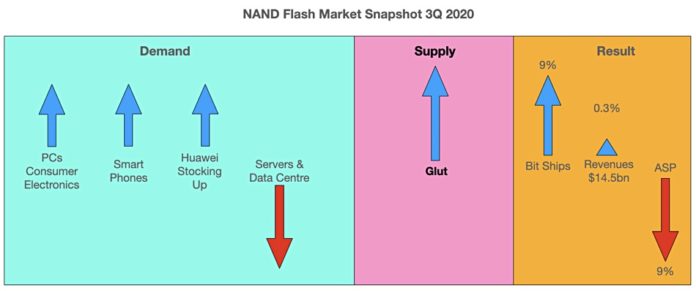

NAND market revenues held steady in Q3, inching up 0.3 per cent to $14.5bn in Q3. However, average selling prices fell nine per cent due to oversupply while bit shipments rose nine per cent.

TrendForce, which compiled the figures, expects lower market revenues in the fourth 2020 quarter.

Shipments last quarter were bolstered by rising demand for PCs, smartphones and stockpiling by Huawei, ahead of US technology import bans. TrendForce reports falling server and data centre demand in the quarter.

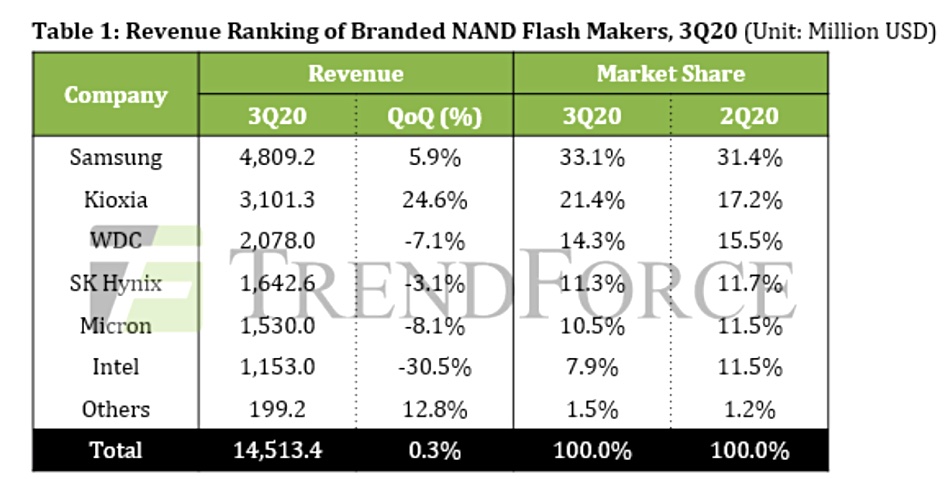

As the TrendForce table above shows, Samsung stands out with rises in revenue and market share, attributed to the iPhone 12 and Huawei stockpiling. Kioxia also saw a good revenue rise in the quarter, on the back of its acquisition of Lite-On.

Intel experienced 30.5 per cent drop in NAND revenues in Q3. TrendForce notes: “Since Intel has a large market share for enterprise SSDs, the increasing pressure on server OEMs to reduce their component inventories turned this advantage into a disadvantage in bit shipments.”

TrendForce expects fourth quarter NAND demand to be affected by Huawei’s withdrawal from the market, and continued digestion of NAND inventories by server and data centre customers. Also, Samsung and YMTC intend to raise production output, adding to the supply glut.

Chinese smartphone makers are expected to stock up as they attack Huawei’s market share. But, nonetheless, “their demand together with the demand related to the iPhone 12 series is not enough to reverse the oversupply situation that will be affecting the entire NAND Flash market through 4Q20.”