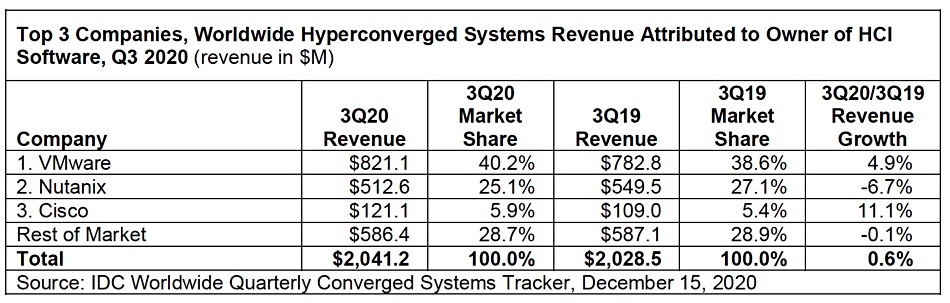

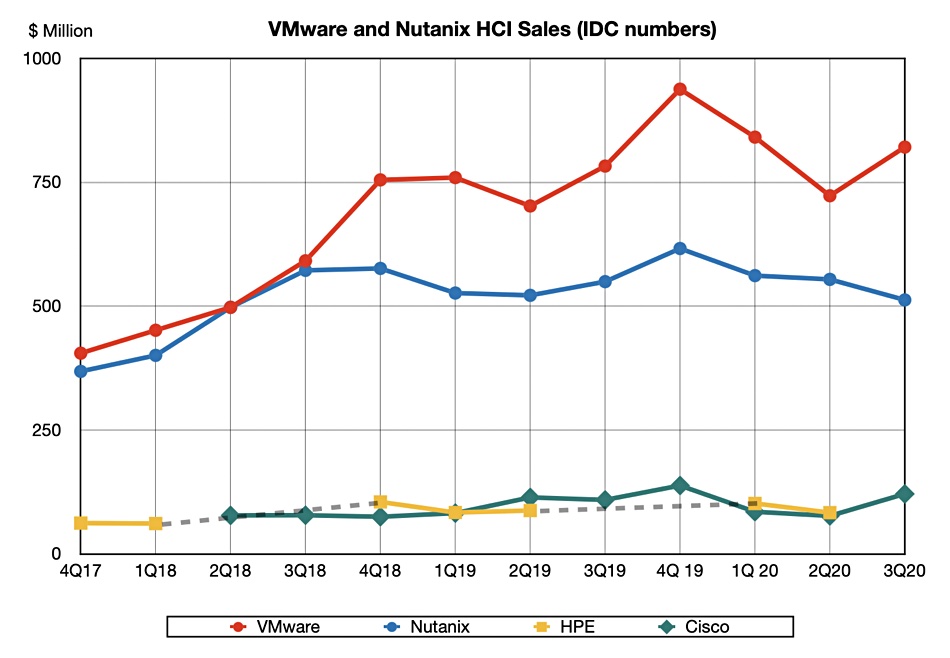

Once again, VMware and Nutanix dominate the IDC quarterly revenue tracker for HCI systems by software owner. But their numbers diverge in the 2020 third quarter tallies, with VMware gaining revenues and share in a flat market and Nutanix falling on both counts.

This is the third quarter in a row that Nutanix HCI revenues have fallen in the IDC tracker but the effect of the company’s ongoing transition to a subscription business is unclear. We are sure that newly-installed Nutanix CEO Rajiv Ramaswami, formerly a senior exec at arch-rival VMware, has a better idea of what is going on.

As the IDC table above shows, revenues for HCI systems installed with VMware software pulled in $821.1m revenues in Q3, up 4.9 per cent y/y and taking 40.2 per cent share (Q3 2019: 38.6 per cent). Nutanix-installed systems generated $512.6m revenues for 25.1 per cent share, down two per cent year on year.

Cisco HyperFlex HCI-installed systems generated $121.1m in revenues, up 11.1 per cent y/y and market share climbed a few points from 5.1 to 5.4 per cent. Could Cisco be a dark horse in the HCI software race? Let’s see how the next few quarters pan out before making that judgement.

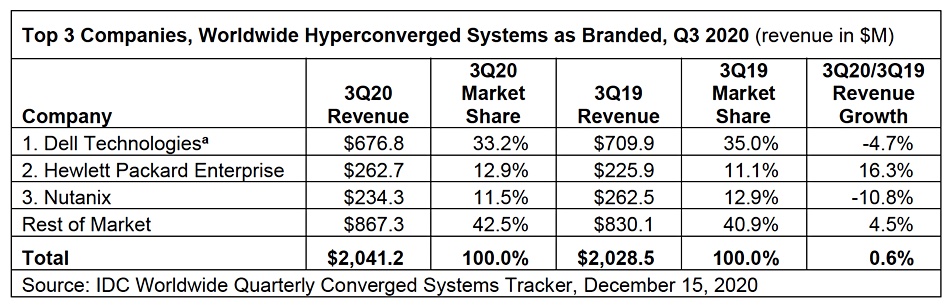

When revenue is determined by HCI software owner, HPE is an also-ran, with SimpliVity and Nimble dHCI SW sales consigned to IDC’s “others”. It’s a different story when the revenue cake is sliced by HCI-branded systems. This gives a market view of the performance of companies that OEM VMware and Nutanix HCI software, as well as Nutanix’s branded sales.

