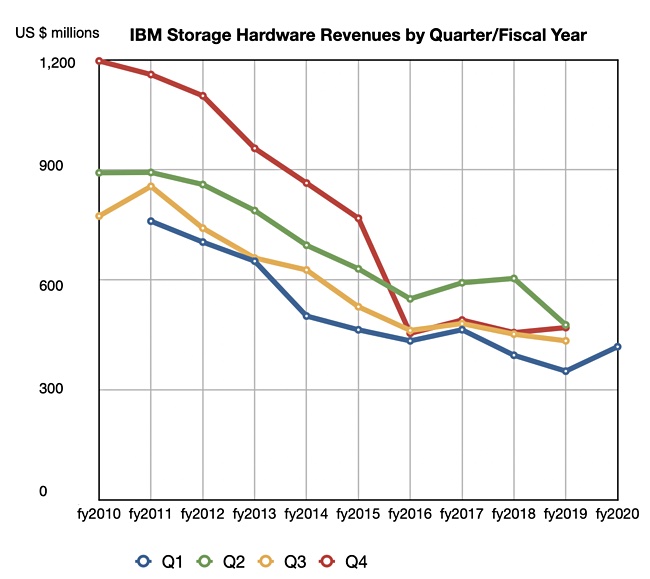

IBM has reported good storage revenue growth in the first 2020 quarter as robust demand for the System z15 mainframe carried DS8900 array sales in its wake.

The Register has covered IBM’s overall results and we focus on the storage side here.

IBM introduced the z15 mainframe in September 2019 and its revenue impact was apparent in the final 2019 quarter. The uplift in high end DS8900 shipments help to edge storage sales up three per cent in that quarter and 18 per cent in Q1 2020.

IBM’s Systems business unit reported $1.4bn in revenues, up 4 per cent, with system hardware climbing 10 per cent to $1bn. Mainframe revenues grew 61 per cent. However the midrange POWER server line declined 32 per cent and operating system software revenue fell nine per cent to $400m.

Citing the Covid-19 pandemic, IBM said general sales fell in March and that this had affected sales of Power systems.

IBM does not break Systems revenues down by segment or product line but CFO Jim Kavanaugh said in prepared remarks that the DS8900, which is tightly integrated with the mainframe, had a good quarter “especially in support of mission-critical banking workloads”.

He also referred to IBM’s FlashSystem line as a “new and simplified distributed storage portfolio, which supports hybrid multi-cloud deployments”.

IBM said it is expanding the digital sales channel for the Storage and Power business and that has a good pipeline in System Z and storage.

Lots of storage software

IBM CEO Arvind Krishna this week said the company’s main intention is to regain growth, with a focus on the hybrid cloud and AI. He said IBM will continue investing through acquisitions and may divest parts of the business that do not fit the new direction.

Blocks & Files anticipates that IBM will reorganise overall storage portfolio in the next few quarters as Krishna’s intentions are put into action.

With the July 2019 acquisition of Red Hat, IBM has two storage software product portfolios – the legacy Spectrum line plus Red Hat’s four storage products. These are:

- OpenShift container storage

- Ceph

- Hyperconverged infrastructure

- Gluster

We might expect these two portfolios to eventually converge.