GigaOm has evaluated 17 suppliers of scaleout file storage systems and has placed NetApp out in front with a substantial lead.

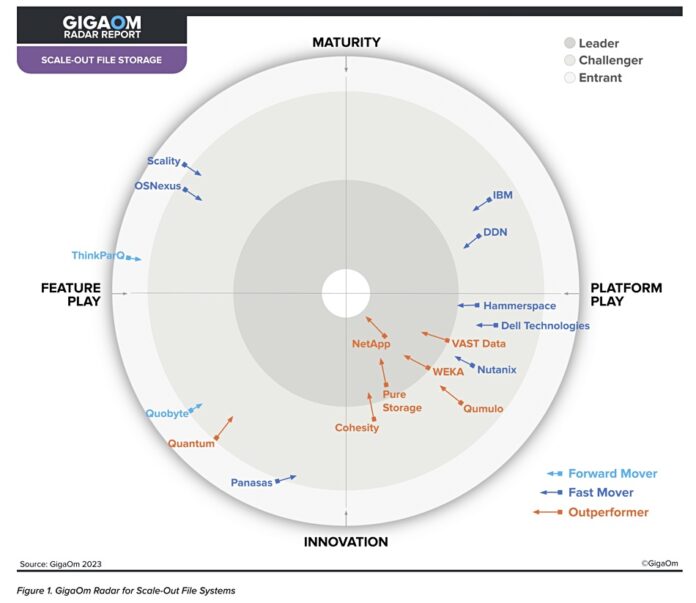

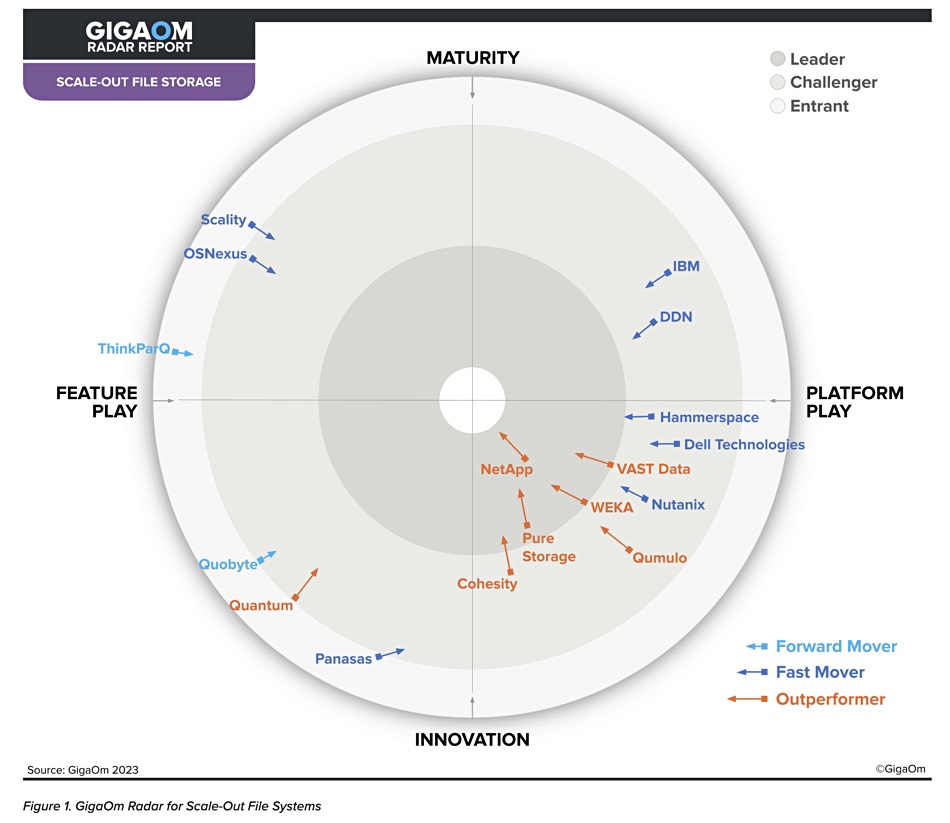

The GigaOm Radar report evaluates products’ technical capabilities and feature sets against 14 criteria to produce a circular chart, divided into concentric inner Leader, mid-way Challenger, and outer New Entrant rings. These are separated into quarter circle segments by two opposed axes: Maturity vs Innovation, and Feature Play vs Platform Play. Suppliers are also rated on their forecast speed of development over the next year to 18 months as forward mover, fast mover, and outperformer.

