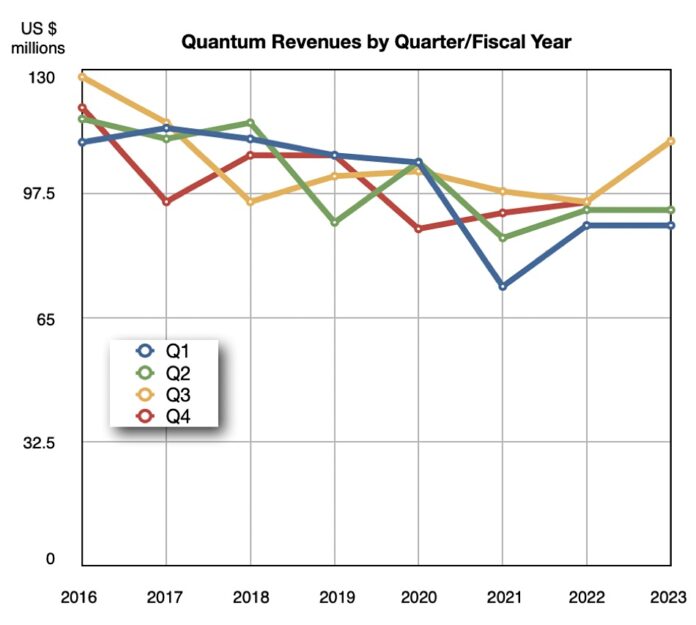

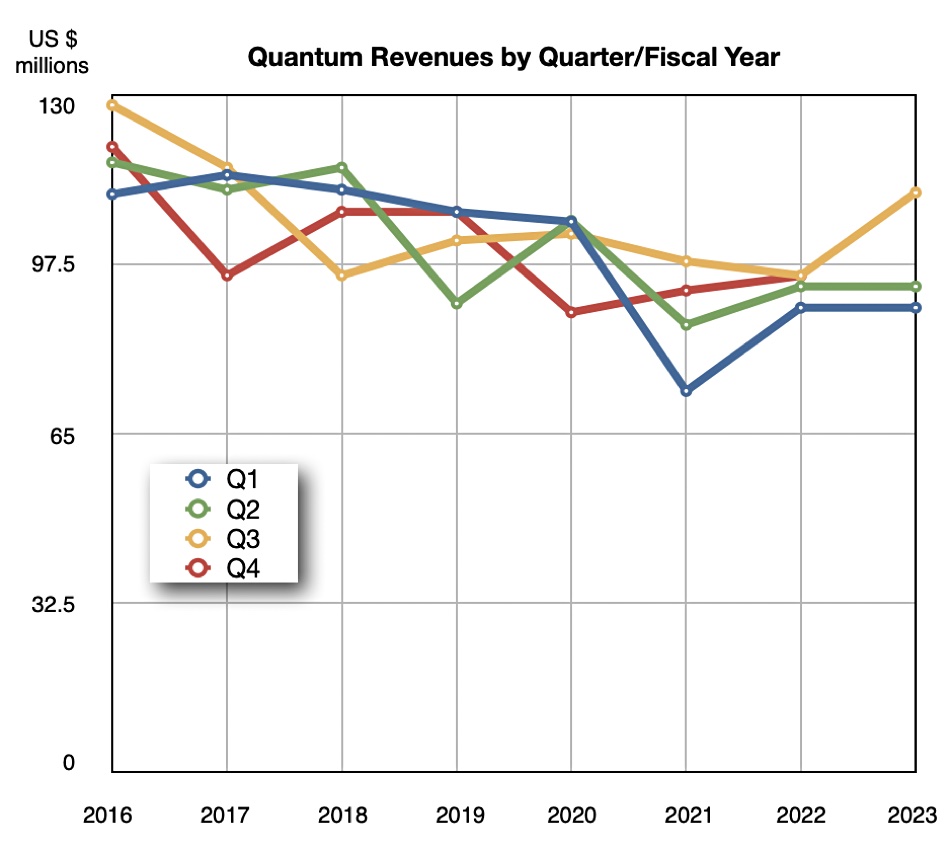

In the week when NetApp and Commvault reported deflating customer markets, data protector and manager Quantum says its revenue is on the way up, growing 16.6 percent year-on-year to $112 million in its third quarter of fiscal ’23 ended December 31 – its highest quarterly sales in five years.

