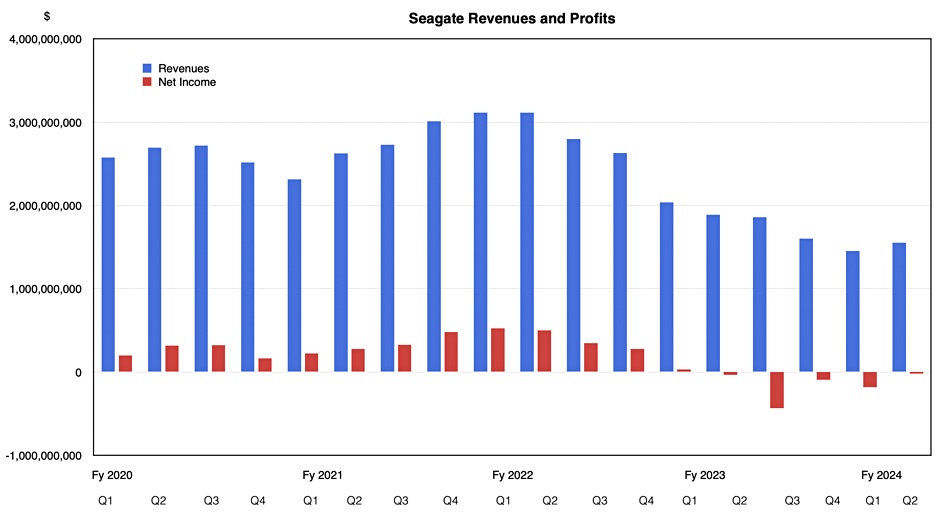

Spinning-disk slinger Seagate this week signaled its revenue recovery has begun with a sequential revenue upturn in its second fiscal 2024 quarter.

It reported [PDF] revenues of $1.56 billion, down 17 percent year-on-year but up seven percent from the previous quarter and its first such Q-to-Q upturn after seven Q-to-Q declines in a row. The biz recorded an overall loss of $19 million, much reduced from the year-ago $33 million loss and especially from last quarter’s $184 million loss.

CEO Dave Mosley on an earnings call with analysts said: “Revenue of $1.56 billion was led by sequentially improving cloud nearline demand and a seasonal uptick in consumer drives, offset partially by the decline in VIA sales that we anticipated. … These performance and demand trends affirm our expectation for the September quarter to be the bottom of this prolonged down cycle.”

VIA refers to the video surveillance market.

Financial summary:

- Operating cash flow: $169 million

- Free cash flow: $99 million

- Gross margin: 23.3% vs 23.6% a year ago

- Diluted EPS: -$0.09/share vs $10.132/share a year ago

- Cash and cash equivalents: $787 million

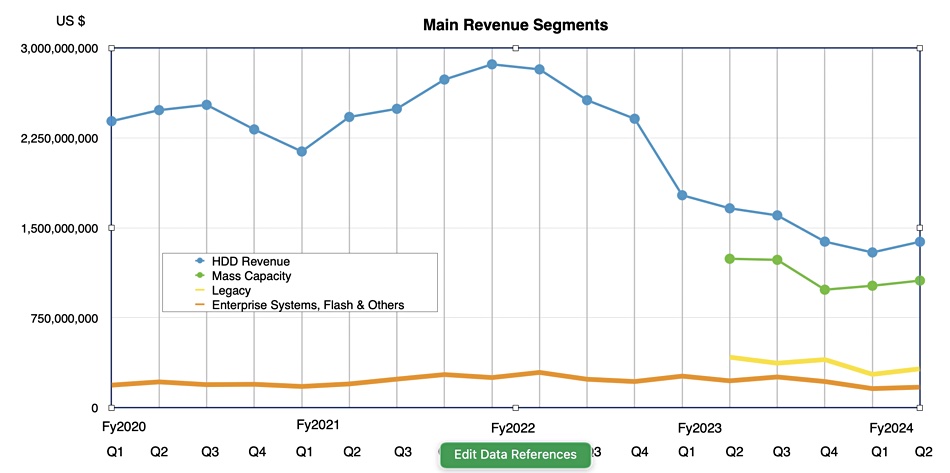

Seagate made $1.38 billion from disk drives and $171 million from enterprise systems and flash drives in the three months to December 29. It said it shipped 95 EB of capacity compared to 89.6 EB last quarter and 112.5 EB a year ago. The average capacity per drive was 8.2 TB, up from 7.3 TB a year ago and 7.5 TB last quarter.

Mosley talked about demand trends on the earnings call, saying: “From a demand standpoint, gradual recovery within the US cloud market has started to take shape, reflecting solid progress in consuming excess inventory, along with more stable end-market behavior.

“Enterprise OEM demand trends have also stabilized within the US markets. Customer feedback still points to macro-related concerns, although IT hardware budgets are projected to modestly improve in calendar 2024, and traditional server growth is expected to resume trends that support incremental HDD demand growth in the calendar year.”

China is lagging a bit, we’re told: “Across the broader China markets, we project a relatively slower pace of recovery given the ongoing economic challenges within the region. However, some local governments announced further steps to support the region’s economy, which our customers believe will bolster local demand across mass capacity markets in China in the second half of the calendar year.”

Seagate introduced its higher capacity HAMR drives this quarter and expects volume shipments to start ramping up. It can use HAMR tech to reduce the platter count in today’s mid-to-low capacity drives and so improve its cost structure. This should lead to increased profitability as the drive recovery gets under way and it ships more drives overall.

Mosley continued: “We are rapidly nearing qualification completion with our initial hyperscale launch partner. The qualification has gone very well, and we are working with this customer at their request to fully transition future Seagate demand to the three-plus terabyte per disk platform.”

This means that other hyperscale drive users have not yet qualified the HAMR drives.

He talked about the manufacturing ramp and getting more hyperscale wins: “Volume ramp is starting in the March quarter according to plan with a goal to ship about 1 million units in the first half of this calendar year. We then expect to continue to ramp through the balance of the calendar year, and we are currently broadening our customer engagements. Based on their planned timelines, we expect to complete qualifications with a majority of US hyperscalers and a couple of global cloud customers during calendar 2024.”

Mosley explained how HAMR will improve Seagate’s drive manufacturing costs: “As we scale areal density to four terabytes per disk, this enables extremely cost-effective product offerings in the low to midrange capacity points used by a majority of our enterprise … customers. With four terabytes per disk, we used half the number of heads and disks to produce a 20-terabyte drive. Prototypes are already working in our labs with revenue planned for the second half of calendar 2025.”

The manufacturer confirmed it expects its second generation Mozaic 3+ 4TB/platter HAMR drives, with 40TB or more capacities, to ship in the second half of next year.

Seagate has just launched a 24TB IronWolf Pro NAS drive using its perpendicular magnetic recording (PMR) technology, not HAMR. This will be one of its last PMR drives as HAMR technology will be used across the board.

The revenue outlook for the next quarter is $1.65 billion+/- $150 million which is 11.3 percent down year-on-year. Seagate’s year-on-year quarterly revenue decline is easing as its recovery gets underway. CFO Gianluca Romano said: “We expect incremental improvements in mass capacity demand from both cloud and enterprise customers to more than offset seasonal-related decline in VIA and the legacy markets.”