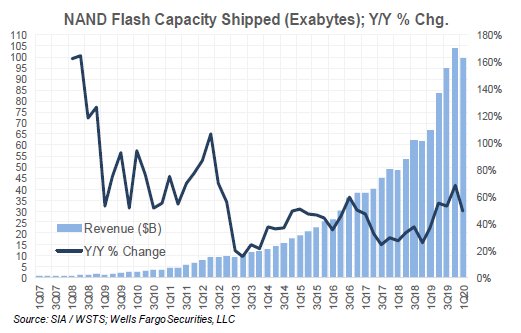

Falling sales of smartphones in the first months of the pandemic has in turn slowed NAND flash shipment growth. Ssmartphones account for 35-40 per cent of NAND flash consumption.

As noted in a story by The Register and by analysts, smartphone sales suffered “the largest year-over-year decline” in Q1 2020, due in part to consumers being unable or unwilling to visit retail stores and purchase new devices. Also, many of the factories in Asia making components were forced to halt production.

The effect on NAND flash bit growth was disclosed in a note from Wells Fargo analyst Aaron Rakers, who put some figures to the slowdown. In May, growth slowed to eight per cent year-on-year, down from 12 per cent year-on-year for April and 49 per cent growth for the first quarter of the year.

“While we maintain a positive view on industry discipline on supply vs. demand, we believe the slowdown in bit growth could be an incremental negative data point – albeit backwards looking and possibly reflective of the lagging impact of smartphone production slowdowns amid Covid,” Rakers stated.

On a quarterly basis, the total NAND flash bit growth was up 22 per cent year-on-year, but this compares to 64 per cent, 49 per cent and 34 per cent for the same figures covering the three months ending February, March, and April.

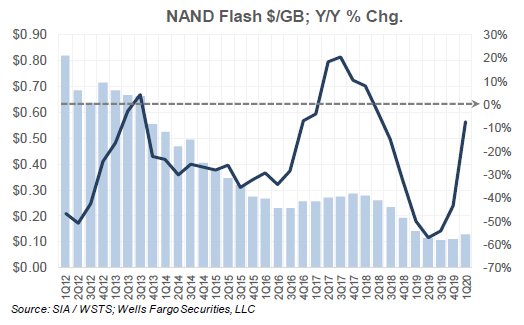

The effect on average selling prices has been an increase of 28.5 per cent year-on-year in May 2020, compared with 13 per cent in April and a decline in pricing of 7.5 per cent for the first quarter of the year.

However, as always, this trend should reverse again when demand for smartphones and other devices starts to pick up.

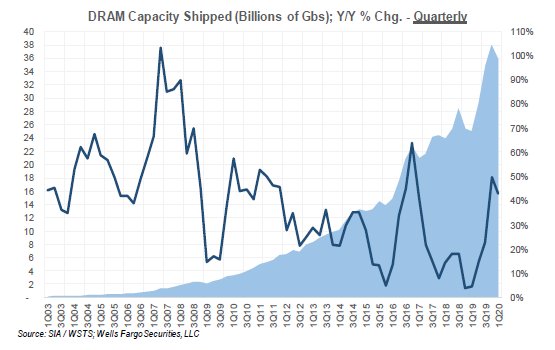

DRAM shipments have also experienced a decline, although presenting a slightly different picture to flash. Capacity shipped in May showed a growth of 20 per cent year-on-year, with the trailing three-monthly figures at 38 per cent, compared with 55 per cent, 43 per cent, and 45.5 per cent for the three-month periods ending February, March, and April.

Blended DRAM average selling prices were down 14 per cent year-on-year for May 2020, which compares to decreases of 40 per cent, 33 per cent, and 20 per cent for February, March, and April. According to Rakers, pricing is stabilising and bit growth remains positive.

“We think the May 2020 DRAM billings, shipment, and implied ASP ($/GB) will be viewed as a net neutral incremental data point,” he commented.