Although Broadcom saw an overall rise in revenues and profit in its latest quarter, sales in the server-to-storage connectivity area were down. It expects a recovery and has cash for an acquisition.

Revenues in Broadcom’s third fiscal 2021 quarter, ended August 1, were $6.78 billion, up 16 per cent on the year. There was a $1.88 billion profit, more than doubling last year’s $688 million.

We’re interested because Broadcom makes server-storage connectivity products such as Brocade host bus adapters (HBAs), SAS and NVMe connectivity products.

President and CEO Hock Tan’s announcement statement said: “Broadcom delivered record revenues in the third quarter reflecting our product and technology leadership across multiple secular growth markets in cloud, 5G infrastructure, broadband, and wireless. We are projecting the momentum to continue in the fourth quarter.”

There are two segments to its business: Semiconductor Solutions, which brought in $5.02 billion, up 19 per cent on the year; and Infrastructure Software, which reported $1.76 billion, an increase of ten per cent.

Tan said in the earnings call: “Demand continued to be strong from hyper-cloud and service provider customers. Wireless continued to have a strong year-on-year compare. And while enterprise has been on a trajectory of recovery, we believe Q3 is still early in that cycle, and that enterprise was down year on year.”

Server-storage connectivity

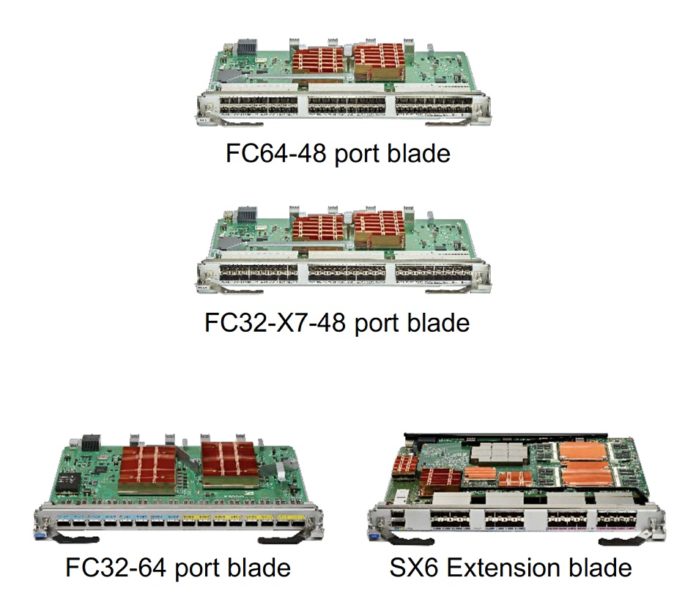

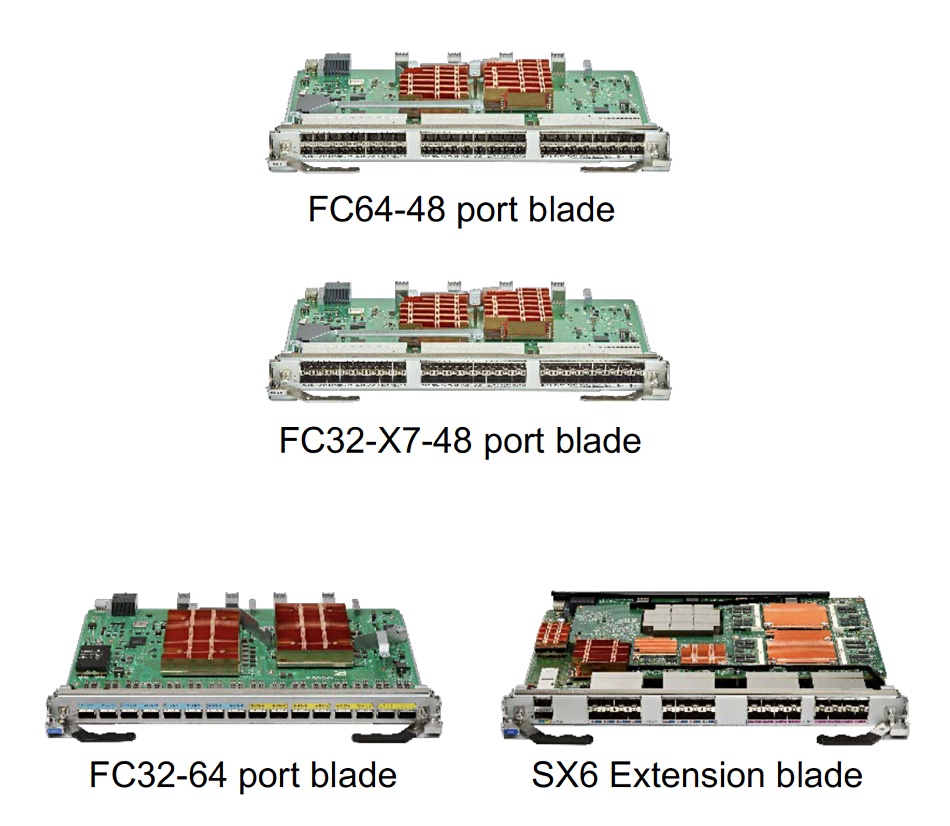

Inside Semiconductor Solutions, the server storage connectivity area had revenues of $673 million, which was nine per cent down on the year-ago quarter. Tan noted: “Within this, Brocade grew 27 per cent year on year, driven by the launch of new Gen 7 Fibre Channel SAN products.

Overall, Tan said: “Our [Infrastructure Solutions] products here supply mission-critical applications largely to enterprise, which, as I said earlier, was in a state of recovery. That being said, we have seen a very strong booking trajectory from traditional enterprise customers within this segment. We expect such enterprise recovery in server storage.”

This will come from aggressive migration in cloud to 18TB disk drives and a transition to next-generation SAS and NVMe products. Tan expects “Q4 server storage connectivity revenue to be up low double-digit percentage year on year.” Think two to five per cent.

The enterprise segment will grow more, with Tan saying: “Because of strong bookings that we have been seeing now for the last three months, at least from enterprise, which is going through largely on the large OEMs, who particularly integrate the products and sell it to end users, we are going to likely expect enterprise to grow double digits year on year in Q4.”

That enterprise business growth should continue throughout 2022, Tan believes: “In fact, I would say that the engine for growth for our semiconductor business in 2022 will likely be enterprise spending, whether it’s coming from networking, one sector for us, and/or from server storage, which is largely enterprise, we see both this showing strong growth as we go into 2022.”

Broadcom is accumulating cash and could make an acquisition or indulge in more share buybacks. Tan said: “By the end of October, our fiscal year, we’ll probably see the cash net of dividends and our cash pool to be up to close to $13 billion, which is something like $6 billion, $7 billion, $8 billion above what we would, otherwise, like to carry on our books.”

SmartNICs and DPUs

Let us pronounce that HBAs are NICs (Network Interface Cards) and that an era of SmartNICs is starting. It might be that Broadcom could have an acquisitive interest in the SmartNIC area.

Broadcom is already participating in the DPU (Data Processing Unit) market, developing and shipping specialised silicon engines to drive specialised workloads for hyperscalers. Answering an analyst question, Tan said: “We have the scale. We have a lot of the IP calls and the capability to do all those chips for those multiple hyperscalers who can afford and are willing to push the envelope on specialised — I used to call it offload computing engines, be they video transcoding, machine learning, even what people call DPUs, smart NICs, otherwise called, and various other specialised engines and security hardware that we put in place in multiple cloud guys.”

Better add Broadcom to the list of DPU vendors such as Fungible, Intel and Pensando, and watch out for any SmartNIC acquisition interest.