Pure Storage outpaced the market in 2019’s first quarter. to make its debut as a top five enterprise storage supplier.

IDC’s first 2019 quarter enterprise storage tracker numbers reveal a flat storage revenue market, slipping 0.6 per cent y-o-y to $13.37bn with capacity up 14.1 per cent.

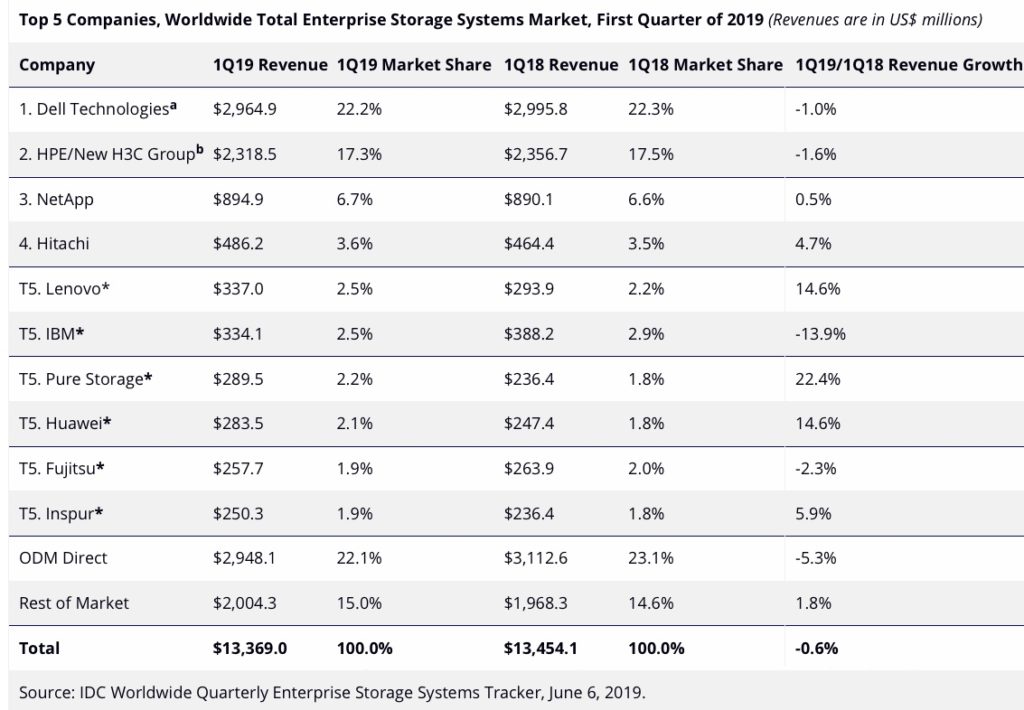

IDC’s numbers for the total enterprise storage market are:-

Note a says Dell Technologies consists of Dell and Dell EMC storage revenues. Note b says HPE revenues are those from HPE and the H3C Group, its joint-venture in China.

Storage arrays

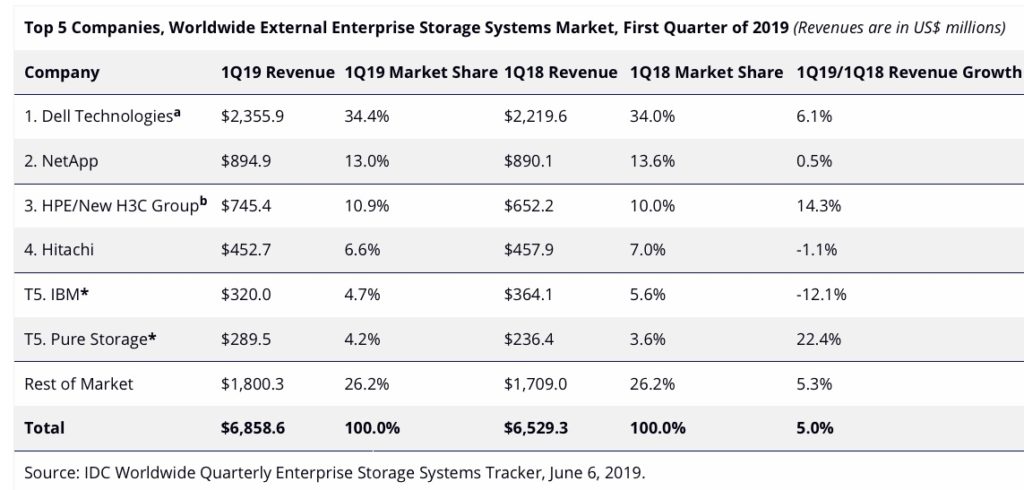

IDC separates out the external enterprise storage market, meaning storage arrays:

Here the supplier ordering is different, with two suppliers sharing joint fifth place; IBM and Pure Storage.

