Two semiconductor analysts have written an Emerging Memories report and suggest MRAM has good prospects for replacing SRAM and NOR flash in edge computing devices needing to process and analyze data in real-time.

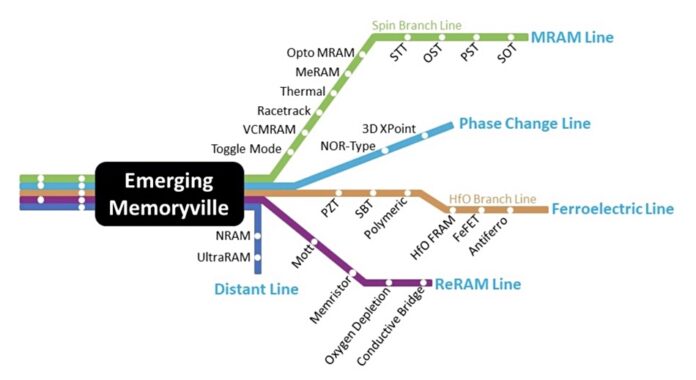

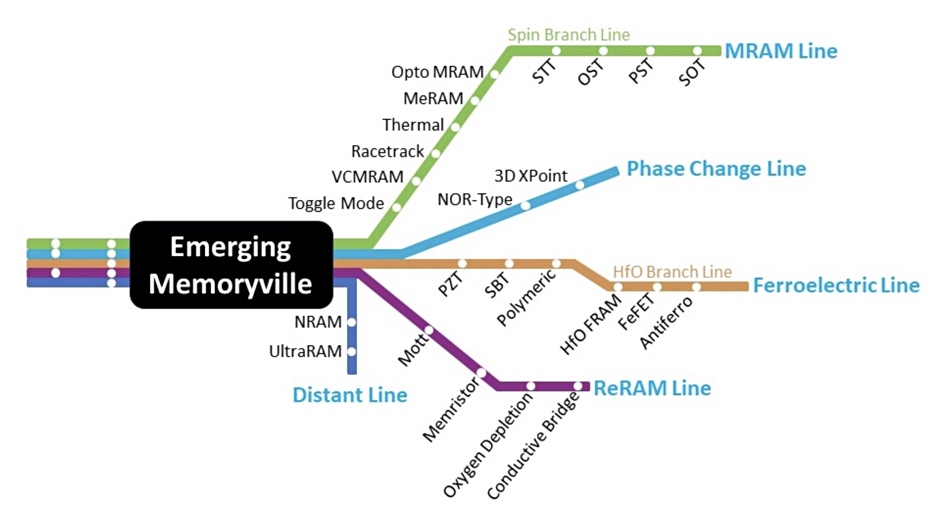

Tom Coughlin of Coughlin Associates and Objective Analysis’ Jim Handy have produced a 272-page, 30-table analysis of the prospects for five emerging memory technologies: MRAM, Phase-Change Memory (PCM), Ferro-Electric RAM (FERAM), Resistive RAM (ReRAM) and NRAM/UltraRAM. These are typically non-volatile memories with DRAM data access speeds, and roadmaps to increased densities that promise to go beyond the scaling limits of NAND and NOR and use less electricity than the constantly refreshed DRAM and SRAM.

Coughlin writes: “As the Internet of Things builds out, and as a growing number of devices make new measurements of data that was previously unmeasured, the world’s data processing needs will grow exponentially, including AI training and inference using data from these devices. This growth will not be matched with increases in communication bandwidth, despite the adoption of new wireless standards like 5G.”

That means that the data will need to be processed where it is generated and where analytics results have to be applied – in IoT edge locations. Communication links between edge sites and remote datacenters will be too slow, Coughlin writes, for remote datacenters to do the work within the real time and near-real time time limits needed.

Intel had the most determined attempt to popularise an emerging memory technology with its Optane 3D-XPoint based on PCM technology. This failed because of the complexity of its programming needs and its cost. The cost of producing the Optane chips is basically production equipment and materials cost divided by the chip output numbers.

It is inherent in semiconductor fabrication that the higher the output volume, the lower the cost.

With Optane, Intel could have priced its chips based on a much higher output and sold more of them, but it would have written down a loss – though the cost would have been astronomically high. This is the emerging memory production cost trap. High sales volume requires low prices based on high volume output from a costly plant. But the supplier starts out with low production volume, meaning high chip costs, and has to bear the loss until sales volume ramps up high enough to justify production volume increases which lower per-chip costs.

It is not guaranteed that sales volumes will ramp up enough and so a gamble that the manufacturer can sell enough chips over time to justify production increases. This did not happen with Optane, and Intel, and its manufacturing partner Micron, pulled the plug and killed the product.

None of the five emerging memory technologies identified by Coughlin and Handy are that new in a time sense, but none of them have yet crossed the chasm into mass-production. The two think MRAM and its close cousin STT-RAM have the leading chance of becoming widely used, with MRAM having the largest chance.

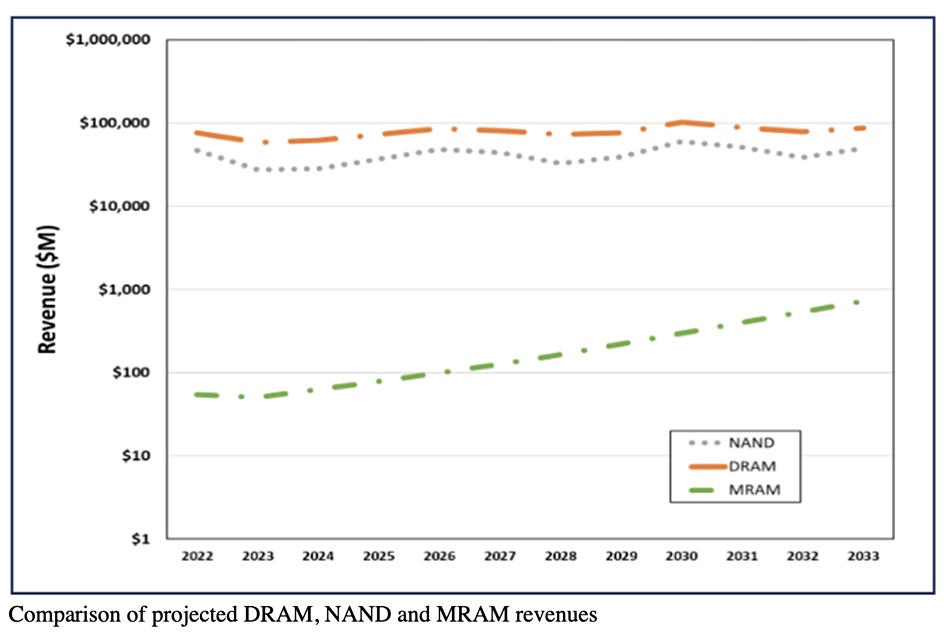

They estimate that 133TB of MRAM were produced in 2022, generating $118 million in revenues, and this could rise to 4.56EB in 2033 and revenues of $980 million.At that time DRAM and NAND revenues would be vastly higher, as a chart they use (above) indicates, with DRAM looking to amount to near $100 billion.

The Emerging Memories Branch Out report is available for $7,500 from Coughlin Associates with a substantial brochure freely available here.

Bootnote

MRAM manufacturer Everspin was profiled here. NRAM is Nantero’s Nano-RAM. UltraRAM is a charge-based memory.