Backblaze is a great and growing cloud storage business and its calendar Q2 earnings illustrate that perfectly.

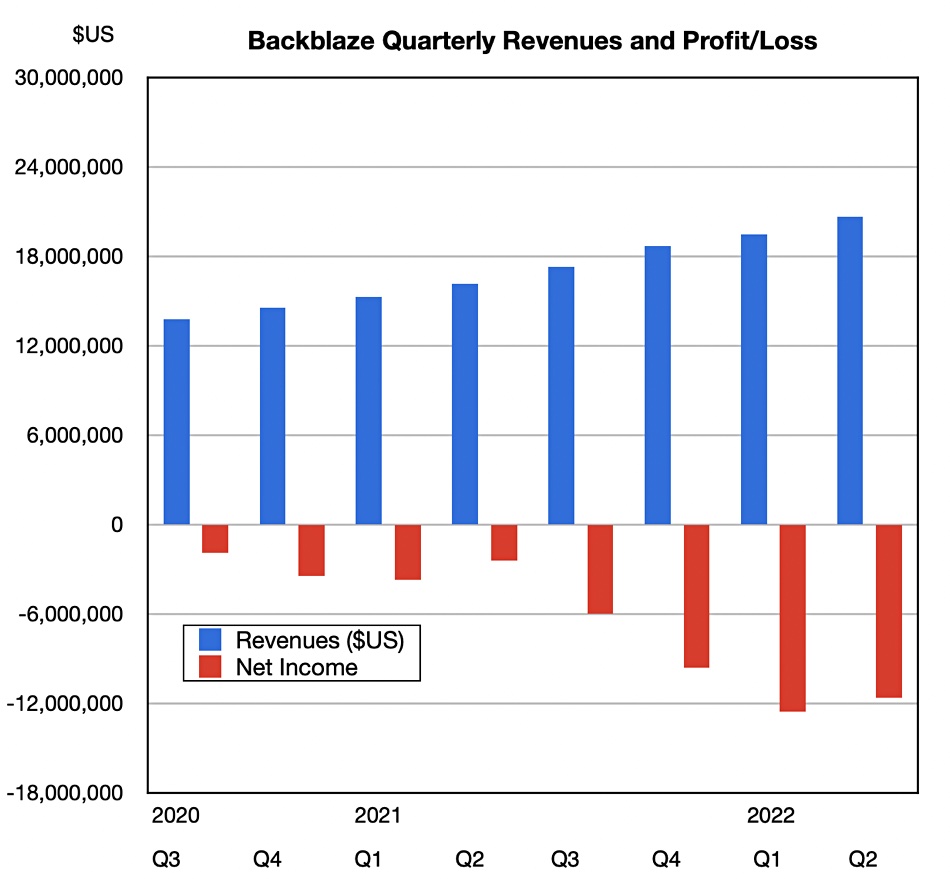

The company, which started out as a cloud vault for backups and then added general cloud storage, had its IPO at the end of 2021. Revenues in the quarter ended June 30 were $20.8 million, up 28 percent year-on-year with a net loss of $11.6 million, worse than the net loss of $2.4 million a year ago.

CEO and co-founder Gleb Budman said: “Our 28 percent revenue growth in Q2 not only outpaced what we achieved last year in the same period, it also highlights the strength of our recurring revenue model and that data grows through varying economic conditions.”

Budman added: “In Q2, the amount of data added by B2 Cloud Storage customers was greater than for any other quarter in company history. We added a customer with our largest purchase order ever, and in July we hired an experienced chief marketing officer, Kevin Gavin, to help continue driving our growth.”

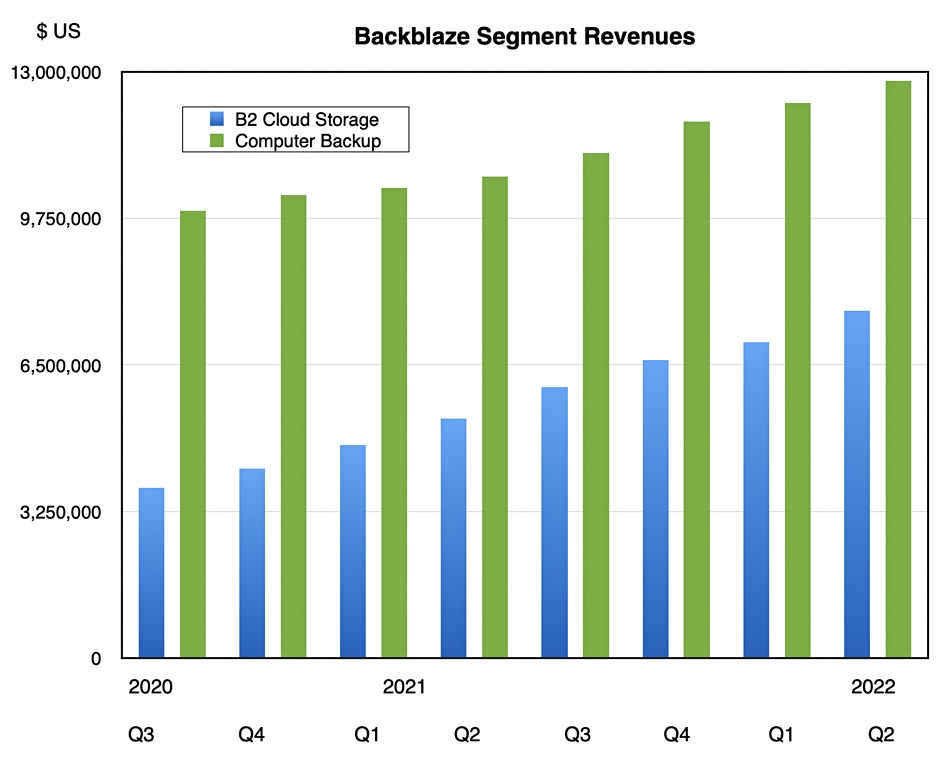

We have tracked the segment revenue history and here is the chart:

It looks like the cloud storage business is catching up with the core backup storage business. The segment annual recurring revenue numbers bear that out. Overall annual recurring revenue (ARR) was $82.7 million – an increase of 28 percent year-on-year. Within that:

- B2 Cloud Storage ARR was $31.3 million – an increase of 44 percent year-on-year.

- Computer Backup ARR was $51.4 million – an increase of 20 percent year-on-year.

Cloud storage is growing twice as fast as backup storage. The net revenue retention (NRR) rate was 113 percent compared to 110 percent a year ago, which means more customers are coming than leaving.

Next quarter’s revenues are being guided to continue the growth trend: $21.4 million to $21.8 million – 24.7 percent growth year-on-year at the mid-point.

Comment

This is a great business which has not put a foot wrong. Its prices are low, it’s open with its customers about pricing, and publishes disk drive failure rates. It also has a growing list of backup partners to whom it provides target cloud storage. Yet its datacenter population is tiny. Backblaze currently has datacenters in Sacramento, California, Phoenix, Arizona, and Amsterdam, Netherlands – just three.

Imagine what its revenues would be if it had a presence in every region in the globe and five or six more in the USA. This would be a $250 million/year run rate business. It seems to Blocks & Files that, for any storage-related or compute-related business, Backblaze represents a potentially wonderful way to get into the cloud storage and computing market.

Surely Gleb Budman and his team must have received acquisition offers already. If their business keeps on growing like this they’ll receive many more.