GigaOm analysts Max Mortillaro and Arjan Timmerman said: “The scaleout file storage market is very active. Roadmaps show a general trend toward expanding hybrid-cloud use cases, implementing AI-based analytics, rolling out more data management capabilities, and strengthening ransomware protection.”

The hybrid cloud use cases include integrating file and object storage, and also integrating on-premises and public cloud file storage in a data fabric with the capability of storing files in specific cloud regions.

Here’s the scaleout file storage (SCOFS) Radar chart:

NetApp, Pure Storage, VAST Data, and Weka are the four leaders. The bulk of the suppliers are challengers with Scality, ThinkParQ (BeeGFS), and long-term supplier Panasas classed as entrants.

There are four main groups of the 17 suppliers on the chart:

- Mature platform plays: DDN (Lustre) and IBM (Storage Scale)

- Mature feature plays: Scality, OS Nexus, and ThinkParQ (BeeGFS)

- Innovative feature plays: Quobyte, Quantum, and Panasas

- The mainstreamers with innovative platform plays: NetApp, Pure Storage, Weka, VAST Data, Cohesity, Qumulo, Nutanix, Dell Technologies, and Hammerspace.

The analysts sub-divide the mainstream group into outperformers and challengers. They point out: “It’s important to keep in mind that there are no universal ‘best’ or ‘worst’ offerings; there are aspects of every solution that might make it a better or worse fit for specific customer requirements.”

They say NetApp is ahead because of its “broad portfolio options to implement and consume a modern scaleout file system solution based on ONTAP with a complete enterprise-grade feature set, flexible deployment models, and ubiquitous service availability across public clouds.”

The report includes a description of each supplier’s offering and technology situation and its scores out of three on a variety of different criteria.

