AI-focused analytics lakehouse supplier Databricks wants to raise more funding to continue its breakneck expansion and aims to overtake Snowflake as the largest data analytics company in the world.

Databricks supplies a data lakehouse, a combination of a data warehouse and data lake, and was founded in 2013 by the original creators of the Apache Spark in-memory big data processing platform. It has raised $3.5 billion in funding through nine funding events and is heavily focussed on AI/ML analytics workloads. Databricks had a $38 billion valuation in 2021. In August 2022 Databricks said it had achieved $1 billion in annual recurring revenues, up from $350 million ARR two years prior, but it did not say it had a positive cash flow.

Both Silicon Angle and The Information report Databricks wants to raise hundreds of millions of dollars. The two mention sources close to the company that say Databricks made an operating loss of $380 million in its fiscal 2023, which ended in January, and has lost around $900 million in its fy2023 and fy2022 combined.

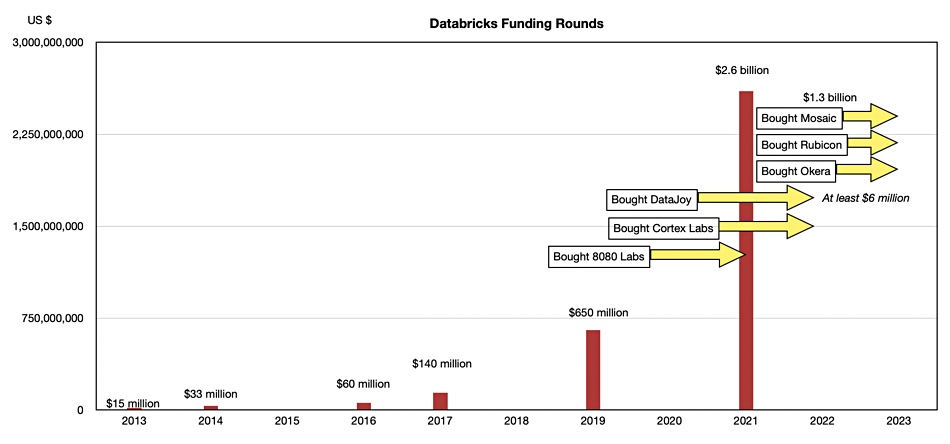

Databricks pulled in a massive $2.6 billion in funding in 2021 and embarked on an acquisition spree to buy in AI/ML-related software technology:

- October 2021 – 8080 Labs – a no-code data analysis tool built for citizen data scientists,

- April 2022 – Cortex Labs – an open-source platform for deploying and managing ML models in production,

- Oct 2022 – DataJoy – which raised a $6 million seed round for its ML-based revenue intelligence software,

- May 2023 – Okera – definitive agreement to buy AI-centric data governance platform,

- June 2023 – Rubicon – storage infrastructure for AI,

- June 2023 – Mosaic – definitive agreement for $1.3 billion in a what Databricks tells us is a mostly stock deal. Buy completed 19 July 2023.

Charting these with its funding rounds gives an indication of Databricks’ fund raising and acquisition spending:

The cost of the Mosaic acquisition was $1.3 billion while the other five acquisitions were for undisclosed amounts. In essence Databricks pulled in a lot of cash in 2021 and then spent a lot of cash in 2021 (buying 8080 Labs), 2022 (buying Cortex Labs and DataJo) and so far this year (buying Okera, Rubicon and Mosaic). That was in addition to its normal cash burn growing the company with marketing spend on trade shows, etc.

Databricks sees the generative AI market as a huge opportunity to grow its business substantially. For that it needs more cash. We’ve asked the company for a comment and were told: ”Databricks won’t comment on this occasion.”