FalconStor is an object lesson in the difficulty of turning around a company when it falls behind the competition.

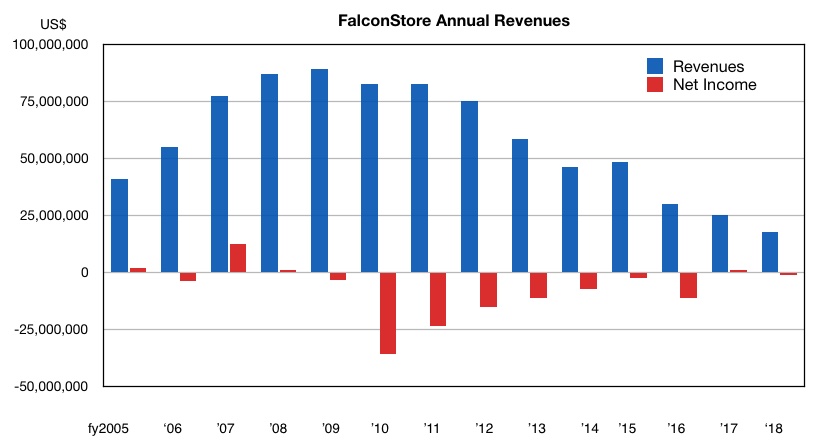

Latest earnings for this small enterprise storage player show how much ground there is to catch up. At its peak in 2009, the company turned over $89m. Fast forward to 2018 and revenues were $17.8m and net loss was $906,000.

Falconstor last week posted $4.5m revenues and a net loss of $500,000 for Q1 2019. The company posted $5m in the year ago quarter and a similar net loss.

In the earnings call CEO Todd Brooks, in cheerleader mode, said: “We do believe the company’s performance over the last several quarters has set up a fantastic opportunity for FalconStor and its shareholders.”

Falconstor achieved non-GAAP operating income of $0.4m, the seventh consecutive quarter of non-GAAP operating profitability. It noted 112 per cent year-over-year sales growth in the Americas although total 2019 billings through the end of April increased only six per cent. The US success was not replicated elsewhere.

Early software-defined storage company

Founded in March 2000, FalconStor was an early software-defined storage startup with its IPStor software which virtualized server storage into an iSCSI-accessed SAN. The company went public in 2001 and grew rapidly.

The company added IPStor services such as replication, failover and tape library emulation (VTL).

The latter service was used by EMC in its Clarion Disk Library in 2004. That was in pre-Data Domain days. EMC acquired the Data Domain deduplicating disk array backup target company in 2009.

Early failing software-defined storage company

FalconStor grew revenues nicely until 2009 when sales started falling. It experienced turmoil in September 2011 when founder and CEO ReiJane Huai committed suicide, in the face of a lawsuits about improper customer payments. These were settled for $6m in 2012.

Three subsequent CEOs failed to stem revenue decline as all-flash arrays came along and newer software-defined storage companies such as Nexenta emerged. Revenues fell from 2009’s $89.5m to 2017’s $25.2m, as Falconstor failed to find new customers. The company appears to be largely dependent on its legacy customer base.

Now Brooks, who arrived in August 2017 from ESW Capital, is trying to turn the company around. He obtained fresh funding from ESW Capital and squeezed a profit of $1m for fiscal 2017 and since then, has ploughed a hard furrow in stony ground.

Brook’s initiatives include product branding and scope. the company changed IPStor’s name to FreeStor Storage Server and is rebranding the software again as the Data Mastery Platform. Falconstor has added public cloud archiving and recovery to VTL and is integrating the software with deduplication under the Data Mastery banner.

Recovering business technology angst

VTL has become vital to FalconStor’s survival as it is the central and highest revenue-generating part of the Data Mastery Platform.

This product has legs: FalconStor commissioned the Evaluator Group to cast its peepers at VTL In a paper published in April 2019, the research group wrote that VTL delivered up to 6x times better price/performance than its leading competitor, understood to be Dell EMC’s Data Domain.

The Evaluator Group tested FalconStor software running on a 24-core X86 server with a dual 16Gbits/s Fibre Channel link to a 35TB Dell SCv3020 all-flash array target. A 39.24TB/hr backup rate was achieved.

Moving forward?

In the earnings call Brooks set out three points of focus: “First, on continued delivery of operating profitability; second, on generating year-over-year billings growth; and then third, on key product expansion.”

The product expansion areas include disaster recovery and high-availability, and FalconStor aims to be hardware- and cloud-agnostic. It has to pay for product development from revenue and the last fund raise.

There is not a lot of money sloshing around: the cash balance at the end of Q1 2019 was $2.4m and net working capital was $0.9m.

Can FalconStor succeed and get back from being a footnote in storage history to having higher revenues and regaining profitability? It has to demonstrate relevance in today’s IT world, data storage and management services in a hybrid and multiple public cloud world.

In essence the company is a high-performance virtual tape library data protection business extending into data management.

Preserving the VTL data-moving niche is vital, as is building cloud-based services on top. But, at some stage FalconStor has to move beyond the VTL niche and expand cloud-based services.

It faces competition from big backup appliance companies, such as Cohesity, Commvault and Rubrik, and from backup target companies such as Exagrid

Reaching revenue growth and profitability will be a huge step forward and that could happen in a quarter or two…if things go well.