; a 3:1 trade ratio. With increased performance and packaging complexity across the industry, Micron expects the trade ratio for HBM4 to be even higher than the trade ratio for HBM3E.”

That will limit the fab capacity available for DRAM and, we reckon, have an upward effect on prices. Micron is planning to increase its manufacturing capacity overall. Announced projects in China, India, and Japan are proceeding as planned and potential US expansion schemes assume CHIPS Act grants for Idaho and New York fabs in its in its capex plans for FY24.

Micron commenced volume production and recognized its first revenue from HBM3E in fiscal Q2 and has now begun high-volume shipments of its HBM3E product. Micron expects 12-high HBM3E will start ramping in high volume production and increase in mix throughout 2025.

End markets

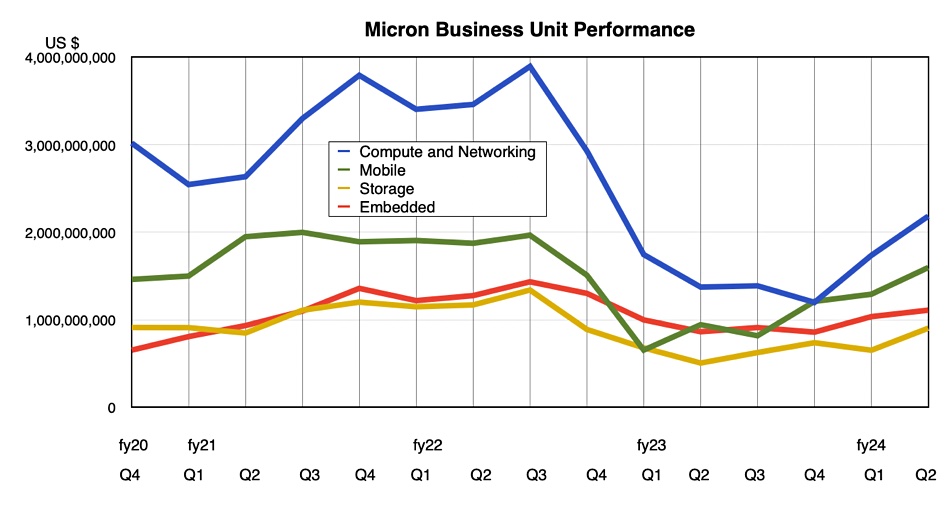

- Compute and Networking: $2.1285 billion, up 59 percent year-over-year

- Mobile: $1.598 billion, up 69 percent

- Embedded: $1.111 billion, up 28 percent

- Storage: $905 million, up 79 percent

The PC market is starting to grow slowly, in the low single digits, after two years of double-digit declines. Mehrotra said momentum was developing for “next-generation AI PCs, which feature high-performance Neural Processing Unit chipsets and 40 to 80 percent more DRAM content versus today’s average PCs. We expect next-gen AI PC units to grow and become a meaningful portion of total PC units in calendar 2025.”

Micron said smartphone unit volumes in calendar 2024 remain on track to grow at a low to mid single digit rate. It expects so-called AI phones to carry 50 to 100 percent more DRAM compared to non-AI flagship phones today. Mehrotra said: “The Honor Magic 6 Pro features the Magic LM, a seven-billion parameter large language model, which can intelligently understand a user’s intent based on language, image, eye movement and gestures, and proactively offer services to enhance and simplify the user experience.”

B&F expects the other DRAM and NAND fabbers and SSD suppliers to report similar revenue uplifts in the coming weeks.

Outlook

Micron expects DRAM and NAND pricing levels to increase further throughout calendar 2024 and is guiding for record revenue and much improved profitability in fiscal 2025. It says we are in the very early innings of a multi-year growth phase driven by AI as this technology ay well transform every aspect of the business world. On that basis, its outlook for the next quarter is for revenues of $6.6 billion, give or take $200 million, a 76 percent increase on the year-ago Q3.