There was a loss of $2.2 million in the quarter, albeit much better than the year-ago $11.1 million loss and the prior quarter’s $11.9 million loss.

Chairman and CEO Jamie Lerner said: “We delivered a solid quarter with revenue increasing 16.6 percent year-over-year and exceeded the preliminary estimates we announced in early January… Revenue growth in our Secondary Storage Systems combined with continued operational expense management, contributed to a significant year-over-year improvement in our operational performance.”

These were the highest quarterly revenues since Lerner joined Quantum in 2018.

Financial summary

- Gross margin: 36.2 percent compared to 36.9 percent a year ago

- ARR: $11.2 million with circa 660 customers, up 84 percent annually

- Cash & cash equivalents: $26 million

- EPS: -$0.02 compared to -$0.19 a year ago, an 89 percent improvement

Where has this revenue increase come from? Quantum highlighted growth in hyperscale tape sales and a strong quarter in the video surveillance business, both helped by supply chain improvements. This latter point is curious as both Seagate and Western Digital attributed some of their revenue decline in disk drives to lower video surveillance sales. Lerner said: “We’re encouraged by the traction we have seen since we acquired the Pivot3 surveillance business last year.”

Quantum said it experienced:

- A 1 percent year-over-year decline in primary storage system sales

- A 24 percent fall in devices and media (lower tape cartridge demand)

- Flat services revenue

- A 23 percent royalty revenue fall (less tape cartridge demand)

There was a 42 percent quarter-on-quarter jump in primary storage sales, led by StorNext and Pivot3.

The earnings call revealed that Lerner saw “positive year-on-year growth with our data protection business in all three geographies and enterprise IT departments continue to invest in their data protection infrastructure, and strengthening cybersecurity.”

Quantum is trying to shift from a point product-selling business to product portfolio sales focused on larger enterprises. Lerner said: “I’m encouraged by the evidence of early success we’re seeing with this model, particularly in Europe and Asia. I would characterize those recent regions as being approximately a year ahead of our North American business in terms of their ability to sell the whole portfolio.”

“Growing our software and systems business in North America will be a key driver for both future revenue growth and improved gross margins. We have made investments in the North American sales teams to drive growth in historically strong segments for us, such as media and entertainment, and the US Federal Government.”

Quantum is developing what it calls next-generation storage software. Customer and analyst feedback has been positive, it said: “we’d expect to begin early access trials this quarter in advance of announcing publicly in the first half of next fiscal year. This new product will further strengthen and differentiate our portfolio and allow us to participate in some of the fastest growing segments in data storage.”

Looking ahead to the next quarter, Lerner said: “As we begin to see signs of the supply chain normalizing, we are cautiously optimistic… We are actively working to increase margins and profitability; looking to accelerate efforts to drive cost out of our operations; and will continue our innovation to remain a global leader in managing and storing unstructured data.”

Quantum expects next quarter’s revenue to be $102 million plus/minus $2.0 million, a 7 percent uplift on a year ago and implying a $410.34 million revenue year, a 10.1 percent increase over 2022’s $372.8 million. The Q4 revenue will include a particularly large volume of hyperscale sales plus a healthcare customer deal in the genomics area with large amounts of unstructured data.

Lerner said of the increased revenue guidance: “I know a lot of my peers are signaling slowdowns and conservativeness and I don’t want to second guess them. We’re guiding up 7 percent year-on-year, right? So we’re guiding the strongest revenue quarter in quite a few years in our Q4. So we’re not guiding to signaling we’re seeing a big slowdown.”

He added: “Our biggest segment is secondary storage, which is protecting and backing up data. And I don’t think that correlates to global economies, meaning if the economy is doing poorly, people don’t say, well, I guess, we’re not going to back up our data.”

Nevertheless, data protector Commvault is experiencing a downturn.

Lastly Quantum has a new CFO, Ken Gianella, who joined in late January.