Changes from last year

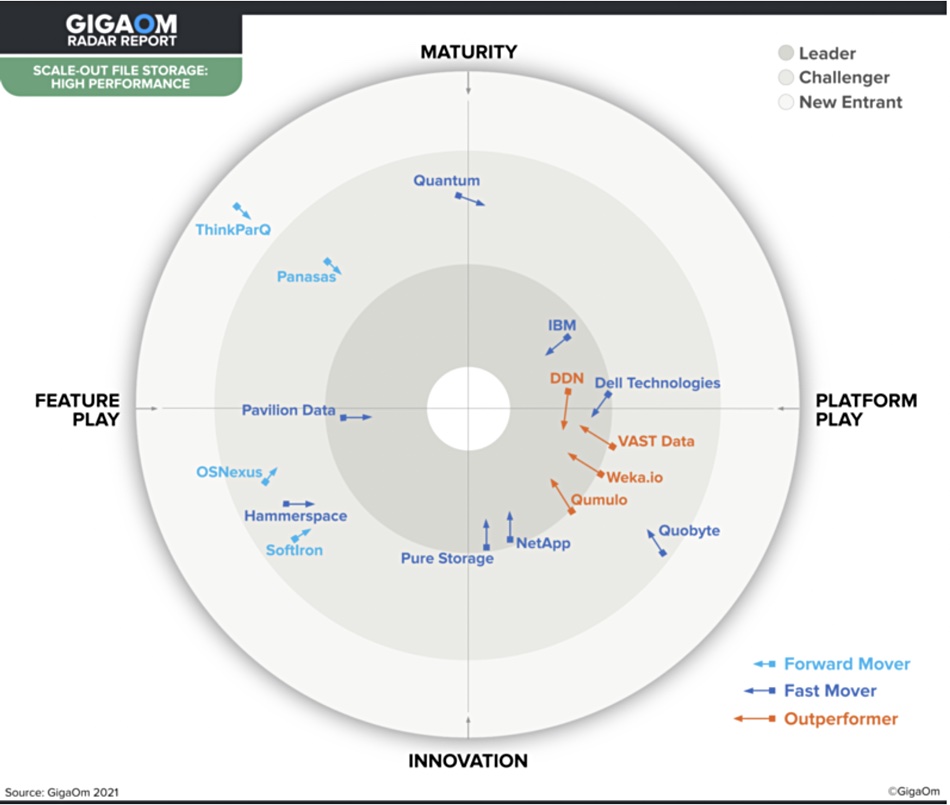

This year’s scaleout file storage report recognizes that there are two market segments; enterprise and high-performance. Last year GigaOm produced a high-performance SCOFS radar plus a separate enterprise SCOFS report. The changes from a year ago are quite startling. Here’s last year’s high-performance SCOFS:

Last year’s leaders, DDN and IBM, have moved backwards and are now challengers. Pavilion and Softiron have gone away. Scality has entered the scene. Quantum, Hammerspace, Panasas, and Quobyte have all swapped hemispheres. Qumulo has gone backwards. NetApp, despite not being classed as an outperformer in 2022, has wildly outperformed every other supplier. Last year’s outperformer, VAST Data, has hardly moved its position at all, ditto Weka.

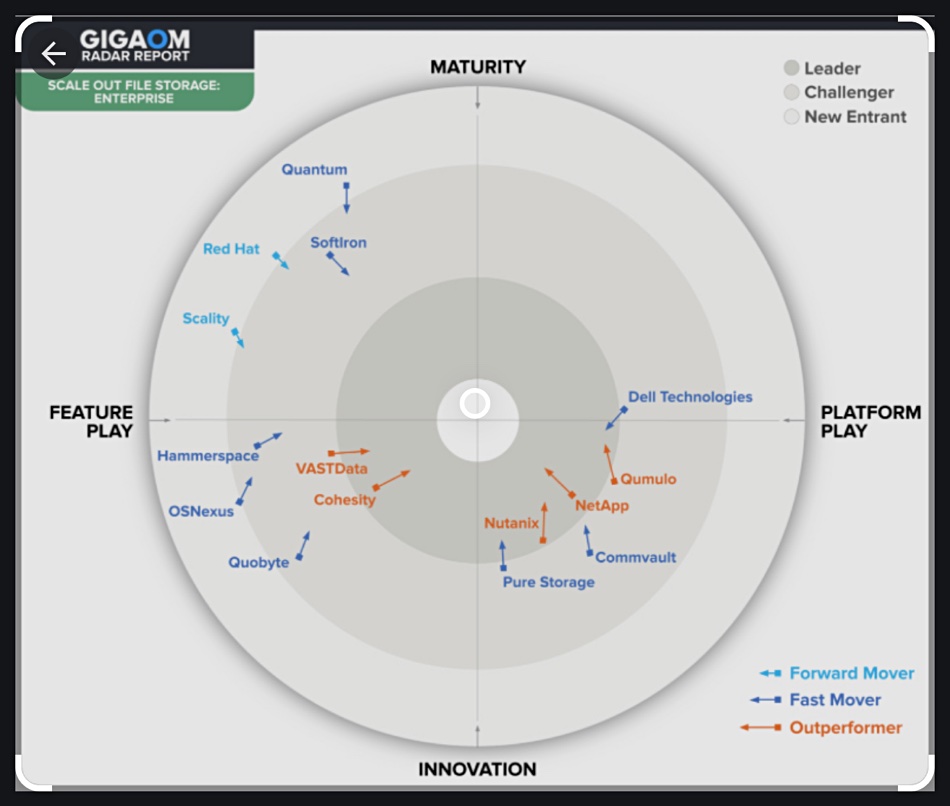

And here’s the enterprise SCOFS from last year:

Again, the changes are dramatic with VAST Data, Cohesity, and Hammerspace swapping east and west hemispheres, and Quantum swapping the north for the south hemisphere. Commvault goes away, as does Red Hat (with IBM’s acquisition).

The 2023 GigaOm scaleout file storage report is available to subscribers.