The table above shows that HPE has had an outstanding year on that score.

Dell led the pack in Q3 with $678.6m revenues, 4.7 per cent down on a year ago, and taking 33.2 per cent share. HPE was second-placed in revenue at $262.7m, up 16.3 per cent, taking 12.9 per cent share. Nutanix with $234.3m revenues, a 10.8 per cent decline Y/Y, had an 11.5 per cent share. The rest of the market grew 4.5 per cent to $867.3m.

The divergence of convergence

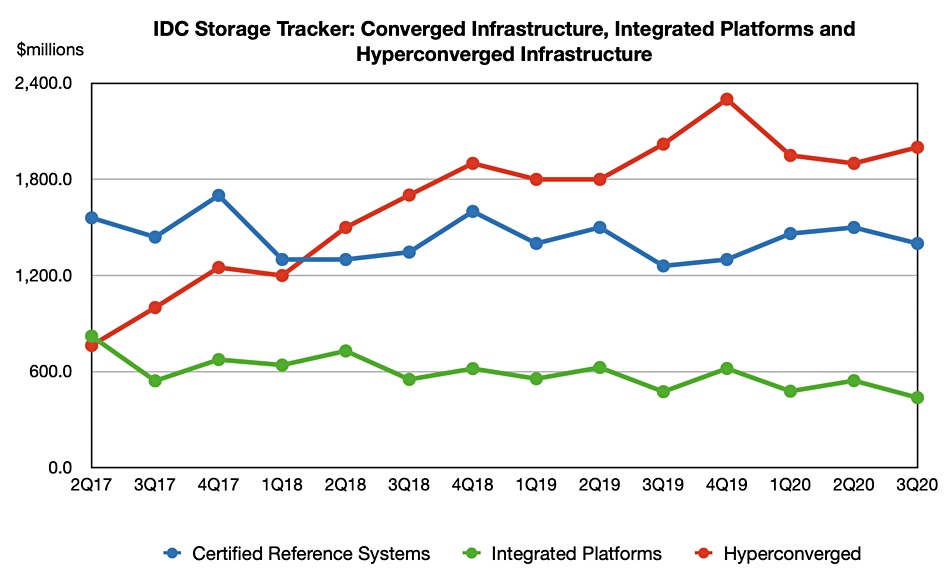

IDC’s numbers are a subset of the analyst firm’s quarterly tracker for the converged systems market. This is a three-sector converged systems market according to IDC’s number crunchers, with hyperconverged systems like VxRail, certified reference systems such as FlexPod, and integrated platforms such as Oracle’s Exadata.

- Certified reference systems & integrated infrastructure grew revenues 2.5 per cent Y/Y to $1.4bn, 36.7 per cent of the market.

- Integrated platforms revenues declined 7.7 per cent Y/Y to $438m; 11.2 per cent of the market.

- Hyperconverged systems revenues grew 0.6 per cent Y/Y to $2bn; 52.1 per cent of the market.

Adding these numbers to our records enabled a history chart showing long term patterns, with HCI rising, certified reference system flattish and integrated platforms declining;

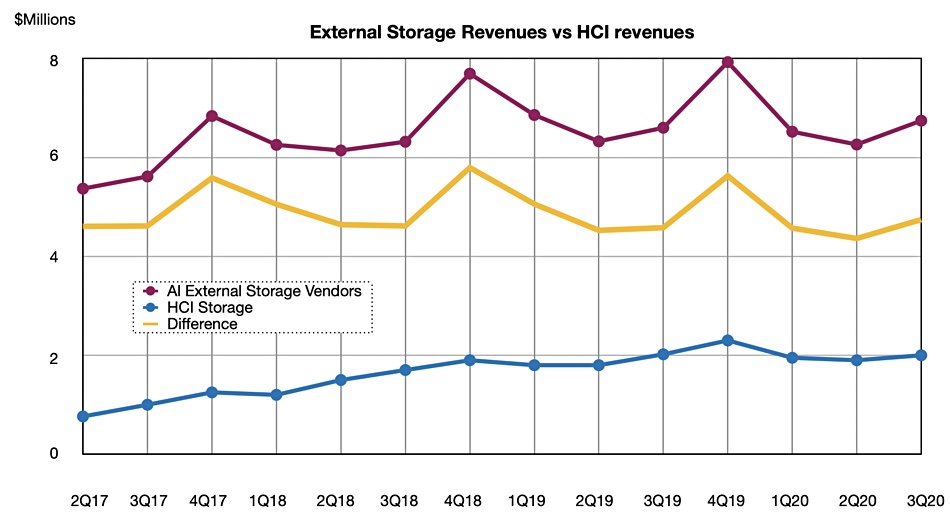

The chart below shows there is no sign yet of HCI revenues overtaking external storage revenues – predicted by many – any time soon.

IDC, for this quarter, has updated its methodology by moving VMware vSAN ReadyNode solutions out of the “Other Suppliers” bucket to the branded server vendor for HCI systems. There is no change to the overall size of the HCI market, but you’ll see new HCI systems shares for some vendors (HPE and Lenovo) because of this new methodology.