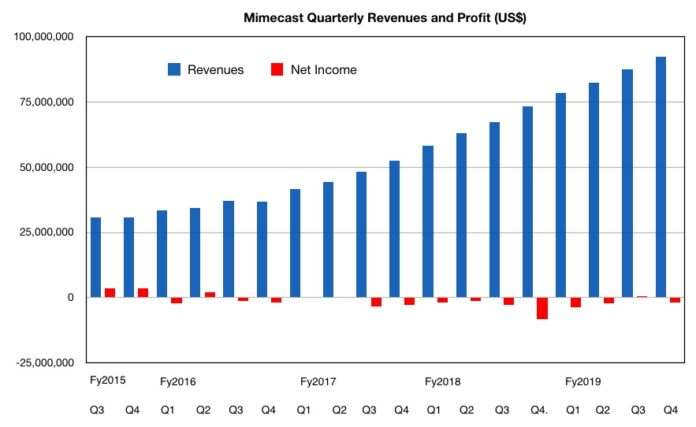

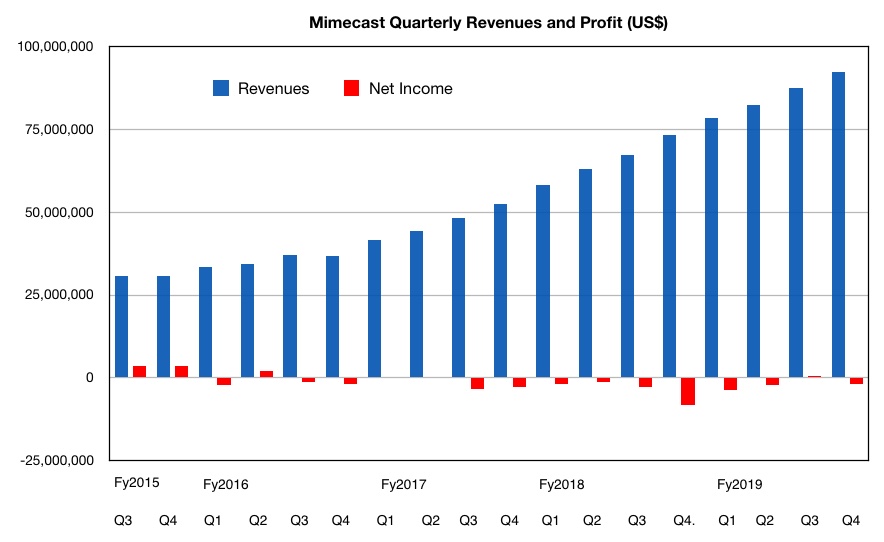

Mimecast recorded yet another set of rising revenues at the end of its fiscal 2019.

Fourth quarter revenues for the email security and archiving vendor were up 26 per cent to $92.2m with a net loss of $1.9m.

Free cash flow was $13.4m compared to $1.9 m a year ago. Cash and short-term investments at quarter end were $173.5m. The revenue retention rate was 111 per cent compared to 110 per cent a year ago, as existing customers renewed their subscriptions and bought additional services.

It gained 1,100 new customers in the quarter, taking its total to 34,400. The company seems able to recruit a thousand customers a quarter as regular as clockwork, with 4,000 gained in the whole fiscal year.

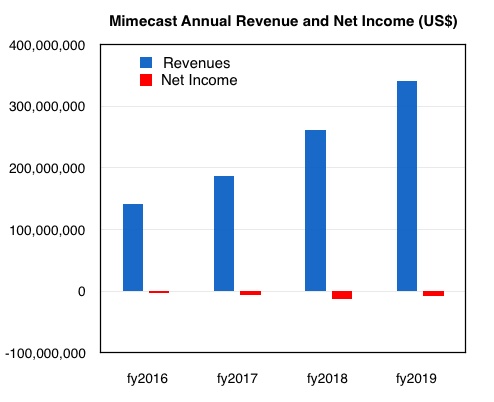

Full year revenues were $340.4m, 30 per cent higher than a year ago. The GAAP net loss was $7m, continuing the trend of trivial annual net losses we have recorded since its fiscal 2016 year.

As long as the company continues to grow investors are more than happy to accept the losses which, anyway are decreasing as a proportion of the company’s revenues.

In the earnings call CEO, chairman and co-founder Peter Bauer said: “In our fourth quarter, our results exceeded our expectations for both revenue and profitability. Revenue of $92.2m grew at 26 per cent year-over-year as reported and 32 per cent in constant currency. We signed over 36-figure deals, a new high aided by the continued adoption of our multi-product bundles and traction with larger accounts.”

Mimecast’s customers are using more of its services as the cyber threat landscape becomes more populated. They used an average of 3.1 services in the quarter. It was 2.9 a year ago.

Co-founder and CTO Neil Murray resigned at the beginning of April. Bauer said: “He remains on the Board of the company, remains a very significant shareholder, very interested in the success of the business.”

Revenue in the next quarter is expected to be between $96.7m and $97.7m, $97.2m at the mid-point and a 23.9 per cent rise on the year-ago quarter. The rising revenue trend should continue unabated.