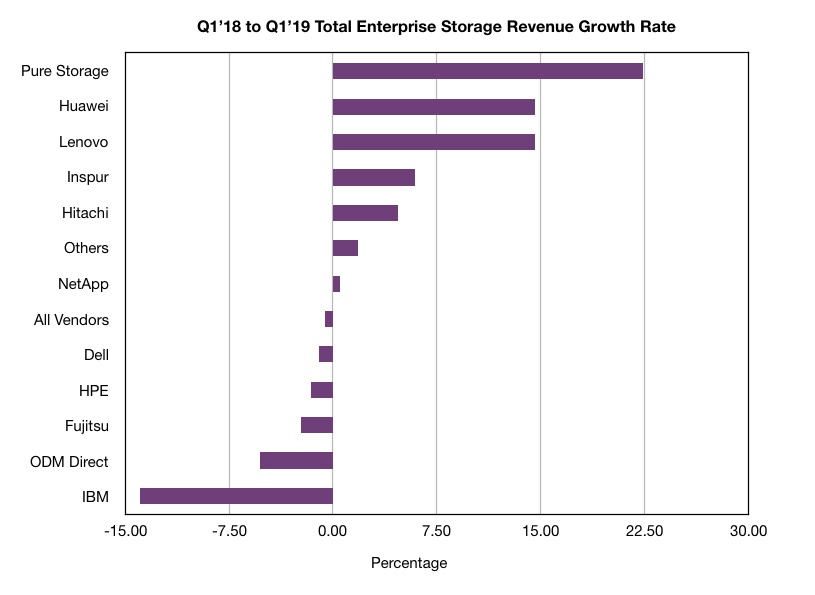

We can plot the revenue growth rates to show big vendor disparities, and reveal some unexpected points. First for total enterprise storage:

Pure Storage is top, followed by Huawei, Lenovo, Inspur and Hitachi. Dell and HPE failed to keep pace but Fujitsu and ODM Direct did worse and IBM worst of all.

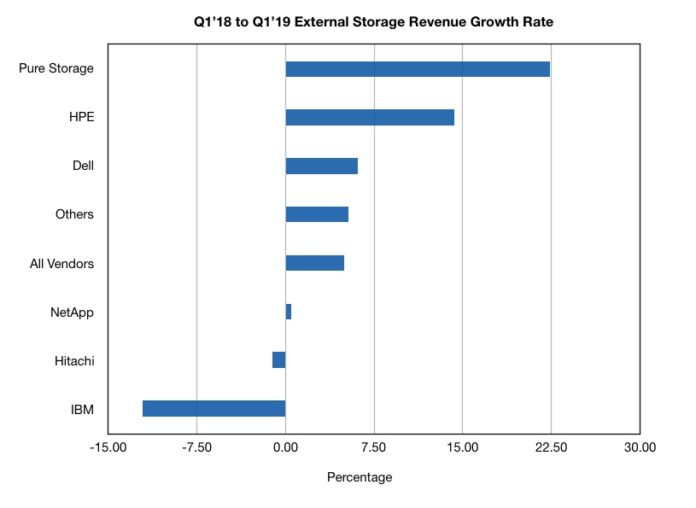

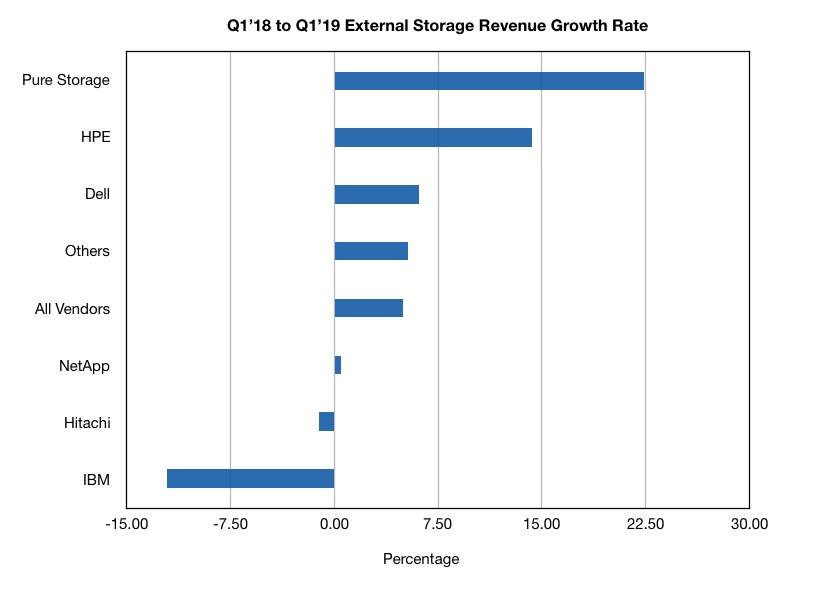

Second, here are the vendor growth rates in external storage:

Pure is still top but HPE is second, growing external storage sales faster than all ricvals except Pure.

Down in the negative growth category are Hitachi and, with the largest decline, IBM.

The Chinese vendors, Huawei, Lenovo, and Inspur, sell far more server-attached than array storage and this is why they do not appear in the external storage chart.

Also, Dell and HPE, unlike IBM, sell a great deal of server-attached storage, which pumps up their total enterprise storage revenues, IBM’s decline in both categories is steep, at -13.9 per cent in all storage and -12.1 per cent in external storage

Summary

IBM has work to do to avoid crashing out of IDC’s top 5 external enterprise storage supplier list and be replaced by Pure Storage. Our second thought is that HPE, with its 3PAR and Nimble arrays, is doing well and is growing more quicky than NetApp.

Also HPE numbers will receive a boost when the Cray acquisition is consolidated into the company, HPE buying Cray and its ClusterStor arrays, so they may grow further.

Could HPE overtake NetApp? That would be quite the upset.