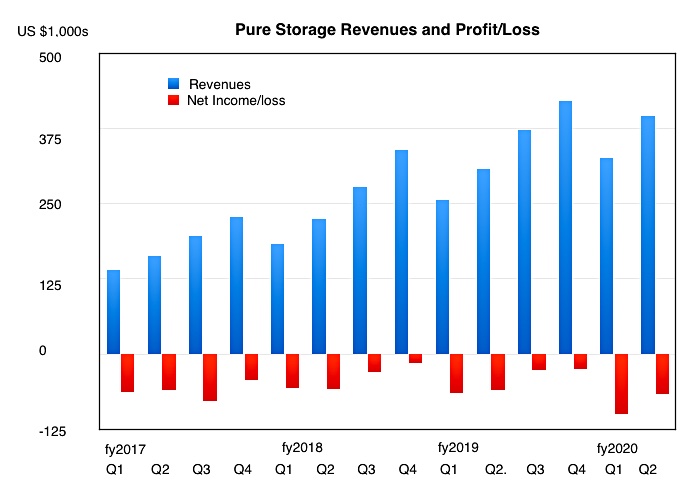

Pure Storage made a net loss of $66m on fiscal Q2 revenues up 28 per cent to $396.3m from a year ago. The results were better than analyst forecasts, but shares still fell overnight in response to reduced forward outlook from the company.

Pure reported:

- Non-GAAP profit $275m, up from $210m a year ago,

- Gross Margin – 69.4 per cent, was 68 per cent a year ago,

- Free cash flow was $19.9m compared to -$11.9m a year ago,

- Cash and investments of $1.19bn,

- Product revenue grew 24 per cent year-on-year to $300.1m.

- Support and subscription revenue grew 42 per cent year-on-year to $96.2m,

The USA accounted for 74 per cent of sales, according to Pure, which gained 450 new customers in the quarter. It said the customer gain was the highest in any Q2 and takes the total past 6,600.

Earnings call

In the earnings call Chairman and CEO Charlie Giancarlo said; “Looking at the market as a whole, Pure is clearly out-executing our traditional competitors, some of whom have expressed concerns around the macro economy. We do not believe the macro environment has affected us this past quarter.”

President David Hatfield added: “Pure is growing approximately 10x faster than any competitor and their rate of spending on innovation is on average 2x less than Pure’s R&D investment… Our win rates continued to hold nicely.”

He said: “Our gross margins continue to be industry-leading, with product margins well above our competitors.”

Pure said it has a lot of new products coming in the next three quarters, and these will help it take more market share.

Outlook, analysts and enterprise buying slowdown

The outlook for the next quarter is $440m at the mid point, 18 per cent higher than the year-ago quarter but a lower grow rate than the current quarter’s 28 per cent. The full year outlook is pared back from $1.76bn to $1.68bn.

Pure execs said the new outlook was a case of prudence and due to lower NAND prices; not in response to an enterprise spending slowdown, as NetApp experienced and Cisco and Intel have mentioned.

Wells Fargo senior analyst Aaron Rakers told subscribers; “We think a reduced forward outlook from Pure has been expected following NetApp’s weak July quarter results and reduced F2020 guide… along with weak enterprise results from Cisco and Intel.”

William Blair analyst Jason Ader sent this message to his readers; “The guide-down was attributed primarily to a precipitous decline in NAND component pricing in the second quarter (which is affecting end-user pricing and deal sizes) and secondarily to increased caution on the macro environment (although Pure has yet to see an impact on its business.)”

Pure CFO Tim Ritters is leaving the company for personal reasons and there were fulsome comments about his great performance as CFO.